We have noted many times the poor structure and performance of the iPath S&P 500 VIX Short Term Futures ETN (NYSE: VXX ). But as you can see in the chart below of VXX (black) versus VIX (yellow), it has performed even worse than we could have imagined in the past three months. Since July 21, VXX has pared a jaw-dropping 45%, while VIX has lost only 20%. That’s incredible when you consider VXX should only move about half of VIX on a given day. That guideline apparently only works on days when the VIX is up, and we have not seen too many of those since July. Let’s say you were unlucky enough to own VXX back then at 27. How far would VIX, which was at 24 in mid-July, have to rally to get you back to even? The answer is pretty darn far. The course of VXX is very path dependent. That is, there’s no rule that says if VIX is “X,” then VXX will go to “Y.” It depends how long it would take VIX to get to “X,” and how closely nearer-term VIX futures track the move to “X.” In other words, if futures believe VIX will stay at “X,” they will rally sharply. If they believe the move to “X” is a one-off pop that won’t sustain, they won’t track so closely. So let’s say VIX doubles or so to 40 in the next week. It’s highly unlikely, but it could happen. The VIX nearly did that in May, albeit with a lower starting level. Right here, right now, VXX predominantly consists of November VIX futures, so we can use those as a proxy for VXX. What would November futures do if VIX soared to 40 in fairly quick order? They would track some of that move, but likely maintain a decent discount. No one is assuming a 40 VIX will hold for a month right off the bat. So let’s say November VIX futures go to something like 33. Well, conveniently, they trade at 22 now, so that’s a 50% lift. If VXX exactly proxies that move, it will lift 50% … all the way back to 20. Yes, that’s right. In mid-July, VIX was 24 and VIX was 27. In a late October crash, that moves VIX to 40, and VXX will have trouble even getting over 20. And trust me, I leaned toward optimistic assumptions here. In a week, VXX will contain more December VIX futures than it does now. And if VIX explodes, the VIX term structure will invert from the current contango to more of a backwardation. And December VIX futures now trade 24.5. So they may only rally about 33% or so in this VIX pop, further dampening a potential VIX move. To get VXX back to that magical 27, you might need to see VIX pop to the 50s, or even the 60s. It all depends on the timing. A slower pop in VIX would ultimately work better for VXX, but of course, that also means you would need to wait longer for the VXX pop. In short, VXX sux as a trading vehicle! Follow Adam Warner on Twitter @agwarner .

tdp2664

gol2664

InvestorPlace

Gold, Mining, silver, index, prices, today, oil, crude, dow jones, nasdaq, s&p 500, TSX, barrick gold, toromocho, CUP, goog, msft, aapl, finance, yahoo, bing, google,currency converter, currency, rates, currency tool, currency trading, currency transfers, foreign exchange, conversion, , live currency rates, mid-market, obsolete, precious metals, rate calculations, save money, save time, special units, tips, trade currency, up to the minute, world currency, xe trade, currency symbols

Sunday, October 24, 2010

VXX Sux!

Ranking U.S.-Listed International Stocks by Short Interest Monthly Change (Oct 24, 2010)

This ranking is UPDATED TODAY before 4:30 AM ET. Below is a ranking of U.S.-listed international stocks based on latest monthly change in short interest.

