Here is another batch of stock briefings which may affect stock trading as the markets continue today. The following companies should see some movement: Verizon Communications Inc. (NYSE:VZ), American International Group (NYSE:AIG), Exxon Mobil Corp. (NYSE:XOM). Here is a more detailed look at the news that will affect each company when trading continues. Verizon Communications Inc. (NYSE:VZ) Verizon Communications' (NYSE:VZ) new president, Toohey, has 22 years of experience at Verizon Communications (NYSE:VZ). He started his career as a GTE in 1988; He will take his new role immediately. He has served Verizon Communications (NYSE:VZ) in various human resources positions, operations and various finance. More recently he was senior vice president of global customer care and services for Verizon Communications (NYSE:VZ) Business The company says it is also searching for an experienced person for the chairman and CEO position as reports say the company's present chairman and CEO Ivan Seidenberg will be retiring next year. American International Group (NYSE:AIG) American International Group (NYSE:AIG) has closed its deal with MetLife. The acquisition of American International Group (NYSE:AIG) foreign unit, is expected to be boost the market value of MetLife. The deal closed for $16.2 billion in cash and MetLife shares. This deal will help MetLife to reach 60 countries and 90 million customers most of whom are a part of American International Group (NYSE:AIG) C. Robert Henrikson, head of MetLife said "With our acquisition of Alico complete, MetLife has become the premier global life insurance and employee benefits powerhouse." Exxon Mobil Corp. (NYSE:XOM) ExxonMobil Corporation (NYSE:XOM) has announced a $750 middle school grant. ExxonMobil Educational Alliance (NYSE:XOM) has announced a $750 grant for Robert E. Lee Academy of Bishopville. The grant money will be used to support the school's middle school science lab for the purchase of microscopes for the middle school science lab. The ExxonMobil Educational Alliance program is designed to grant ExxonMobil Corporation (NYSE:XOM)'s retailers with an opportunity to invest in the future of their communities through educational grants to neighborhood schools. We could possibly see more movement when trading continues for Verizon Communications Inc. (NYSE:VZ), American International Group (NYSE:AIG) and Exxon Mobil Corp. (NYSE:XOM).

tdp2664

E money daily

Gold, Mining, silver, index, prices, today, oil, crude, dow jones, nasdaq, s&p 500, TSX, barrick gold, toromocho, CUP, goog, msft, aapl, finance, yahoo, bing, google,currency converter, currency, rates, currency tool, currency trading, currency transfers, foreign exchange, conversion, , live currency rates, mid-market, obsolete, precious metals, rate calculations, save money, save time, special units, tips, trade currency, up to the minute, world currency, xe trade, currency symbols

Wednesday, November 3, 2010

Early Market News: Verizon Communications Inc. (NYSE:VZ), American International Group (NYSE:AIG), Exxon Mobil Corp. (NYSE:XOM)

Top 10 Best-Performing Gaming Stocks Year-to-Date: LVS, MPEL, WYNN, EGT, MNTG, PNK, MCRI, PENN, MGM, PTEK (Nov 03, 2010)

Below are the top 10 best-performing Gaming stocks year-to-date, UPDATED TODAY before 4:30 AM ET. One Chinese company (MPEL) is on the list.

Las Vegas Sands Corp. (NYSE:LVS) is the 1st best-performing stock year-to-date in this segment of the market. It has risen 228.25% since the beginning of this year. Its price percentage change is 243.18% for the last 52 weeks. Melco Crown Entertainment Ltd (NASDAQ:MPEL) is the 2nd best-performing stock year-to-date in this segment of the market. It has risen 97.17% since the beginning of this year. Its price percentage change is 27.65% for the last 52 weeks. Wynn Resorts, Limited (NASDAQ:WYNN) is the 3rd best-performing stock year-to-date in this segment of the market. It has risen 93.32% since the beginning of this year. Its price percentage change is 109.51% for the last 52 weeks. Entertainment Gaming Asia Inc. (AMEX:EGT) is the 4th best-performing stock year-to-date in this segment of the market. It has risen 51.94% since the beginning of this year. Its price percentage change is 34.28% for the last 52 weeks. MTR Gaming Group, Inc. (NASDAQ:MNTG) is the 5th best-performing stock year-to-date in this segment of the market. It has risen 51.54% since the beginning of this year. Its price percentage change is -0.51% for the last 52 weeks.