Ranking | Company (Ticker) | Monthly Short Interest Change | Country/Region

1 Rediff.com India Limited (ADR) (NASDAQ:REDF) 10006.7% India

2 James Hardie Industries SE (NYSE:JHX) 3518.9% Netherlands

3 China Jo Jo Drugstores Inc (NASDAQ:CJJD) 1715.7% China

4 China Kanghui Holdings (NYSE:KH) 1103.1% China

5 ZST Digital Networks Inc (NASDAQ:ZSTN) 891.9% China

6 HiSoft Technology International Limited (NASDAQ:HSFT) 829.3% China

7 Alon Holdings Blue Square Israel Ltd (NYSE:BSI) 814.5% Israel

8 NewLead Holdings Ltd (NASDAQ:NEWL) 647.4% Greece

9 MakeMyTrip Limited (NASDAQ:MMYT) 552.7% India

10 Quest Capital Corp. (USA) (AMEX:SILU) 521.9% Canada

11 YPF SA (ADR) (NYSE:YPF) 509.2% Argentina

12 CGI Group Inc. (USA) (NYSE:GIB) 489.4% Canada

13 Pluristem Therapeutics Inc. (NASDAQ:PSTI) 381.6% Israel

14 Universal Travel Group (NYSE:UTA) 345.9% China

15 Atlantic Power Corporation (NYSE:AT) 338.6% Canada

16 Pearson PLC (ADR) (NYSE:PSO) 327.9% United Kingdom

17 RADCOM Ltd. (NASDAQ:RDCM) 319.1% Israel

18 Semiconductor Manufacturing Int'l (ADR) (NYSE:SMI) 286.0% China

19 LJ International, Inc. (NASDAQ:JADE) 282.6% Hong Kong

20 DRDGOLD Ltd. (ADR) (NASDAQ:DROOY) 281.9% South Africa

21 Ku6 Media Co., Ltd. (ADR) (NASDAQ:KUTV) 276.8% China

22 Brookfield Infrastructure Partners L.P. (NYSE:BIP) 274.3% Bermuda

23 Sify Technologies Limited (NASDAQ:SIFY) 268.4% India

24 Tianyin Pharmaceutical Co, Inc. (AMEX:TPI) 245.9% China

25 China GengSheng Minerals, Inc. (AMEX:CHGS) 242.5% China

26 Northern Dynasty Minerals Ltd. (USA) (AMEX:NAK) 232.7% Canada

27 Oncolytics Biotech, Inc. (USA) (NASDAQ:ONCY) 222.8% Canada

28 National Bank of Greece (ADR) (NYSE:NBG) 208.0% Greece

29 BBVA Banco Frances S.A. (ADR) (NYSE:BFR) 207.0% Argentina

30 Allot Communications Ltd. (NASDAQ:ALLT) 204.0% Israel

31 Ultrapar Participacoes SA (ADR) (NYSE:UGP) 198.7% Brazil

32 China Advanced Con. Materials Gr. Inc (NASDAQ:CADC) 195.6% China

33 EDENOR S.A. (ADR) (NYSE:EDN) 188.2% Argentina

34 Silvercorp Metals Inc. (USA) (NYSE:SVM) 183.7% Canada

35 Banro Corporation (AMEX:BAA) 176.9% Canada

36 Panasonic Corporation (ADR) (NYSE:PC) 165.6% Japan

37 BHP Billiton plc (ADR) (NYSE:BBL) 157.8% United Kingdom

38 eLong, Inc. (ADR) (NASDAQ:LONG) 156.6% China

39 Duoyuan Printing, Inc. (NYSE:DYP) 156.6% China

40 Valeant Pharmaceuticals Int (USA) (NYSE:VRX) 152.9% Canada

41 A.F.P Provida SA (ADR) (NYSE:PVD) 149.7% Chile

42 51job, Inc. (ADR) (NASDAQ:JOBS) 144.6% China

43 New Energy Systems Group. (AMEX:NEWN) 137.6% China

44 CE Franklin Ltd. (USA) (NASDAQ:CFK) 135.9% Canada

45 Satyam Computer Services Limited(ADR) (NYSE:SAYCY) 135.7% India

46 Kobex Minerals Inc. (USA) (AMEX:KXM) 132.1% Canada

47 Qiao Xing Mobile Communication Co., Ltd. (NYSE:QXM) 131.1% China

48 Majestic Capital, Ltd. (NASDAQ:MAJC) 130.4% Bermuda

49 Shiner International, Inc. (NASDAQ:BEST) 129.3% China

50 Chemspec International Ltd (NYSE:CPC) 127.3% China

51 Banco de Chile (ADR) (NYSE:BCH) 126.5% Chile

52 Acorn International, Inc. (ADR) (NYSE:ATV) 125.5% China

53 Trintech Group PLC (ADR) (NASDAQ:TTPA) 124.0% Ireland

54 ClickSoftware Technologies Ltd. (NASDAQ:CKSW) 119.7% Israel

55 Radware Ltd. (NASDAQ:RDWR) 119.6% Israel

56 Sasol Limited (ADR) (NYSE:SSL) 119.5% South Africa

57 Fushi Copperweld, Inc. (NASDAQ:FSIN) 115.0% China

58 China Valves Technology, Inc. (NASDAQ:CVVT) 109.7% China

59 China Nepstar Chain Drugstore Ltd. (NYSE:NPD) 109.3% China

60 Novogen Limited (ADR) (NASDAQ:NVGN) 108.3% Australia

61 Central Gold-Trust (AMEX:GTU) 107.9% Canada

62 Anooraq Resources Corporation (USA) (AMEX:ANO) 105.3% Canada

63 ReneSola Ltd. (ADR) (NYSE:SOL) 100.7% China

64 Petrobras Energia Participaciones SA ADR (NYSE:PZE) 98.3% Argentina

65 CNH Global N.V. (ADR) (NYSE:CNH) 98.2% Netherlands

66 Pan American Silver Corp. (USA) (NASDAQ:PAAS) 98.1% Canada

67 ORIX Corporation (ADR) (NYSE:IX) 96.2% Japan

68 Puda Coal, Inc (AMEX:PUDA) 94.8% China

69 The Bank of Nova Scotia (USA) (NYSE:BNS) 93.6% Canada

70 Elbit Imaging Ltd (NASDAQ:EMITF) 89.7% Israel

71 Gammon Gold, Inc. (NYSE:GRS) 86.5% Canada

72 SunOpta, Inc. (USA) (NASDAQ:STKL) 81.1% Canada

73 China Petroleum & Chemical Corp. (ADR) (NYSE:SNP) 79.1% China

74 Optibase Ltd. (NASDAQ:OBAS) 77.2% Israel

75 China Pharma Holdings, Inc. (AMEX:CPHI) 76.1% China

76 ATA Inc.(ADR) (NASDAQ:ATAI) 75.2% China

77 Cresud Inc. (ADR) (NASDAQ:CRESY) 72.7% Argentina

78 Gulf Resources, Inc. (NASDAQ:GFRE) 72.3% China

79 Commtouch Software Ltd. (NASDAQ:CTCH) 70.4% Israel

80 Sapiens International Corporation N.V. (NASDAQ:SPNS) 68.3% Netherland Antilles

81 Lihua International, Inc. (NYSE:LIWA) 68.0% China

82 Goldcorp Inc. (USA) (NYSE:GG) 66.5% Canada

83 BOS Better OnLine Sol (USA) (NASDAQ:BOSC) 66.0% Israel

84 Allied Irish Banks, plc. (ADR) (NYSE:AIB) 65.6% Ireland

85 Banco Santander-Chile (ADR) (NYSE:SAN) 64.6% Chile

86 VimpelCom Ltd. (NYSE:VIP) 64.2% Netherlands

87 Grupo TMM, S.A.B. (ADR) (NYSE:TMM) 64.0% Mexico

88 VistaPrint NV (NASDAQ:VPRT) 63.1% Bermuda

89 AEGON N.V. (ADR) (NYSE:AEG) 62.9% Netherlands

90 Allied World Assurance Holdings, Ltd. (NYSE:AWH) 62.4% Bermuda

91 Omega Navigation Enterprises, Inc. (NASDAQ:ONAV) 60.2% Greece

92 Signet Jewelers Ltd. (NYSE:SIG) 59.6% Bermuda

93 ChipMOS Technologies (Bermuda) Ltd (NASDAQ:IMOS) 59.3% Taiwan

94 First BanCorp. (NYSE:FBP) 59.0% Puerto Rico

95 Qiao Xing Universal Resources, Inc. (NASDAQ:XING) 56.2% China

96 Nevsun Resources (USA) (AMEX:NSU) 55.9% Canada

97 T.A.T. Technologies Ltd. (NASDAQ:TATT) 55.2% Israel

98 AngloGold Ashanti Limited (ADR) (NYSE:AU) 54.9% South Africa

99 China Yida Holding, Co. (NYSE:CNYD) 54.9% Hong Kong

100 Tri-Tech Holding, Inc. (NASDAQ:TRIT) 53.6% China

101 Keegan Resources Inc. (AMEX:KGN) 53.4% Canada

102 W Holding Company, Inc. (NYSE:WHI) 53.0% Puerto Rico

103 MI Developments Inc. (USA) (NYSE:MIM) 52.7% Canada

104 Genpact Limited (NYSE:G) 52.6% Bermuda

105 Euro Tech Holdings Co. Ltd. (NASDAQ:CLWT) 52.5% Hong Kong

106 Spreadtrum Communications, Inc. (NASDAQ:SPRD) 52.1% China

107 Wimm-Bill-Dann Foods OJSC (ADR) (NYSE:WBD) 51.6% Russia

108 Banco Macro SA (ADR) (NYSE:BMA) 51.5% Argentina

109 Baytex Energy Trust (USA) (NYSE:BTE) 50.9% Canada

110 NetEase.com, Inc. (ADR) (NASDAQ:NTES) 50.4% China

111 Hitachi, Ltd. (ADR) (NYSE:HIT) 49.7% Japan

112 GlaxoSmithKline plc (ADR) (NYSE:GSK) 48.3% United Kingdom

113 China Integrated Energy, Inc. (NASDAQ:CBEH) 48.1% China

114 Crosshair Exploration & Mining Corp. (AMEX:CXZ) 47.8% Canada

115 Sohu.com Inc. (NASDAQ:SOHU) 47.3% China

116 Descartes Systems Group (USA) (NASDAQ:DSGX) 45.5% Canada

117 Gerdau SA (ADR) (NYSE:GGB) 45.1% Brazil

118 Fronteer Gold Inc. (AMEX:FRG) 45.0% Canada

119 Nexen Inc. (USA) (NYSE:NXY) 44.8% Canada

120 Makita Corporation (ADR) (NASDAQ:MKTAY) 44.6% Japan

121 Deer Consumer Products, Inc. (NASDAQ:DEER) 44.3% China

122 ICON plc (ADR) (NASDAQ:ICLR) 44.3% Ireland

123 Shinhan Financial Group Co., Ltd. (ADR) (NYSE:SHG) 43.6% South Korea

124 TOTAL S.A. (ADR) (NYSE:TOT) 43.5% France

125 UTi Worldwide Inc. (NASDAQ:UTIW) 43.4% Virgin Islands, British

126 Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP) 43.0% China

127 Silver Wheaton Corp. (USA) (NYSE:SLW) 42.9% Canada

128 Vina Concha y Toro S.A. (ADR) (NYSE:VCO) 42.5% Chile

129 Crude Carriers Corp. (NYSE:CRU) 42.3% Greece

130 Fresenius Kabi Pharma. Holding Inc (NASDAQ:APCVZ) 42.1% Germany

131 Syngenta AG (ADR) (NYSE:SYT) 42.0% Switzerland

132 Silver Standard Resources Inc. (USA) (NASDAQ:SSRI) 41.7% Canada

133 Sensata Technologies Holding N.V. (NYSE:ST) 41.4% Netherlands

134 Mellanox Technologies, Ltd. (NASDAQ:MLNX) 41.2% Israel

135 Harmony Gold Mining Co. (ADR) (NYSE:HMY) 40.9% South Africa

136 China Yuchai International Limited (NYSE:CYD) 40.9% Singapore

137 Banco Itau Holding Financeira S.A. (ADR) (NYSE:ITUB) 40.8% Brazil

138 Grupo Aeroportuario del Pacifico (ADR) (NYSE:PAC) 40.8% Mexico

139 ZHONGPIN INC. (NASDAQ:HOGS) 40.3% China

140 Seaspan Corporation (NYSE:SSW) 40.1% Hong Kong

141 Aurizon Mines Ltd.(USA) (AMEX:AZK) 39.2% Canada

142 SMART Technologies Inc (NASDAQ:SMT) 38.9% Canada

143 Yamana Gold Inc. (USA) (NYSE:AUY) 38.8% Canada

144 Cardero Resources Corp. (USA) (AMEX:CDY) 37.7% Canada

145 Corpbanca (ADR) (NYSE:BCA) 36.8% Chile

146 Samson Oil & Gas Limited (ADR) (AMEX:SSN) 36.5% Australia

147 Gildan Activewear Inc. (USA) (NYSE:GIL) 35.4% Canada

148 British American Tobacco (ADR) (AMEX:BTI) 35.1% United Kingdom

149 Repsol YPF, S.A. (ADR) (NYSE:REP) 35.0% Spain

150 North American Palladium Ltd. (AMEX:PAL) 34.9% Canada

151 CIBT Education Group Inc. (USA) (AMEX:MBA) 34.6% Canada

152 Mitsubishi UFJ Financial Group Inc (ADR) (NYSE:MTU) 34.5% Japan

153 Hong Kong Highpower Technology, Inc. (NASDAQ:HPJ) 34.3% China

154 Textainer Group Holdings Limited (NYSE:TGH) 33.8% Bermuda

155 Amdocs Limited (NYSE:DOX) 33.4% United Kingdom

156 Yongye International, Inc. (NASDAQ:YONG) 33.1% China

157 BMB Munai Inc. (AMEX:KAZ) 33.1% Kazakhstan

158 O2Micro International Limited (ADR) (NASDAQ:OIIM) 32.7% Cayman Islands

159 China Telecom Corporation Limited (ADR) (NYSE:CHA) 32.5% China

160 3SBio Inc. (ADR) (NASDAQ:SSRX) 32.3% China

161 Smith & Nephew plc (ADR) (NYSE:SNN) 32.3% United Kingdom

162 Validus Holdings, Ltd. (NYSE:VR) 31.7% Bermuda

163 Agrium Inc. (USA) (NYSE:AGU) 31.3% Canada

164 Gushan Environmental Energy Limited (NYSE:GU) 30.9% China

165 Noble Corporation (NYSE:NE) 30.7% Cayman Islands

166 CAE, Inc. (USA) (NYSE:CAE) 30.7% Canada

167 Given Imaging Ltd. (NASDAQ:GIVN) 30.7% Israel

168 Grupo Simec S.A.B. de C.V. (ADR) (AMEX:SIM) 30.5% Mexico

169 Nokia Corporation (ADR) (NYSE:NOK) 30.3% Finland

170 PetroChina Company Limited (ADR) (NYSE:PTR) 30.3% China

171 China Agritech Inc. (NASDAQ:CAGC) 30.2% China

172 Seagate Technology PLC (NASDAQ:STX) 30.2% Ireland

173 Winner Medical Group, Inc (NASDAQ:WWIN) 30.1% China

174 Delhaize Group (ADR) (NYSE:DEG) 29.8% Belgium

175 Baidu.com, Inc. (ADR) (NASDAQ:BIDU) 29.5% China

176 KongZhong Corporation (ADR) (NASDAQ:KONG) 29.2% China

177 Tenaris S.A. (ADR) (NYSE:TS) 28.1% Luxembourg

178 Cameco Corporation (USA) (NYSE:CCJ) 28.0% Canada

179 Tanzanian Royalty Exploration Corp. (US) (AMEX:TRE) 27.9% Canada

180 Fabrinet (NYSE:FN) 27.8% Thailand

181 Navios Maritime Holdings Inc. (NYSE:NM) 27.8% Greece

182 China Wind Systems, Inc. (NASDAQ:CWS) 26.7% China

183 Angiotech Pharmaceuticals, Inc. (USA) (NASDAQ:ANPI) 26.4% Canada

184 Minco Gold Corporation (ADR) (AMEX:MGH) 26.4% Canada

185 Fibria Celulose S.A. (ADR) (NYSE:FBR) 25.2% Brazil

186 Sony Corporation (ADR) (NYSE:SNE) 25.2% Japan

187 Domtar Corp. (USA) (NYSE:UFS) 25.1% Canada

188 Knightsbridge Tankers Limited (NASDAQ:VLCCF) 25.1% Bermuda

189 Oriental Financial Group Inc. (NYSE:OFG) 24.9% Puerto Rico

190 Central Fund of Canada Limited (USA) (AMEX:CEF) 24.8% Canada

191 Homex Development Corp. (ADR) (NYSE:HXM) 24.7% Mexico

192 Marshall Edwards, Inc. (NASDAQ:MSHL) 24.7% Australia

193 IRSA Inversiones Representaciones (ADR) (NYSE:IRS) 24.6% Argentina

194 Philippine Long Distance Telephone (ADR) (NYSE:PHI) 24.5% Philippines

195 Huaneng Power International, Inc. (ADR) (NYSE:HNP) 24.4% China

196 AudioCodes Ltd. (NASDAQ:AUDC) 24.2% Israel

197 Brasil Telecom SA (ADR) (NYSE:BTM) 24.2% Brazil

198 Ryanair Holdings plc (ADR) (NASDAQ:RYAAY) 23.6% Ireland

199 Subaye Inc (NASDAQ:SBAY) 23.4% China

200 America Movil SAB de CV (ADR) (NYSE:AMX) 22.9% Mexico

201 Braskem SA (ADR) (NYSE:BAK) 22.4% Brazil

202 Innospec Inc. (NASDAQ:IOSP) 22.2% United Kingdom

203 Nova Measuring Instruments Ltd. (NASDAQ:NVMI) 22.0% Israel

204 Randgold Resources Ltd. (ADR) (NASDAQ:GOLD) 21.8% Jersey

205 NTT DoCoMo, Inc. (ADR) (NYSE:DCM) 21.4% Japan

206 ArcelorMittal (ADR) (NYSE:MT) 21.4% Luxembourg

207 Top Image Systems Ltd. (NASDAQ:TISA) 21.0% Israel

208 Xinhua Finance Media Limited (ADR) (NASDAQ:XSEL) 21.0% China

209 Global Crossing Ltd. (NASDAQ:GLBC) 20.6% Bermuda

210 Sanofi-Aventis SA (ADR) (NYSE:SNY) 20.4% France

211 China Biologic Products Inc (NASDAQ:CBPO) 20.1% China

212 Navios Maritime Partners L.P. (NYSE:NMM) 19.7% Greece

213 Jacada Ltd. (NASDAQ:JCDA) 19.5% Israel

214 China TransInfo Technology Corp. (NASDAQ:CTFO) 19.3% China

215 Lan Airlines S.A. (ADR) (NYSE:LFL) 19.1% Chile

216 eFuture Information Technology Inc. (NASDAQ:EFUT) 19.0% China

217 KB Financial Group, Inc. (ADR) (NYSE:KB) 19.0% South Korea

218 Platinum Group Metals Limited (USA) (AMEX:PLG) 18.8% Canada

219 Wonder Auto Technology, Inc. (NASDAQ:WATG) 18.7% China

220 TransGlobe Energy Corporation (USA) (NASDAQ:TGA) 18.6% Canada

221 Sun Life Financial Inc. (USA) (NYSE:SLF) 18.4% Canada

222 Augusta Resource Corp. (USA) (AMEX:AZC) 18.2% Canada

223 B Communications Ltd (NASDAQ:SMLC) 18.1% Israel

224 Bank of Ireland (ADR) (NYSE:IRE) 18.0% Ireland

225 Teck Resources Limited (NYSE:TCK) 17.5% Canada

226 Cimatron Ltd. (NASDAQ:CIMT) 17.3% Israel

227 OceanFreight Inc. (NASDAQ:OCNF) 17.2% Greece

228 China Eastern Airlines Corp. Ltd. (ADR) (NYSE:CEA) 17.1% China

229 Aixtron AG (ADR) (NASDAQ:AIXG) 17.1% Germany

230 Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) 17.0% Luxembourg

231 Bonso Electronics International Inc. (NASDAQ:BNSO) 17.0% Hong Kong

232 Telefonaktiebolaget LM Ericsson (ADR) (NASDAQ:ERIC) 16.9% Sweden

233 Diana Shipping Inc. (NYSE:DSX) 16.8% Greece

234 Xyratex Ltd. (NASDAQ:XRTX) 16.8% United Kingdom

235 Tiens Biotech Group (USA), Inc. (AMEX:TBV) 16.8% China

236 ABB Ltd (ADR) (NYSE:ABB) 16.7% Switzerland

237 UBS AG (USA) (NYSE:UBS) 16.4% Switzerland

238 Weatherford International Ltd. (NYSE:WFT) 16.4% Switzerland

239 Ivanhoe Mines Ltd. (USA) (NYSE:IVN) 16.4% Canada

240 Fuwei Films (Holdings) Co., Ltd (NASDAQ:FFHL) 16.3% China

241 PT Telekomunikasi Indonesia (ADR) (NYSE:TLK) 16.2% Indonesia

242 Hadera Paper Ltd. (AMEX:AIP) 16.0% Israel

243 Golar LNG Limited (USA) (NASDAQ:GLNG) 15.9% Bermuda

244 EnCana Corporation (USA) (NYSE:ECA) 15.7% Canada

245 Autoliv Inc. (NYSE:ALV) 15.4% Sweden

246 Warner Chilcott Plc (NASDAQ:WCRX) 15.3% Ireland

247 InterOil Corporation (USA) (NYSE:IOC) 15.2% Australia

248 Energy XXI (Bermuda) Limited (NASDAQ:EXXI) 15.2% Bermuda

249 Focus Media Holding Limited (ADR) (NASDAQ:FMCN) 15.1% Hong Kong

250 Cott Corporation (USA) (NYSE:COT) 15.0% Canada

251 Teekay Offshore Partners L.P. (NYSE:TOO) 14.6% Bermuda

252 Rio Tinto plc (ADR) (NYSE:RIO) 14.3% United Kingdom

253 Imperial Oil Limited (USA) (AMEX:IMO) 14.3% Canada

254 Companhia Siderurgica Nacional (ADR) (NYSE:SID) 14.0% Brazil

255 Northgate Minerals Corporation (USA) (AMEX:NXG) 13.6% Canada

256 Logitech International SA (USA) (NASDAQ:LOGI) 13.4% Switzerland

257 China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU) 13.0% Hong Kong

258 Westpac Banking Corporation (ADR) (NYSE:WBK) 12.8% Australia

259 China Natural Resources Inc. (NASDAQ:CHNR) 12.6% Hong Kong

260 Teekay Corporation (NYSE:TK) 12.6% Bermuda

261 Tyco Electronics Ltd. (NYSE:TEL) 12.6% Switzerland

262 Voltaire Ltd. (NASDAQ:VOLT) 12.6% Israel

263 China Natural Gas, Inc. (NASDAQ:CHNG) 12.5% China

264 ING Groep N.V. (ADR) (NYSE:ING) 12.4% Netherlands

265 MercadoLibre, Inc. (NASDAQ:MELI) 12.3% Argentina

266 Millicom International Cellular SA (USA) (NASDAQ:MICC) 12.2% Luxembourg

267 Orckit Communications Ltd (NASDAQ:ORCT) 12.0% Israel

268 Methanex Corporation (USA) (NASDAQ:MEOH) 11.9% Canada

269 GEROVA Financial Group, Ltd. (NYSE:GFC) 11.6% Cayman Islands

270 QKL Stores Inc (NASDAQ:QKLS) 11.5% China

271 IMAX Corporation (USA) (NASDAQ:IMAX) 11.5% Canada

272 CNinsure Inc. (NASDAQ:CISG) 11.3% China

273 Agnico-Eagle Mines Limited (USA) (NYSE:AEM) 11.0% Canada

274 HSBC Holdings plc (ADR) (NYSE:HBC) 11.0% United Kingdom

275 China-Biotics Inc. (NASDAQ:CHBT) 10.6% China

276 China Real Estate Information Corp (NASDAQ:CRIC) 10.5% China

277 Banco Bilbao Vizcaya Argentaria SA (ADR) (NYSE:BBVA) 10.4% Spain

278 ARM Holdings plc (ADR) (NASDAQ:ARMH) 10.4% United Kingdom

279 Cenovus Energy Inc (ADR) (NYSE:CVE) 10.3% Canada

280 Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB) 10.2% Mexico

281 ShengdaTech, Inc. (NASDAQ:SDTH) 10.0% China

282 Sappi Limited (ADR) (NYSE:SPP) 10.0% South Africa

283 Elbit Systems Ltd. (ADR) (NASDAQ:ESLT) 9.9% Israel

284 Transition Therapeutics Inc. (NASDAQ:TTHI) 9.8% Canada

285 Ecopetrol S.A. (ADR) (NYSE:EC) 9.8% Colombia

286 Grupo Financiero Galicia S.A. (ADR) (NASDAQ:GGAL) 9.7% Argentina

287 Net Servicos de Comunicacao SA (ADR) (NASDAQ:NETC) 9.7% Brazil

288 Herbalife Ltd. (NYSE:HLF) 9.6% Cayman Islands

289 Gafisa SA (ADR) (NYSE:GFA) 9.5% Brazil

290 Kingsway Financial Services Inc. (USA) (NYSE:KFS) 9.1% Canada

291 AutoChina International Limited (NASDAQ:AUTC) 8.9% China

292 China Finance Online Co. (ADR) (NASDAQ:JRJC) 8.8% China

293 Tata Motors Limited (ADR) (NYSE:TTM) 8.6% India

294 SINA Corporation (USA) (NASDAQ:SINA) 8.5% China

295 PartnerRe Ltd. (NYSE:PRE) 8.5% Bermuda

296 Elan Corporation, plc (ADR) (NYSE:ELN) 8.4% Ireland

297 Veolia Environnement (ADR) (NYSE:VE) 8.3% France

298 On Track Innovations Ltd.(USA) (NASDAQ:OTIV) 8.3% Israel

299 FirstService Corporation (USA) (NASDAQ:FSRV) 8.3% Canada

300 CNOOC Limited (ADR) (NYSE:CEO) 8.2% Hong Kong

301 Vale (ADR) (NYSE:VALE) 8.1% Brazil

302 NovaGold Resources Inc. (USA) (AMEX:NG) 7.8% Canada

303 Core Laboratories N.V. (NYSE:CLB) 7.6% Netherlands

304 YM BioSciences Inc. (USA) (AMEX:YMI) 7.4% Canada

305 Harbin Electric, Inc. (NASDAQ:HRBN) 7.3% China

306 Sino Clean Energy Inc. (NASDAQ:SCLX) 7.3% China

307 China Medical Technologies, Inc. (ADR) (NASDAQ:CMED) 7.2% China

308 Guanwei Recycling Corp. (NASDAQ:GPRC) 7.1% China

309 Cemex SAB de CV (ADR) (NYSE:CX) 7.1% Mexico

310 MER Telemanagement Solutions Ltd. (NASDAQ:MTSL) 7.0% Israel

311 Stantec Inc. (USA) (NYSE:STN) 7.0% Canada

312 China Recycling Energy Corp. (NASDAQ:CREG) 6.8% China

313 E-House (China) Holdings Limited (NYSE:EJ) 6.7% China

314 TBS International plc (NASDAQ:TBSI) 6.6% Ireland

315 Partner Communications Company Ltd (ADR) (NASDAQ:PTNR) 6.6% Israel

316 Kimber Resources, Inc. (AMEX:KBX) 6.5% Canada

317 China Life Insurance Company Ltd. (ADR) (NYSE:LFC) 6.4% China

318 Research In Motion Limited (USA) (NASDAQ:RIMM) 6.4% Canada

319 Woori Finance Holdings Co., Ltd. (ADR) (NYSE:WF) 6.2% South Korea

320 Yingli Green Energy Hold. Co. Ltd. (ADR) (NYSE:YGE) 6.2% China

321 Garmin Ltd. (NASDAQ:GRMN) 6.2% Switzerland

322 China BAK Battery Inc. (NASDAQ:CBAK) 6.1% China

323 China Security & Surveillance Tech. Inc. (NYSE:CSR) 6.1% China

324 Empresa Nacional de Electricidad (ADR) (NYSE:EOC) 5.9% Chile

325 Mindray Medical International Limited (NYSE:MR) 5.7% China

326 Mountain Province Diamonds, Inc. (AMEX:MDM) 5.7% Canada

327 American Lorain Corporation (AMEX:ALN) 5.6% China

328 Reed Elsevier NV (ADR) (NYSE:ENL) 5.5% Netherlands

329 Infosys Technologies Limited (ADR) (NASDAQ:INFY) 5.3% India

330 JinkoSolar Holding Co., Ltd. (NYSE:JKS) 5.2% China

331 Royal Bank of Canada (USA) (NYSE:RY) 5.2% Canada

332 CRH PLC (ADR) (NYSE:CRH) 5.1% Ireland

333 Royal Dutch Shell plc (ADR) (NYSE:RDS.A) 5.1% Netherlands

334 Vimicro International Corporation (ADR) (NASDAQ:VIMC) 4.8% China

335 Enersis S.A. (ADR) (NYSE:ENI) 4.6% Chile

336 China Lodging Group, Ltd (NASDAQ:HTHT) 4.5% China

337 Tele Norte Leste Participacoes SA (ADR) (NYSE:TNE) 4.4% Brazil

338 Aspen Insurance Holdings Limited (NYSE:AHL) 4.4% Bermuda

339 Protalix BioTherapeutics Inc. (AMEX:PLX) 4.4% Israel

340 Capital Product Partners L.P. (NASDAQ:CPLP) 4.0% Greece

341 Advantest Corp. (ADR) (NYSE:ATE) 4.0% Japan

342 THT Heat Transfer Technology, Inc.(NDA) (NASDAQ:THTI) 3.9% China

343 Aegean Marine Petroleum Network Inc. (NYSE:ANW) 3.9% Greece

344 A-Power Energy Generation Systems, Ltd. (NASDAQ:APWR) 3.7% China

345 Longwei Petroleum Investment Hold Ltd (AMEX:LPH) 3.7% China

346 Dr. Reddy's Laboratories Limited (ADR) (NYSE:RDY) 3.7% India

347 Mizuho Financial Group, Inc. (ADR) (NYSE:MFG) 3.6% Japan

348 Chinacast Education Corporation (NASDAQ:CAST) 3.5% China

349 Teekay Tankers Ltd. (NYSE:TNK) 3.4% Bermuda

350 Alexco Resource Corp. (USA) (AMEX:AXU) 3.4% Canada

351 EZchip Semiconductor Ltd. (NASDAQ:EZCH) 3.4% Israel

352 PolyMet Mining Corp. (USA) (AMEX:PLM) 3.3% Canada

353 Ceragon Networks Ltd. (NASDAQ:CRNT) 3.3% Israel

354 VanceInfo Technologies Inc. (NYSE:VIT) 3.2% China

355 Ultrapetrol (Bahamas) Limited (NASDAQ:ULTR) 3.2% Bahamas

356 Ivanhoe Energy Inc. (USA) (NASDAQ:IVAN) 2.9% Canada

357 Sterlite Industries India Limited (ADR) (NYSE:SLT) 2.7% India

358 Deutsche Bank AG (USA) (NYSE:DB) 2.7% Germany

359 The9 Limited (ADR) (NASDAQ:NCTY) 2.7% China

360 Novo Nordisk A/S (ADR) (NYSE:NVO) 2.4% Denmark

361 Skystar Bio-Pharmaceutical Company (NASDAQ:SKBI) 2.3% China

362 Genetic Technologies Limited (ADR) (NASDAQ:GENE) 2.3% Australia

363 Enerplus Resources Fund (USA) (NYSE:ERF) 2.3% Canada

364 Qiagen NV (NASDAQ:QGEN) 2.1% Netherlands

365 TransAlta Corporation (USA) (NYSE:TAC) 2.1% Canada

366 AEterna Zentaris Inc. (USA) (NASDAQ:AEZS) 2.1% Canada

367 MGT Capital Investments Inc. (AMEX:MGT) 2.0% United Kingdom

368 HONDA MOTOR CO., LTD. (ADR) (NYSE:HMC) 1.9% Japan

369 Platinum Underwriters Holdings, Ltd. (NYSE:PTP) 1.9% Bermuda

370 Compugen Ltd. (USA) (NASDAQ:CGEN) 1.9% Israel

371 Rubicon Minerals Corp. (USA) (AMEX:RBY) 1.7% Canada

372 Suncor Energy Inc. (USA) (NYSE:SU) 1.6% Canada

373 LDK Solar Co., Ltd. (NYSE:LDK) 1.5% China

374 Barclays PLC (ADR) (NYSE:BCS) 1.5% United Kingdom

375 China Precision Steel, Inc. (NASDAQ:CPSL) 1.5% Hong Kong

376 Toronto-Dominion Bank (USA) (NYSE:TD) 1.2% Canada

377 Trinity Biotech plc (ADR) (NASDAQ:TRIB) 0.9% Ireland

378 Teva Pharmaceutical Industries Ltd (ADR) (NASDAQ:TEVA) 0.8% Israel

379 Sierra Wireless, Inc. (USA) (NASDAQ:SWIR) 0.8% Canada

380 Mettler-Toledo International Inc. (NYSE:MTD) 0.8% Switzerland

381 Camtek LTD. (NASDAQ:CAMT) 0.8% Israel

382 Shengkai Innovations, Inc. (NASDAQ:VALV) 0.7% China

383 Alto Palermo S.A. (ADR) (NASDAQ:APSA) 0.6% Argentina

384 Flamel Technologies S.A. (ADR) (NASDAQ:FLML) 0.6% France

385 Birks & Mayors Inc. (AMEX:BMJ) 0.5% Canada

386 Royal Bank of Scotland Group plc (ADR) (NYSE:RBS) 0.5% United Kingdom

387 New Dragon Asia Corp. (AMEX:NWD) 0.5% China

388 Lloyds TSB Group plc (ADR) (NYSE:LYG) 0.4% United Kingdom

389 Nordic American Tanker Shipping Limited (NYSE:NAT) 0.3% Bermuda

390 KONAMI CORPORATION (ADR) (NYSE:KNM) 0.2% Japan

391 STMicroelectronics N.V. (ADR) (NYSE:STM) 0.2% Switzerland

392 OccuLogix, Inc. (USA) (NASDAQ:TEAR) 0.2% Canada

393 Mag Silver Corp (ADR) (AMEX:MVG) 0.1% Canada

394 GeoGlobal Resources Inc. (AMEX:GGR) 0.1% Canada

395 Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO) 0.0% Taiwan

396 Lazard Ltd (NYSE:LAZ) 0.0% Bermuda

397 Paramount Gold and Silver Corp. (AMEX:PZG) 0.0% Canada

398 Navios Maritime Acquisition Corporation (NYSE:NNA.U) 0.0% Greece

399 China Shenghuo Pharmaceutical Hldg, Inc. (AMEX:KUN) 0.0% China

400 Orthofix International NV (NASDAQ:OFIX) -0.1% Netherland Antilles

401 Dejour Enterprises Ltd (USA) (AMEX:DEJ) -0.1% Canada

402 MDC Partners Inc. (USA) (NASDAQ:MDCA) -0.2% Canada

403 Alpha Pro Tech, Ltd. (AMEX:APT) -0.2% Canada

404 Safe Bulkers, Inc. (NYSE:SB) -0.3% Greece

405 Luxottica Group S.p.A. (ADR) (NYSE:LUX) -0.3% Italy

406 Recon Technology, Ltd. (NASDAQ:RCON) -0.4% China

407 New Gold Inc. (USA) (AMEX:NGD) -0.4% Canada

408 Gold Fields Limited (ADR) (NYSE:GFI) -0.5% South Africa

409 Guangshen Railway Co. Ltd (ADR) (NYSE:GSH) -0.6% China

410 TAM S.A. (ADR) (NYSE:TAM) -0.6% Brazil

411 Rogers Communications Inc. (USA) (NYSE:RCI) -0.6% Canada

412 WPP PLC (ADR) (NASDAQ:WPPGY) -0.7% Ireland

413 Prudential Public Limited Company (ADR) (NYSE:PUK) -0.7% United Kingdom

414 Ballard Power Systems Inc. (USA) (NASDAQ:BLDP) -0.8% Canada

415 Denison Mines Corp. (AMEX:DNN) -0.8% Canada

416 Wacoal Holdings Corporation (ADR) (NASDAQ:WACLY) -0.8% Japan

417 Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS) -1.0% Germany

418 Sinopec Shanghai Petrochemical Co. (ADR) (NYSE:SHI) -1.1% China

419 Assured Guaranty Ltd. (NYSE:AGO) -1.1% Bermuda

420 Fuqi International, Inc. (NASDAQ:FUQI) -1.1% China

421 Diageo plc (ADR) (NYSE:DEO) -1.2% United Kingdom

422 Greenlight Capital Re, Ltd. (NASDAQ:GLRE) -1.2% Cayman Islands

423 Endurance Specialty Holdings Ltd. (NYSE:ENH) -1.2% Bermuda

424 CGG Veritas (ADR) (NYSE:CGV) -1.3% France

425 QLT Inc. (USA) (NASDAQ:QLTI) -1.4% Canada

426 Pansoft Company Limited (NASDAQ:PSOF) -1.4% China

427 Melco Crown Entertainment Ltd (NASDAQ:MPEL) -1.4% Hong Kong

428 Hydrogenics Corporation (USA) (NASDAQ:HYGS) -1.5% Canada

429 Copernic Inc. (NASDAQ:CNIC) -1.7% Canada

430 Ritchie Bros. Auctioneers (USA) (NYSE:RBA) -1.8% Canada

431 Canadian Imperial Bank of Commerce (USA) (NYSE:CM) -1.8% Canada

432 China Housing & Land Development, Inc. (NASDAQ:CHLN) -2.0% China

433 Great Basin Gold Ltd. (USA) (AMEX:GBG) -2.0% Canada

434 AirMedia Group Inc. (ADR) (NASDAQ:AMCN) -2.0% China

435 JA Solar Holdings Co., Ltd. (ADR) (NASDAQ:JASO) -2.1% China

436 Grupo Radio Centro SAB de CV (ADR) (NYSE:RC) -2.2% Mexico

437 Primus Guaranty, Ltd. (NYSE:PRS) -2.2% Bermuda

438 Shanda Interactive Entertainment Ltd ADR (NASDAQ:SNDA) -2.3% China

439 China Mass Media Intl Adv Corp. (ADR) (NYSE:CMM) -2.5% China

440 Envoy Capital Group Inc. (NASDAQ:ECGI) -2.6% Canada

441 Banco Latinoamericano de Comercio Exr SA (NYSE:BLX) -2.6% Panama

442 Sonde Resources Corp. (AMEX:SNG) -2.7% Canada

443 CDC Corporation (NASDAQ:CHINA) -2.8% Hong Kong

444 Alterra Capital Holdings Ltd. (NASDAQ:ALTE) -2.8% Bermuda

445 Gilat Satellite Networks Ltd. (NASDAQ:GILT) -2.8% Israel

446 Telecom Italia S.p.A. (ADR) (NYSE:TI) -2.9% Italy

447 New Oriental Education & Tech. Group Inc (NYSE:EDU) -3.0% China

448 Aluminum Corp. of China Limited (ADR) (NYSE:ACH) -3.0% China

449 Coca-Cola FEMSA, S.A.B. de C.V. (ADR) (NYSE:KOF) -3.1% Mexico

450 Carnival plc (ADR) (NYSE:CUK) -3.1% United Kingdom

451 Suntech Power Holdings Co., Ltd. (ADR) (NYSE:STP) -3.2% China

452 Nymox Pharmaceutical Corporation (NASDAQ:NYMX) -3.2% Canada

453 Frontline Ltd. (USA) (NYSE:FRO) -3.3% Bermuda

454 Lululemon Athletica inc. (NASDAQ:LULU) -3.3% Canada

455 MDS Inc. (USA) (NYSE:MDZ) -3.4% Canada

456 Alvarion Ltd. (USA) (NASDAQ:ALVR) -3.5% Israel

457 DHT Holdings Inc (NYSE:DHT) -3.5% Jersey

458 Toyota Motor Corporation (ADR) (NYSE:TM) -3.5% Japan

459 China Green Agriculture, Inc (NYSE:CGA) -3.5% China

460 Euroseas Ltd. (NASDAQ:ESEA) -3.6% Greece

461 LG Display Co Ltd. (ADR) (NYSE:LPL) -3.7% South Korea

462 Thompson Creek Metals Company, Inc. (NYSE:TC) -3.9% Canada

463 Novartis AG (ADR) (NYSE:NVS) -3.9% Switzerland

464 Maiden Holdings, Ltd. (NASDAQ:MHLD) -3.9% Bermuda

465 Fundtech Ltd. (NASDAQ:FNDT) -4.0% Israel

466 Accenture Plc (NYSE:ACN) -4.2% Ireland

467 Ship Finance International Limited (NYSE:SFL) -4.4% Bermuda

468 Leading Brands, Inc. (NASDAQ:LBIX) -4.4% Canada

469 BRF Brasil Foods SA(ADR) (NYSE:BRFS) -4.4% Brazil

470 SinoHub Inc (AMEX:SIHI) -4.4% China

471 Solarfun Power Holdings Co., Ltd. (ADR) (NASDAQ:SOLF) -4.8% China

472 Grupo Televisa, S.A. (ADR) (NYSE:TV) -4.8% Mexico

473 Advantage Oil & Gas Ltd. (NYSE:AAV) -4.9% Canada

474 Credicorp Ltd. (USA) (NYSE:BAP) -4.9% Peru

475 Petroleo Brasileiro SA (ADR) (NYSE:PBR) -4.9% Brazil

476 BHP Billiton Limited (ADR) (NYSE:BHP) -5.0% Australia

477 Minefinders Corp. Ltd. (USA) (AMEX:MFN) -5.1% Canada

478 RINO International Corporation (NASDAQ:RINO) -5.1% China

479 Telecomunicacoes de Sao Paulo SA (ADR) (NYSE:TSP) -5.1% Brazil

480 Telefonos de Mexico, S.A. (ADR) (NYSE:TMX) -5.1% Mexico

481 AerCap Holdings N.V. (NYSE:AER) -5.2% Netherlands

482 Nippon Telegraph & Telephone Corp. (ADR) (NYSE:NTT) -5.4% Japan

483 Orsus Xelent Technologies Inc. (AMEX:ORS) -5.4% China

484 EXFO Electro-Optical Engineering (USA) (NASDAQ:EXFO) -5.5% Canada

485 Everest Re Group, Ltd. (NYSE:RE) -5.5% Bermuda

486 Canon Inc. (ADR) (NYSE:CAJ) -5.5% Japan

487 Yuhe International, Inc (NASDAQ:YUII) -5.6% China

488 AgFeed Industries, Inc. (NASDAQ:FEED) -5.7% China

489 Kandi Technolgies Corp. (NASDAQ:KNDI) -5.7% China

490 Magyar Telekom Plc. (ADR) (NYSE:MTA) -5.7% Hungary

491 BluePhoenix Solutions, Ltd.(USA) (NASDAQ:BPHX) -5.8% Israel

492 Excel Maritime Carriers Ltd (NYSE:EXM) -5.9% Greece

493 Ninetowns Internet Technlgy Grp Co Ltd. (NASDAQ:NINE) -6.0% China

494 ICICI Bank Limited (ADR) (NYSE:IBN) -6.0% India

495 Coca-Cola HBC S.A. (ADR) (NYSE:CCH) -6.1% Greece

496 China Technology Development Group Corp. (NASDAQ:CTDC) -6.1% Hong Kong

497 Embraer – Empr Bras Aeronautica (ADR) (NYSE:ERJ) -6.2% Brazil

498 TIM Participacoes SA (ADR) (NYSE:TSU) -6.2% Brazil

499 XL Group plc (NYSE:XL) -6.3% Ireland

500 Magal Security Systems Ltd. (USA) (NASDAQ:MAGS) -6.3% Israel

501 AstraZeneca plc (ADR) (NYSE:AZN) -6.3% United Kingdom

502 Shire Plc. (ADR) (NASDAQ:SHPGY) -6.4% United Kingdom

503 Vodafone Group Plc (ADR) (NASDAQ:VOD) -6.4% United Kingdom

504 Seabridge Gold, Inc. (USA) (AMEX:SA) -6.4% Canada

505 Bancolombia S.A. (ADR) (NYSE:CIB) -6.4% Colombia

506 Sociedad Quimica y Minera (ADR) (NYSE:SQM) -6.5% Chile

507 Statoil ASA(ADR) (NYSE:STO) -6.5% Norway

508 Wipro Limited (ADR) (NYSE:WIT) -6.5% India

509 Talisman Energy Inc. (USA) (NYSE:TLM) -6.6% Canada

510 Crystallex International Corp. (USA) (AMEX:KRY) -6.7% Canada

511 Duoyuan Global Water Inc (NYSE:DGW) -7.0% China

512 Central European Media Enterprises Ltd. (NASDAQ:CETV) -7.1% Bermuda

513 China Techfaith Wireless Comm. Tech. Ltd (NASDAQ:CNTF) -7.1% China

514 Companhia Paranaense de Energia (ADR) (NYSE:ELP) -7.1% Brazil

515 Grupo Aeroportuario del Sureste (ADR) (NYSE:ASR) -7.1% Mexico

516 SAP AG (ADR) (NYSE:SAP) -7.2% Germany

517 RiT Technologies Ltd. (NASDAQ:RITT) -7.3% Israel

518 Argo Group International Holdings, Ltd. (NASDAQ:AGII) -7.4% Bermuda

519 Endeavour Silver Corp. (CAN) (AMEX:EXK) -7.6% Canada

520 Fly Leasing Ltd(ADR) (NYSE:FLY) -7.7% Ireland

521 China Sky One Medical, Inc. (NASDAQ:CSKI) -7.8% China

522 Eurand N.V. (NASDAQ:EURX) -7.8% Netherlands

523 Vivo Participacoes SA (ADR) (NYSE:VIV) -7.8% Brazil

524 Credit Suisse Group AG (ADR) (NYSE:CS) -7.8% Switzerland

525 Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL) -7.8% Bermuda

526 LML Payment Systems, Inc. (NASDAQ:LMLP) -7.9% Canada

527 China Gerui Adv Mtals Grp Ltd (NASDAQ:CHOP) -8.0% China

528 Perfect World Co., Ltd. (ADR) (NASDAQ:PWRD) -8.1% China

529 Telestone Technologies Corporation (NASDAQ:TSTC) -8.1% China

530 Companhia de Saneamento Basico (ADR) (NYSE:SBS) -8.1% Brazil

531 VisionChina Media Inc (NASDAQ:VISN) -8.2% China

532 Avago Technologies Limited (NASDAQ:AVGO) -8.2% Singapore

533 American Dairy, Inc. (NYSE:ADY) -8.2% China

534 Willis Group Holdings PLC (NYSE:WSH) -8.2% United Kingdom

535 National Grid plc (ADR) (NYSE:NGG) -8.2% United Kingdom

536 Gol Linhas Aereas Inteligentes SA (ADR) (NYSE:GOL) -8.3% Brazil

537 StealthGas Inc. (NASDAQ:GASS) -8.3% Greece

538 New Oriental Energy & Chemical Corp. (NASDAQ:NOEC) -8.4% China

539 Korea Electric Power Corporation (ADR) (NYSE:KEP) -8.4% South Korea

540 Private Media Group Inc. (NASDAQ:PRVT) -8.5% Spain

541 SK Telecom Co., Ltd. (ADR) (NYSE:SKM) -8.5% South Korea

542 Mobile TeleSystems OJSC (ADR) (NYSE:MBT) -8.6% Russia

543 Enstar Group Ltd. (NASDAQ:ESGR) -8.6% Bermuda

544 Alcatel-Lucent (ADR) (NYSE:ALU) -8.8% France

545 NXP Semiconductors NV (NASDAQ:NXPI) -8.8% Netherlands

546 Ampal-American Israel Corporation (NASDAQ:AMPL) -9.0% Israel

547 Ingersoll-Rand PLC (NYSE:IR) -9.1% Ireland

548 Highway Holdings Limited (NASDAQ:HIHO) -9.1% Hong Kong

549 HDFC Bank Limited (ADR) (NYSE:HDB) -9.1% India

550 Claude Resources Inc. (USA) (AMEX:CGR) -9.2% Canada

551 Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) -9.2% Israel

552 VocalTec Communications Ltd. (NASDAQ:CALL) -9.2% Israel

553 Mitsui & Co., Ltd. (ADR) (NASDAQ:MITSY) -9.4% Japan

554 Telvent Git, S.A (NASDAQ:TLVT) -9.5% Spain

555 Kinross Gold Corporation (USA) (NYSE:KGC) -9.5% Canada

556 BT Group plc (ADR) (NYSE:BT) -9.5% United Kingdom

557 Shamir Optical Industry Ltd. (NASDAQ:SHMR) -9.6% Israel

558 Foster Wheeler Ltd. (NASDAQ:FWLT) -9.7% Switzerland

559 Zoom Technologies, Inc. (NASDAQ:ZOOM) -9.8% China

560 Charm Communications Inc (NASDAQ:CHRM) -9.8% China

561 EDAP TMS S.A. (ADR) (NASDAQ:EDAP) -9.8% France

562 Arch Capital Group Ltd. (NASDAQ:ACGL) -9.9% Bermuda

563 Sinovac Biotech Ltd. (NASDAQ:SVA) -9.9% China

564 Triple-S Management Corp. (NYSE:GTS) -10.0% Puerto Rico

565 Telecom Argentina S.A. (ADR) (NYSE:TEO) -10.1% Argentina

566 Trina Solar Limited (ADR) (NYSE:TSL) -10.1% China

567 Magic Software Enterprises Ltd. (NASDAQ:MGIC) -10.2% Israel

568 MIND C.T.I. Ltd. (NASDAQ:MNDO) -10.3% Israel

569 Kyocera Corporation (ADR) (NYSE:KYO) -10.3% Japan

570 Cellcom Israel Ltd. (NYSE:CEL) -10.3% Israel

571 Exeter Resource Corp. (AMEX:XRA) -10.4% Canada

572 B + H Ocean Carriers Ltd. (AMEX:BHO) -10.5% Bermuda

573 Orient-Express Hotels Ltd. (NYSE:OEH) -10.6% Bermuda

574 AU Optronics Corp. (ADR) (NYSE:AUO) -10.6% Taiwan

575 Labopharm Inc. (NASDAQ:DDSS) -10.6% Canada

576 Nomura Holdings, Inc. (ADR) (NYSE:NMR) -10.6% Japan

577 China Southern Airlines Limited (ADR) (NYSE:ZNH) -10.7% China

578 Companhia Energetica Minas Gerais (ADR) (NYSE:CIG) -10.7% Brazil

579 Natuzzi, S.p.A (ADR) (NYSE:NTZ) -10.7% Italy

580 Technicolor S.A.(ADR) (NYSE:TCH) -10.8% France

581 Syneron Medical Ltd. (NASDAQ:ELOS) -10.8% Israel

582 Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM) -10.9% Taiwan

583 Origin Agritech Ltd. (NASDAQ:SEED) -11.1% China

584 Companhia de Bebidas das Americas (ADR) (NYSE:ABV) -11.1% Brazil

585 Global-Tech Advanced Innovations Inc. (NASDAQ:GAI) -11.2% Hong Kong

586 North American Energy Partners Inc.(USA) (NYSE:NOA) -11.3% Canada

587 General Steel Holdings, Inc. (NYSE:GSI) -11.4% China

588 Marvell Technology Group Ltd. (NASDAQ:MRVL) -11.5% Bermuda

589 Eni S.p.A. (ADR) (NYSE:E) -11.7% Italy

590 China Ritar Power Corp. (NASDAQ:CRTP) -11.8% China

591 Mechel OAO (ADR) (NYSE:MTL) -12.1% Russia

592 Montpelier Re Holdings Ltd. (NYSE:MRH) -12.2% Bermuda

593 Wuhan General Group China Inc. (NASDAQ:WUHN) -12.3% China

594 G. Willi-Food International Limited (NASDAQ:WILC) -12.5% Israel

595 SmartHeat Inc (NASDAQ:HEAT) -12.5% China

596 Provident Energy Trust (USA) (NYSE:PVX) -12.6% Canada

597 Copa Holdings, S.A. (NYSE:CPA) -12.6% Panama

598 Nice Systems Ltd. (ADR) (NASDAQ:NICE) -12.7% Israel

599 Barrick Gold Corporation (USA) (NYSE:ABX) -12.7% Canada

600 Global Indemnity plc (NASDAQ:GBLI) -12.7% Cayman Islands

601 DragonWave, Inc.(USA) (NASDAQ:DRWI) -12.7% Canada

602 Steiner Leisure Limited (NASDAQ:STNR) -12.8% Bahamas

603 Vitran Corporation, Inc. (USA) (NASDAQ:VTNC) -12.9% Canada

604 Ness Technologies, Inc. (NASDAQ:NSTC) -12.9% Israel

605 Mercer International Inc. (NASDAQ:MERC) -13.1% Canada

606 Helen of Troy Limited (NASDAQ:HELE) -13.1% Bermuda

607 Transocean LTD (NYSE:RIG) -13.3% Switzerland

608 Tsakos Energy Navigation Ltd. (NYSE:TNP) -13.3% Greece

609 Tucows Inc. (USA) (AMEX:TCX) -13.3% Canada

610 Canadian National Railway (USA) (NYSE:CNI) -13.5% Canada

611 CARDIOME PHARMA CORP (NASDAQ:CRME) -13.5% Canada

612 IncrediMail Ltd. (USA) (NASDAQ:MAIL) -13.5% Israel

613 Xinyuan Real Estate Co., Ltd. (ADR) (NYSE:XIN) -13.7% China

614 ASML Holding N.V. (ADR) (NASDAQ:ASML) -13.7% Netherlands

615 TransCanada Corporation (USA) (NYSE:TRP) -13.7% Canada

616 FreeSeas Inc. (NASDAQ:FREE) -13.8% Greece

617 BP plc (ADR) (NYSE:BP) -13.9% United Kingdom

618 China Information Security Tech, Inc. (NASDAQ:CNIT) -13.9% China

619 Simcere Pharmaceutical Group (NYSE:SCR) -13.9% China

620 American Oriental Bioengineering, Inc. (NYSE:AOB) -14.3% China

621 BCE Inc. (USA) (NYSE:BCE) -14.3% Canada

622 Bank of Montreal (USA) (NYSE:BMO) -14.4% Canada

623 Popular, Inc. (NASDAQ:BPOP) -14.6% Puerto Rico

624 China Automotive Systems, Inc. (NASDAQ:CAAS) -14.7% China

625 Agria Corporation (ADR) (NYSE:GRO) -14.7% China

626 IntelliPharmaCeutics Intl Inc (USA) (NASDAQ:IPCI) -14.8% Canada

627 China Mobile Ltd. (ADR) (NYSE:CHL) -14.9% Hong Kong

628 Rosetta Genomics Ltd. (USA) (NASDAQ:ROSG) -15.1% Israel

629 Tower Semiconductor Ltd. (USA) (NASDAQ:TSEM) -15.2% Israel

630 Transportadora de Gas del Sur SA (ADR) (NYSE:TGS) -15.3% Argentina

631 Fresh Del Monte Produce Inc. (NYSE:FDP) -15.3% Cayman Islands

632 Torm A/S (ADR) (NASDAQ:TRMD) -15.3% Denmark

633 Longtop Financial Technologies Limited (NYSE:LFT) -15.4% China

634 Funtalk China Holdings Ltd. (NASDAQ:FTLK) -15.5% China

635 AsiaInfo-Linkage, Inc. (NASDAQ:ASIA) -15.6% China

636 Unilever plc (ADR) (NYSE:UL) -15.6% United Kingdom

637 7 DAYS GROUP HOLDINGS LIMITED(ADR) (NYSE:SVN) -15.9% China

638 Flextronics International Ltd. (NASDAQ:FLEX) -16.0% Singapore

639 Eldorado Gold Corporation (USA) (NYSE:EGO) -16.0% Canada

640 American Safety Insurance Holdings, Ltd. (NYSE:ASI) -16.2% Bermuda

641 ACE Limited (NYSE:ACE) -16.2% Switzerland

642 Eltek Ltd. (NASDAQ:ELTK) -16.2% Israel

643 Canadian Solar Inc. (NASDAQ:CSIQ) -16.3% China

644 Oilsands Quest Inc. (AMEX:BQI) -16.4% Canada

645 Tim Hortons Inc. (USA) (NYSE:THI) -16.5% Canada

646 Canadian Natural Resource Ltd (USA) (NYSE:CNQ) -16.7% Canada

647 Siliconware Precision Industries (ADR) (NASDAQ:SPIL) -16.7% Taiwan

648 IESI BFC Ltd (NYSE:BIN) -17.2% Canada

649 Sutor Technology Group Ltd. (NASDAQ:SUTR) -17.3% China

650 Banco Bradesco SA (ADR) (NYSE:BBD) -17.4% Brazil

651 Flagstone Reinsurance Holdings SA (NYSE:FSR) -17.4% Bermuda

652 DryShips Inc. (NASDAQ:DRYS) -17.5% Greece

653 Advanced Semiconductor Engineering (ADR) (NYSE:ASX) -17.6% Taiwan

654 Tongjitang Chinese Medicines Co. (ADR) (NYSE:TCM) -17.7% China

655 Kingtone Wirelessinfo Solutions Hldg Ltd (NASDAQ:KONE) -18.1% China

656 Portugal Telecom, SGPS (ADR) (NYSE:PT) -18.1% Portugal

657 Acergy S.A. (ADR) (NASDAQ:ACGY) -18.3% Luxembourg

658 Noah Education Holdings Ltd. (ADR) (NYSE:NED) -18.4% China

659 Nabors Industries Ltd. (NYSE:NBR) -18.5% Bermuda

660 Entertainment Gaming Asia Inc. (AMEX:EGT) -18.8% Hong Kong

661 CryptoLogic Limited (USA) (NASDAQ:CRYP) -19.2% Canada

662 China INSOnline Corp. (NASDAQ:CHIO) -19.4% China

663 Nortel Inversora S.A. (ADR) (NYSE:NTL) -19.6% Argentina

664 Embotelladora Andina SA (ADR) (NYSE:AKO.A) -19.7% Chile

665 Open Text Corporation (USA) (NASDAQ:OTEX) -19.9% Canada

666 China Architectural Engineering, Inc. (NASDAQ:CAEI) -20.0% China

667 RRSat Global Communications Network Ltd. (NASDAQ:RRST) -20.0% Israel

668 RADA Electronic Ind. Ltd. (NASDAQ:RADA) -20.0% Israel

669 City Telecom (H.K.) Limited (ADR) (NASDAQ:CTEL) -20.4% Hong Kong

670 Gran Tierra Energy Inc. (AMEX:GTE) -20.5% Canada

671 Himax Technologies, Inc. (ADR) (NASDAQ:HIMX) -20.6% Taiwan

672 Ternium S.A. (ADR) (NYSE:TX) -21.3% Luxembourg

673 RenaissanceRe Holdings Ltd. (NYSE:RNR) -21.4% Bermuda

674 Global Sources Ltd. (Bermuda) (NASDAQ:GSOL) -21.5% Bermuda

675 Pointer Telocation Limited (NASDAQ:PNTR) -22.0% Israel

676 Penn West Energy Trust (USA) (NYSE:PWE) -22.2% Canada

677 Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) -22.2% Greece

678 InterContinental Hotels Group PLC (ADR) (NYSE:IHG) -22.3% United Kingdom

679 Yanzhou Coal Mining Co. (ADR) (NYSE:YZC) -22.3% China

680 Consolidated Water Co. Ltd. (NASDAQ:CWCO) -22.7% Cayman Islands

681 Danaos Corporation (NYSE:DAC) -22.7% Greece

682 IAMGOLD Corporation (USA) (NYSE:IAG) -23.1% Canada

683 Compania de Minas Buenaventura SA (ADR) (NYSE:BVN) -23.1% Peru

684 Internet Gold Golden Lines Ltd. (NASDAQ:IGLD) -23.1% Israel

685 GigaMedia Limited (NASDAQ:GIGM) -23.3% Taiwan

686 Anheuser-Busch InBev NV (ADR) (NYSE:BUD) -23.3% Belgium

687 China Sunergy Co., Ltd. (ADR) (NASDAQ:CSUN) -23.5% China

688 Taseko Mines Limited (USA) (AMEX:TGB) -23.6% Canada

689 France Telecom SA (ADR) (NYSE:FTE) -23.7% France

690 Canadian Pacific Railway Limited (USA) (NYSE:CP) -23.7% Canada

691 China Distance Education Holdings Ltd. (NYSE:DL) -24.0% China

692 China Shen Zhou Mining & Resources Inc. (AMEX:SHZ) -24.1% China

693 Maxcom Telecomunic S.A.B. de C.V. (ADR) (NYSE:MXT) -24.7% Mexico

694 Deswell Industries, Inc. (NASDAQ:DSWL) -24.7% Macao

695 United Microelectronics Corp (ADR) (NYSE:UMC) -25.0% Taiwan

696 CTC Media, Inc. (NASDAQ:CTCM) -25.1% Russia

697 Covidien plc (NYSE:COV) -25.2% Ireland

698 Hollysys Automation Technologies Ltd (NASDAQ:HOLI) -25.2% China

699 Changyou.com Limited(ADR) (NASDAQ:CYOU) -25.3% China

700 Tianli Agritech, Inc. (NASDAQ:OINK) -25.8% China

701 Potash Corp./Saskatchewan (USA) (NYSE:POT) -25.9% Canada

702 Siemens AG (ADR) (NYSE:SI) -26.1% Germany

703 ENSCO PLC (NYSE:ESV) -26.2% United Kingdom

704 Andatee China Marine Fuel Ser Corp (NASDAQ:AMCF) -26.2% China

705 KT Corporation (ADR) (NYSE:KT) -26.2% South Korea

706 Orient Paper Inc (NYSE:ONP) -26.4% China

707 Cosan Limited (NYSE:CZZ) -26.4% Brazil

708 Tata Communications Limited (ADR) (NYSE:TCL) -26.8% India

709 Axis Capital Holdings Limited (NYSE:AXS) -27.2% Bermuda

710 POSCO (ADR) (NYSE:PKX) -27.3% South Korea

711 Orbotech Ltd. (NASDAQ:ORBK) -27.4% Israel

712 CPFL Energia S.A. (ADR) (NYSE:CPL) -27.6% Brazil

713 Turkcell Iletisim Hizmetleri A.S. (ADR) (NYSE:TKC) -27.7% Turkey

714 Almaden Minerals Ltd. (USA) (AMEX:AAU) -27.7% Canada

715 Cogo Group, Inc. (NASDAQ:COGO) -27.7% China

716 Banco Santander, S.A. (ADR) (NYSE:STD) -27.8% Spain

717 China GrenTech Corporation Limited (ADR) (NASDAQ:GRRF) -27.9% China

718 WuXi PharmaTech (Cayman) Inc. (ADR) (NYSE:WX) -28.0% China

719 Empresas ICA SA (ADR) (NYSE:ICA) -28.3% Mexico

720 Telefonica S.A. (ADR) (NYSE:TEF) -28.4% Spain

721 Companhia Brasileira de Distrib. (ADR) (NYSE:CBD) -28.6% Brazil

722 Harry Winston Diamond Corporation (USA) (NYSE:HWD) -28.6% Canada

723 Grupo Casa Saba, S.A. (ADR) (NYSE:SAB) -28.6% Mexico

724 Check Point Software Technologies Ltd. (NASDAQ:CHKP) -28.9% Israel

725 RADVISION LTD. (USA) (NASDAQ:RVSN) -28.9% Israel

726 Telecom Corp of New Zealand (ADR) (NYSE:NZT) -29.0% New Zealand

727 China Digital TV Holding Co., Ltd. (NYSE:STV) -29.6% China

728 Sorl Auto Parts, Inc. (NASDAQ:SORL) -30.0% China

729 Tyco International Ltd. (NYSE:TYC) -30.4% Switzerland

730 China Fire & Security Group, Inc. (NASDAQ:CFSG) -31.5% China

731 Silicom Ltd. (NASDAQ:SILC) -31.6% Israel

732 Linktone Ltd. (ADR) (NASDAQ:LTON) -31.8% China

733 Reed Elsevier plc (ADR) (NYSE:RUK) -32.0% United Kingdom

734 WNS (Holdings) Limited (ADR) (NYSE:WNS) -32.5% India

735 Home Inns & Hotels Management Inc. (ADR) (NASDAQ:HMIN) -33.5% China

736 Unilever N.V. (ADR) (NYSE:UN) -33.5% Netherlands

737 Manulife Financial Corporation (USA) (NYSE:MFC) -34.1% Canada

738 Verigy Ltd. (NASDAQ:VRGY) -34.4% Singapore

739 Magna International Inc. (USA) (NYSE:MGA) -34.8% Canada

740 Pampa Energia S.A. (ADR) (NYSE:PAM) -35.1% Argentina

741 Celestica Inc. (USA) (NYSE:CLS) -36.3% Canada

742 Chicago Bridge & Iron Company N.V. (NYSE:CBI) -36.3% Netherlands

743 Koninklijke Philips Electronics NV (ADR) (NYSE:PHG) -36.8% Netherlands

744 Brookfield Asset Management Inc. (USA) (NYSE:BAM) -36.9% Canada

745 Terra Nova Royalty Corp (NYSE:TTT) -37.1% Canada

746 ChinaEdu Corporation (ADR) (NASDAQ:CEDU) -37.4% China

747 Retalix Limited (NASDAQ:RTLX) -38.4% Israel

748 Chunghwa Telecom Co., Ltd (ADR) (NYSE:CHT) -38.9% Taiwan

749 TOP Ships Inc. (NASDAQ:TOPS) -39.2% Greece

750 Alumina Limited (ADR) (NYSE:AWC) -39.5% Australia

751 IFM Investments Limited (NYSE:CTC) -39.6% China

752 AutoNavi Holdings Ltd (NASDAQ:AMAP) -40.2% China

753 Alcon, Inc. (NYSE:ACL) -40.5% Switzerland

754 Richmont Mines Inc. (USA) (AMEX:RIC) -42.0% Canada

755 Giant Interactive Group Inc (NYSE:GA) -42.6% China

756 International Tower Hill Mines Ltd(USA] (AMEX:THM) -42.7% Canada

757 Patni Computer Systems Limited (ADR) (NYSE:PTI) -42.7% India

758 Renhuang Pharmaceuticals, Inc. (AMEX:RHGP) -43.0% China

759 Enbridge Inc. (USA) (NYSE:ENB) -43.1% Canada

760 Banco Santander (Brasil) SA(ADR) (NYSE:BSBR) -43.6% Brazil

761 China Intelligent Lighting & Elec Inc (AMEX:CIL) -43.9% China

762 Kubota Corporation (ADR) (NYSE:KUB) -44.5% Japan

763 Formula Systems (1985) Ltd. (ADR) (NASDAQ:FORTY) -44.7% Israel

764 PT Indosat Tbk (ADR) (NYSE:IIT) -45.5% Indonesia

765 Internet Initiative Japan Inc. (ADR) (NASDAQ:IIJI) -45.5% Japan

766 Flexible Solutions International, Inc. (AMEX:FSI) -46.5% Canada

767 China Education Alliance, Inc. (NYSE:CEU) -47.0% China

768 Shaw Communications Inc. (USA) (NYSE:SJR) -47.4% Canada

769 China Auto Logistics Inc (NASDAQ:CALI) -48.5% China

770 China Marine Food Group Ltd (AMEX:CMFO) -50.0% China

771 Crucell N.V. (ADR) (NASDAQ:CRXL) -50.2% Netherlands

772 Gentium S.p.A. (ADR) (NASDAQ:GENT) -50.2% Italy

773 Paragon Shipping Inc. (NYSE:PRGN) -50.3% Greece

774 WSP Holdings Limited (NYSE:WH) -50.7% China

775 Doral Financial Corp. (NYSE:DRL) -51.8% Puerto Rico

776 Concord Medical Services Holding Ltd. (NYSE:CCM) -52.1% China

777 China Cord Blood Corp (NYSE:CO) -52.2% China

778 Jingwei International Limited (NASDAQ:JNGW) -52.9% China

779 China Hydroelectric Corporation (NYSE:CHC) -53.0% China

780 SearchMedia Holdings Limited (AMEX:IDI) -53.1% China

781 Schlumberger Limited. (NYSE:SLB) -53.4% Netherland Antilles

782 Nam Tai Electronics, Inc. (NYSE:NTE) -54.8% China

783 ChinaNet Online Holdings Inc (NDA) (NASDAQ:CNET) -55.4% China

784 NIVS IntelliMedia Technology Group Inc (NYSE:NIV) -55.8% China

785 CDC Software Corp (NASDAQ:CDCS) -56.7% Hong Kong

786 Prana Biotechnology Limited (ADR) (NASDAQ:PRAN) -57.3% Australia

787 Fomento Economico Mexicano SAB (ADR) (NYSE:FMX) -58.9% Mexico

788 ASM International N.V. (USA) (NASDAQ:ASMI) -59.0% Netherlands

789 Teekay LNG Partners L.P. (NYSE:TGP) -60.2% Bermuda

790 SMTC Corporation (USA) (NASDAQ:SMTX) -60.4% Canada

791 China Infrastructure Investment Corp (NASDAQ:CIIC) -60.7% China

792 Equal Energy Ltd. (USA) (NYSE:EQU) -61.0% Canada

793 Entree Gold Inc. (AMEX:EGI) -62.3% Canada

794 Net 1 UEPS Technologies, Inc. (NASDAQ:UEPS) -62.6% South Africa

795 Industrias Bachoco, S.A.B. de C.V. (ADR) (NYSE:IBA) -64.3% Mexico

796 SinoCoking Coal and Coke Chem Ind, Inc. (NASDAQ:SCOK) -64.5% China

797 Star Bulk Carriers Corp. (NASDAQ:SBLK) -65.4% Greece

798 Gravity Co., LTD. (ADR) (NASDAQ:GRVY) -66.9% South Korea

799 Metalink Ltd. (NASDAQ:MTLK) -67.4% Israel

800 TELUS Corporation (USA) (NYSE:TU) -67.9% Canada

801 Shanda Games Limited(ADR) (NASDAQ:GAME) -68.5% China

802 Midway Gold Corp. (AMEX:MDW) -70.3% Canada

803 Actions Semiconductor Co., Ltd. (ADR) (NASDAQ:ACTS) -74.4% China

804 Nidec Corporation (ADR) (NYSE:NJ) -76.3% Japan

805 Biostar Pharmaceuticals, Inc. (NASDAQ:BSPM) -76.7% China

806 Compania Cervecerias Unidas S.A. (ADR) (NYSE:CCU) -77.3% Chile

807 Jinpan International Limited (NASDAQ:JST) -78.5% China

808 Pengrowth Energy Trust (USA) (NYSE:PGH) -78.6% Canada

809 Gruma S.A.B. de C.V. (ADR) (NYSE:GMK) -82.1% Mexico

810 China Nuokang Bio-Pharmaceutical Inc. (NASDAQ:NKBP) -83.7% China

811 Mitel Networks Corporation (NASDAQ:MITL) -86.3% Canada

812 Mahanagar Telephone Nigam Limited (ADR) (NYSE:MTE) -86.6% India

813 China Metro Rural Holdings Ltd (AMEX:CNR) -91.4% Hong Kong

814 Jiangbo Pharmaceuticals, Inc. (NASDAQ:JGBO) -91.4% China

tdp2664

China Analyst

Ranking U.S.-Listed International Stocks by Short Interest Monthly Change (Oct 24, 2010)

US stocks higher after the open; Dow Jones rises 0.52%

dow2664

US stocks higher after the open; Dow Jones rises 0.52% Stock Markets Review – Oct 21, 2010 Forex Pros – US stocks were higher after the open on Thursday, as strong corporate earnings reports boosted sentiment on Wall Street and led markets higher. During early US trade, the Dow Jones …

US stocks higher after the open; Dow Jones rises 0.52%

Market News: Google Inc. (NASDAQ:GOOG), Microsoft Corp. (NASDAQ:MSFT), Apple Inc. (NASDAQ:AAPL)

Here is another batch of news briefings which could affect stocks on world markets in trading later today. The following companies should see some movement: Google Inc. (NASDAQ:GOOG), Microsoft Corp. (NASDAQ:MSFT), Apple Inc. (NASDAQ:AAPL). Here is a more detailed look at the news that will affect each company when trading continues. Google Inc. (NASDAQ:GOOG) Google Inc. (NASDAQ:GOOG) has launched a standalone YouTube application for Froyo. On a move to split one more application from the Android platform, Google Inc. (NASDAQ:GOOG) has released Froyo as another standalone application. The search engine giant had come up with a separate Gmail client last month. The newest application is available for handsets running on Android 2.2 or above. It was reported that the updated features include in-page playback, the option that allows users to read comments while watching videos. Other notable features include the option to rotate to full screen, home screen personalization, and shooting videos and uploading them directly from the application rather than opening a separate camera client. Microsoft Corp. (NASDAQ:MSFT) Microsoft Corporation (NASDAQ:MSFT) has sold 240 Million licenses of Windows 7 in the first year. Brandon LeBlanc, a Windows Communications Manager at Microsoft Corporation (NASDAQ:MSFT), wrote in a blog post that the company could sell 240 Million licenses in a single year, making Windows 7 as the fastest selling operating system in the history. LeBlanc said that "Six months after launch, 100% (over 18,000) of our OEM partners were selling Windows 7 PCs versus 70% for Windows Vista PCs at a comparable time period. And there is an incredible ecosystem of products – software and hardware – that work great with Windows 7 too." Apple Inc. (NASDAQ:AAPL) President Obama has met with Apple Inc. (NASDAQ:AAPL) CEO Steve Jobs for a policy discussion. Robert Gibbs, a White House spokesperson, said that the president met the Mac maker's CEO on Thursday afternoon in San Francisco. Gibbs said in his statement “They discussed American competitiveness and education, especially reforms such as the President’s Race to the Top initiative.” It was also said that Obama and Jobs discussed energy independence and ways to increase job creation. “I think they last met … along the trail in the 2008 (presidential) campaign,” Gibbs added. Expect more movement when trading continues for Google Inc. (NASDAQ:GOOG), Microsoft Corp. (NASDAQ:MSFT) and Apple Inc. (NASDAQ:AAPL).

tdp2664

E money daily

Large Cap Stock Movers (LVS, ERIC, Baidu.com, Inc.)

Las Vegas Sands Corp. (NYSE:LVS) jumped 2.55% to $38.95 on high volume on Friday. The stock has soared 159% so far this year. It has a 52-week range of $12.95-$39.59. Las Vegas Sands Corp. (LVSC) owns and operates The Venetian Resort Hotel Casino (The Venetian Las Vegas), The Palazzo Resort Hotel Casino (The Palazzo) and The Sands Expo and Convention Center (the Sands Expo Center) in Las Vegas, Nevada, and the Sands Macao. Telefonaktiebolaget LM Ericsson (ADR) (NASDAQ:ERIC) climbed 6.22% to $11.45 on very hevry hefrty volume after the world's largest maker of wireless networks beat market expectations with a more than four-fold increase in third-quarter profit. Telefonaktiebolaget LM Ericsson (Ericsson) is a supplier of equipment, integrated solutions, multimedia applications and services to operators worldwide. The Company is a provider of communications networks, related services and multimedia solutions. Baidu.com, Inc. (ADR) (NASDAQ:BIDU) surged 4.77% to $107.37 and made an all time high of $109.34 after it posted a better than expected third quarterly earnings. The company earned 46 cents a share on revenue of $337.2 million, topping analysts estimates of 41 cents a share on revenue of $333.3 million. The company forecast its revenue to be $354.2 million – $364.7 million, better than street's estimates of $348.5 million.

tdp2664

Epic Stock Picks

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES October 22nd, 2010 Mid Day

dow2664

Stocks closed on Thursday with gains as investors continue to tally reports of better than anticipated corporate third quarter earnings, a decline in jobless claims, and a continued anticipation that the Fed will roll out another round of asset purchases to assist with stimulating the economy. This influx of positive news and expectations temporarily heightened activity. Friday stocks are mixed as currency tensions emerge and new reports indicate that the Fed’s stimulus response may not be worthy of all the hype. A two day meeting started today in South Korea for G-20 ministers regarding finance and central banking. A formal announcement of discussions will be released next week. At mid day the market indices are mixed. NASDAQ is up 7.90 points to 2,467.59 . S&P 500 is up 0.55 points to 1,180.81. DJIA is in the red, down 20.89 points to 11,125.68. The dollar continues in the red and the Treasurys 10-year yield is up 0.02 to 2.55%. Crude oil is up 0.45 to $81.03 a barrel. Gold is down 3.6 to $1322.00 an ounce. Strong sectors include: oil and gas equipment; food retailers; hotels; automakers; application software; asset managers; regional banks; and trucking. There are no new postings on the economic calendar at this time. Author: Pamela Frost

An Outrageous True Story: Why People Don't Trust Banks

dow2664

Last week, my mother went into a branch of a major banking institution, the same branch she had been going to for many years. She wanted to get something out of her safety deposit box, so she filled out the form, showed the clerk her key, and waited while the clerk went in the back. (My mother usually goes into her safebox about once a month.) After waiting for ten minutes, my mother finally asked one of the tellers what was taking so long. The teller went to check and came back with the clerk who told my mother that they had no record of her having a safe deposit box there. My mother told her that was ridiculous, showed the woman her key and driver’s license, and said that she had been going into her box regularly for years. Then the clerk asked her if she was in the right branch, and she replied that of course she was in the right branch, she never used any other branches. Finally the branch manager came over, and asked what the problem was. When my mother told him, he went in the back. After a very long wait, he came out and said that he couldn’t find any record of her having a safebox. My mother said that she had to get into her box. The manager said “I’m sorry, there is nothing I can do.” Apparently, there has been a recent turnover of employees at the branch. One of the tellers who did know my mother said that she saw that the safebox signature cards were moved from a drawer to a metal box, and maybe her signature card got lost in the transfer. Anyway, my mother finally left, completely stunned, stressed, and devastated, without being able to get access to her safety deposit box. My questions to you, dear readers, is: 1. What would you do if this happened to you? 2. What would you do if this happened to your mother who lives 500 miles away, and asks you what she should do?

An Outrageous True Story: Why People Don’t Trust Banks

Top Volume Gainers at NASDAQ Technology Sector are (MU, SATC, PMCS, ATML, CPWR)

Dear PSL members Micron Technology, Inc. (NASDAQ: MU) plunged 2.47%, closing the day at $7.50 with the overall trading volume of 15.42 million shares for the day. Its market capitalization is $7.46 billion and in 52 weeks the price range remained $6.12-$11.40. SatCon Technology Corporation (NASDAQ: SATC) increased 6.13%, closing the day at $4.33 with the overall trading volume 11.45 million shares for the day. Its market capitalization is $314.41 million and in 52 weeks the price range remained $1.83-$4.53. PMC-Sierra, Inc. (NASDAQ: PMCS) jumped 6.56%, closing the day at $7.47 with the overall trading volume of 10.41 million shares for the day. Its market capitalization is $1.73 billion and in 52 weeks the price range remained $6.85-$9.73. Atmel Corporation (NASDAQ: ATML) gained 2.64%, closing the day at $8.15 with the overall trading volume of 10.36 million shares for the day. Its market capitalization is $3.76 billion and in 52 weeks the price range remained $3.60-$8.70. Compuware Corporation (NASDAQ: CPWR) reported a gain of 12.47%, closing the day at $9.92 with the overall trading volume of 10.17 million shares for the day. Its market capitalization is $2.21 billion and 52 week price range remained $6.79-$10.39.

tdp2664Penny Stock Live

Service Sector Stocks Ended Higher (EBAY, AMZN, SVU)

eBay Inc. (NASDAQ:EBAY) surged 3.22% to $28.07. Late Wednesday, eBay said its third-quarter earnings rose 23% from a year ago, mostly due to strength in its PayPal business. For the quarter, eBay earned $432 million, or 33 cents a share, on $2.25 billion in sales. The stock went up more than 17% year-to-date. The stock opened at $27.25 and traded within the range of $27.20-$28.09. Amazon.com, Inc. (NASDAQ:AMZN) added 2.52% to $169.13. For the period ended Sept. 30, Amazon this week, reported net income of $231 million, or 51 cents a share, compared with net income of $199 million or 45 cents a share for the same period last year. For the December quarter, Amazon said it expects revenue to come in the range of $12 billion to $13.3 billion. Analysts were looking for about $12.3 billion in revenues, according to FactSet estimates. Operating margin for the period is expected to come in the range of 3% to 4.2%. Wall Street had been expecting 5%, on average, for the quarter. Over the past 52-week, the stock had traded within the range of $91.70-$170.17. The stock made its fresh one-year high of $170.17. SUPERVALU INC. (NYSE:SVU) went up 2.37% and closed at $10.80. For the quarter ended Sept. 11, Supervalu said its profit, excluding charges, fell 20% from a year ago to $59 million, or 28 cents a share. Sales fell 8% to $8.7 billion. Excluding charges, the Minnesota grocer said it expects to earn $1.40 to $1.60 a share. Its July 27 forecast was $1.75 to $1.95 a share. Supervalu pegged its identical store sales to fall 5.5%, compared to its previous target for a drop of 5%. The stock went down more than 14% year-to-date.

tdp2664

Newsworthy Stocks

Mobile Games Gold Rush Continues

DeNA Co.’s $400 million purchase of iPhone game maker Ngmoco was just the beginning. Large corporations are spending big on mobile game developers, looking to cash in on the burgeoning app market as the Apple (NASDAQ: AAPL ) App Store, Microsoft’s (NASDAQ: MSFT ) Windows Phone 7 Zune Market, Nokia’s (NYSE: NOK ) Ovi store, and Google’s (NASDAQ: GOOG ) Android App Market bring in the dollars from an ever-growing audience millions strong. Electronic Arts (NASDAQ: ERTS ), already one of the five most profitable social and browser game publishers, has added one more mobile game developer to its growing stable. Electronic Arts purchased U.K. mobile publisher Chillingo for $20 million in cash yesterday. Chillingo is the publisher behind break out iPhone App Store hits Angry Birds and Cut the Rope , titles that have dominated the App Store charts in recent weeks. Rovio Mobile, the creators of Angry Birds , and Zepto Lab, Cut the Rope ‘s designers, remain independent following the acquisition but it’s likely that Electronic Arts will hire them to develop software based on their existing intellectual property. Electronic Arts isn’t the only company following DeNA’s lead. Shanghai-based game operater The9 (NASDAQ: NCTY ), which became a major player in the game publishing industry when it began distributing Activision Blizzard’s (NASDAQ: ATVI ) World of Warcraft in China, has joined with Intel Capital (NASDAQ: INTC) in investing a total of $8 million in the Burlingame, Calif.-based Aurora Feint. Aurora Feint is the creator of OpenFeint, an online gaming network not dissimilar to Microsoft’s Xbox Live or Apple’s Game Center. The service connects game players across a variety of mobile platforms, including both Apple’s iPhone and hand-held devices running Google’s Android. OpenFeint already supports more than 3400 games across the services and is partnered with major game publishers, including the Square-Enix owned Taito, Konami (NYSE: KNM ) subsidiary Hudson Soft, and Capcom. Intel Capital, Intel’s investment arm, and The9 are likely strengthening Aurora Feint’s operation in the hopes of attracting DeNA into making another high-profile buy in the mobile gaming space. While Ngmoco has developed a number of successful downloadable games for the iPhone, it is also the creator of the Ngmoco Plus+ online gaming network, a competitor of Aurora Feint. DeNA also has a 20% stake in Aurora Feint, meaning that the two networks could be merged under a single banner. The new network would be established enough to combat both Apple and Microsoft’s gaming networks on mobile platforms. Elsewhere in the mobile game space, while major publishers are moving quickly to secure their control of the emerging mobile game space, game retailers are attempting to establish their own foothold on smartphones and other handhelds. North American retailer GameStop (NYSE: GME ), a company whose profits have wilted as consumers increasingly move away from physical game purchases toward digital and browser-based options, has released its first game on the Apple App Store. Buck and the Coin of Destiny is both a game and a marketing tool, in that it stars the rabbit spokescreature featured in the company’s print and television advertising. Investors are advised to keep an eye out for IPOs from independent developers like Rovio Mobile and Zepto Lab. Apps and mobile games are one sector that is seeing serious growth at the end of 2010. As of this writing, Anthony Agnello did not own a position in any of the stocks named here.

tdp2664

gol2664

InvestorPlace

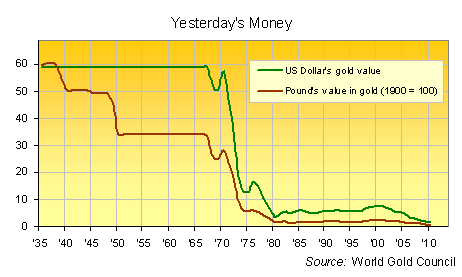

What Geithner Wants & What Geithner Gets

Living standards in the West are certain to fall as Asian wealth grows…

“There are more tears shed over answered prayers than over unanswered prayers…”

– Teresa of Ávila, patron saint of headache sufferers

IT’S NOW five years and $1.7 trillion of Chinese foreign-currency reserves since the People’s Bank ended a decade-long peg to the Dollar, writes Adrian Ash of BullionVault.

Throughout the mid-to-late 1990s’ Asian Crisis, and again as the US currency first began its long decline in the early Noughties, Beijing had defended 8.3 per Dollar. Its rising power – plus grumblings from trade partners – made some level of appreciation inevitable, but only if Beijing kept it strictly controlled. So back then, as today, China refused to even begin making the Yuan freely convertible – and thus accessible to foreign investment – but for very different reasons.

The fear when China carefully recalibrated its Dollar peg in 2005 was of foreign speculators driving the Yuan lower. Whereas in 2010, it’s got the opposite problem. Grabbing export share (and that mountain of foreign-exchange reserves) by suppressing its currency way below any measure of “fair value”, Beijing clearly fears a repeat of the Japanese bubble-and-bust that followed 1985′s Dollar-weakening Plaza Accord. Because since first loosening the Yuan’s Dollar peg (if only a little) half-a-decade ago, China has overtaken Japan as the world’s No.2 economy, and become the world’s top importer of copper, biggest user of cement, No.1 consumer of energy, edible oils, soybeans, rice and wheat, and the No.2 destination for physical Gold Bullion.

Yes, China’s currency should reflect this growth, at least according to non-Confucian theories of floating currencies and trade rebalancing. No doubt it will in due course, too. But if US Treasury Secretary Tim Geithner were to get his wish at the G20 meeting this weekend – which he won’t, not yet – and the Chinese Yuan did bear a greater share of the Dollar’s global devaluation, Beijing’s impact purchasing power in the food, energy and mineral markets would only grow greater.

So where Timmy might want to watch out is that the appreciation in China’s purchasing power must come at the expense of today’s freely convertible currencies.

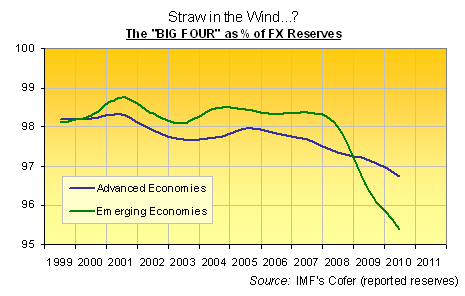

First, Beijing likely holds some $2 trillion or more of the “big four” reserve currencies – Dollars, Euros, Sterling and Yen. Gresham’s Law says it’s more likely to spend those holdings ahead of its own, increasingly valuable money, as it buys ever-more food, energy and mineral resources to meet its surging domestic demand for a better standard of living.

Second, and should the Yuan extend its global usage from this year’s McDonalds’ bond float to central-banking reserves, the relative loss of purchasing power in Dollars, Euros, Sterling and Yen will only accelerate further. Together, the Big Four account for 96% of forex reserves according to the IMF, but that’s the lowest proportion since before the late ’90s Asian Crisis – a crisis which Beijing managed to avoid but remembers all too well.

Third, and most critically amid the global currency war – a war which will not be settled over the conference table for as long as Western central-bank policy remains fixated on currency inflation – flows of “hot money” are rightly expected, not least from US, UK and Japanese wealth fleeing zero-per-cent rates at home.

As it is, China is gently loosening controls on money outflows, but only a little, and actual outflows of Yuan remain blocked. So trying to preserve its global value, retained wealth in the West cannot get direct exposure to the currency (nor the equities at present) which will increasingly put a price on the biggest trend of the 21st century – the Eastward shift of global demand and consumption.

Even if China does liberalize (which it won’t any time soon) retail investors will be last in the queue. So a fair proxy, meantime, remains buying hard assets and natural resources. It also gets to the heart of the problem, because living standards in the West (by way of our global purchasing power) are certain to fall long-term. Asia’s growing use of world resources must come at our expense, in just the same way as the Pound Sterling’s first fall from top-dog currency status – starting some seven decades ago, and running pretty much ever since – made for a relative loss of wealth to the United States.

Most clearly amid the currency turmoil only just getting started, China’s ever-growing demand for Physical Gold and silver highlight that big, fat 21st century trend in action. By the time (if ever) that Yuan deposits become widely available through retail banking in the US, Eurozone, UK or Japan, this morning’s $1319 price-tag on gold might look a great bargain.

Buying Gold today…?

gol2664

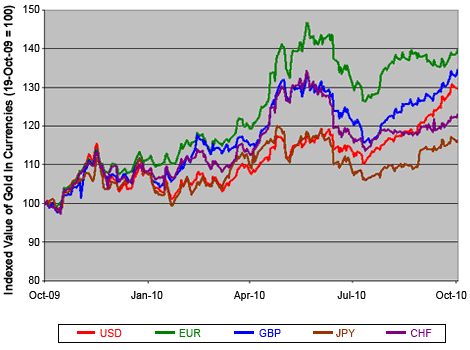

Dollar Shocker! Not the Worst vs. Gold

Gold Bullion has risen faster against the Euro and Sterling than vs. the Dollar…

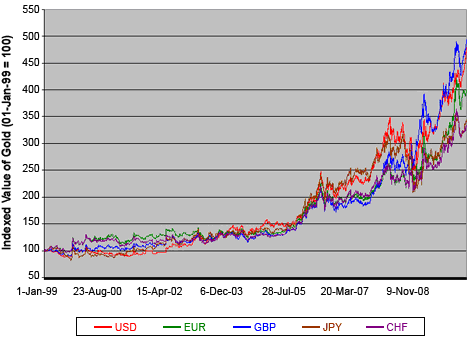

TO THE SURPRISE of many investors, the Yankee Dollar has earned only a third-place ribbon for its depreciation against gold over the past 12 months, writes Brad Zigler at Hard Assets Investor.

With all the recent hoopla and headlines about gold making new highs against the greenback, the destruction derby of the world’s reserve currencies is actually won by the Euro, with Sterling close behind, on an annual basis.

Over the past year, the US Dollar lost 29.8% vs. bullion compared with a 39.7% tumble for the European common currency and a 34.5% decline in the British Pound. Bringing up the rear is the Swiss Franc, with a 23.1% loss, and the Japanese Yen, which gave up 16.4% to gold.

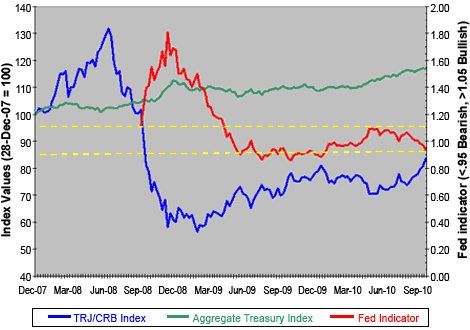

Oddly enough, the US Dollar is also the least volatile reserve currency when it comes to Gold Bullion purchasing power, too.

The standard deviation of the Gold Price in Dollars stands at just 15.3% for the past year. This may not seem like a testament to the Fed’s steady hand on the nation’s economic tiller, but it’s something. It actually bespeaks the wait-and-see attitude of the central bank after last year’s stimulus and accommodation.

The likelihood of Fed intervention increases when commodity prices – a basic metric of inflation – rise or fall significantly compared with Treasury securities. In the chart below, the red Fed Indicator line dances within a neutral zone – a condition that compels the central bank to watch, but not act. A sustained move in the indicator above the upper band would signal an increased likelihood of accommodation – or lower money rates and a weaker Dollar.

A dip below the lower band flashes a higher probability of tightening, or higher rates and a stronger Dollar…

Keep in mind that this indicator is just that – an indicator. It measures the likelihood of Fed intervention, not its certainty. Political considerations – which can be substantial – are put aside here.

For now, the Fed’s keeping a fairly even keel – even though it’s been economically painful for employees or the unemployed. There’s nascent inflation, reflected in the blue line’s recent trajectory, which complicates the Fed’s handling of the Dollar. What’s economically expedient may not be politically fruitful.

On the other side of The Pond, Sterling’s been the most volatile currency, flopping about with a 17.8% standard deviation in the Gold Bullion market. Largely, this reflects the rising and falling fortunes of the former Labour government. And with all this, one can’t ignore the longer-term trends.

Since the Euro’s introduction in 1999, the Pound’s lost more ground to Gold Bullion than any other reserve currency. Sterling’s average annual loss in gold purchasing power has been 15.3%. The US Dollar follows with an average loss of 14.8% per year. Meantime, the Euro’s given up an average 13.1% each year.

Kinda makes you wonder who’ll take the pennant next year!

Buying Gold online today…?

gol2664

Arena Pharmaceuticals (NASDAQ: ARNA) Jumps On FDA Response

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) shares climbed 18.50% to $1.73 on heavy volume after the company announced results for its ongoing results from a Phase 1 clinical trial of APD916, the histamine H3 receptor for the treatment of narcolepsy with cataplexy. The randomized, double-blind and placebo-controlled trial evaluated the safety, tolerability and pharmacokinetics of 1mg, 3mg and 5mg single doses of APD916. All adverse events in the trial were mild or moderate in nature. No serious adverse events were reported nor were there any significant safety issues with respect to vital signs, electrocardiography or laboratory testing. Earlier in the month of September shares of ARNA lunged about 50% in a single day when a Food and Drug Administration advisory committee rejected the company's most awaited drug, lorcaserin. Numbers of investors were disappointed after the results as most of them were expected a positive response about the drug. Several investors assumed Arena’s pill safer than rival drugs. They were surprised when the FDA staff and the agency’s outside advisers rejected in September. FDA reviewers said lorcaserin was only modestly effective in trimming pounds and had some safety issues. Shares of ARNA today made a new 52-week low of $1.45%. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Today’s STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES October 22nd, 2010 Close

dow2664