Pinnacle Entertainment, Inc (NYSE:PNK) is the 6th best-performing stock year-to-date in this segment of the market. It has risen 49.78% since the beginning of this year. Its price percentage change is 61.85% for the last 52 weeks. Monarch Casino & Resort, Inc. (NASDAQ:MCRI) is the 7th best-performing stock year-to-date in this segment of the market. It has risen 44.20% since the beginning of this year. Its price percentage change is 77.51% for the last 52 weeks. Penn National Gaming, Inc (NASDAQ:PENN) is the 8th best-performing stock year-to-date in this segment of the market. It has risen 22.55% since the beginning of this year. Its price percentage change is 30.67% for the last 52 weeks. MGM Resorts International. (NYSE:MGM) is the 9th best-performing stock year-to-date in this segment of the market. It has risen 22.26% since the beginning of this year. Its price percentage change is 23.48% for the last 52 weeks. PokerTek, Inc. (NASDAQ:PTEK) is the 10th best-performing stock year-to-date in this segment of the market. It has risen 20.43% since the beginning of this year. Its price percentage change is 3.23% for the last 52 weeks.

tdp2664

China Analyst

Top 10 Best-Performing Gaming Stocks Year-to-Date: LVS, MPEL, WYNN, EGT, MNTG, PNK, MCRI, PENN, MGM, PTEK (Nov 03, 2010)

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES November 3rd, 2010; Close

dow2664

Anxieties were obviously fresh in the market place today as anticipations grew and rumors spread regarding the extent of the Federal Reserve’s plan to stimulate economic recovery. Trend lines for major market index values were lower this morning before opening bell and the red trending continued throughout the day until the end. The Fed policy report aimed to detail plans to purchase Treasury bonds and many worried about the overall scope and sequence of the plan. Earlier today, the Institute for Supply Management posted a report detailing growth in the service sector. Additionally, payroll company, ADP posted data that revealed an increase of 43,000 jobs for private employers. The changes from the mid-term election are being viewed as positive as more Republican control is viewed as business friendly. Overall, reports were strong today for the market but trending was mostly lower for a majority of the day. The current Fed verdict is in and the policy report revealed that the Federal Reserve will purchase $600 billion in Treasury bonds. The purchase will be phased in over time at approximately $75 billion a month. The phase in period will be between now and June 30th 2011. This move will keep interest rates lower for the long term. With this news, the dollar fell today against the euro, the British pound and gained against the Japanese yen. Still trends pushed commodity prices lower. Gold settled down today at $1,337.60 an ounce and silver fell to $24.44 and ounce. The Dow Jones Industrial Average ended the day up .24% and settled at 11,215.13. The Nasdaq settled up at 2,540.27 and the S&P 500 settled up at 1,197.96. The ten year treasury yield is 2.62%. Author: Frank Matto

Magic Software Enterprises Ltd. (MGIC) Finishes Higher after Q3 Results

Magic Software Enterprises Ltd. (NASDAQ: MGIC) shares saw a huge rally today, following the announcement of third-quarter financial results. The stock ended the day 14.14% higher at $3.31, on above average volume of 1.84 million. The stock touched a 52-week high of $3.72 in today's trading. It has a 52-week range of $1.55-$3.72. The stock is up 2.11% to $3.38 in after-hours trading today. Magic Software today reported that its third-quarter revenues increased 66% to $22.4 million. The company's third-quarter operating income came in at $2.5 million, up from $0.8 million reported in the third quarter of 2009. For nine-month period ended September 30, 2010, the company's operating and net income more than doubled to $6.3 million, compared with $2.5 million reported for the nine-month period ended September 30, 2009. Israel-based Magic Software Enterprises Ltd. is a developer, marketer and seller of an application platform and business and process integration solutions. The company sells its products and services through a worldwide network of it regional offices, independent software vendors, system integrators, distributors and value added resellers. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Asian Shares Mostly Up; Earnings Lift Tokyo, Fed Move Welcomed

dow2664

Asian Shares Mostly Up; Earnings Lift Tokyo, Fed Move Welcomed Wall Street Journal – 1 hour ago By Shri Navaratnam SINGAPORE (Dow Jones)–Asian share markets were mostly higher Thursday with the Tokyo market rising sharply on recent positive earnings reports, while most investors welcomed …

Asian Shares Mostly Up; Earnings Lift Tokyo, Fed Move Welcomed

Dive Into Water ETFs And Mutual Funds

While water is the world's most precious resource, it's also an industry dripping with investing opportunities via water exchange traded funds (or ETFs) or mutual fund investments. Today, investors can buy ETF funds, mutual funds, hedge funds of international companies and even individual water-related stocks engaged in all aspects of the water business worldwide. But astute investors interested in navigating investment opportunities in the water business should undertake two separate steps: First, they should research all aspects of the water business to determine which investment vehicle gives them the exposure they are looking for. Second, they should choose the right ETF, mutual fund or individual stocks to isolate the opportunity or industry sectors they want to pursue. To do this, investors need to research the regulations, technology and treatment processes affecting water purification and waste water treatment. Many investors do not realize that investing in water is even possible. That's because the U.S. water industry has undergone significant structural changes in its management and regulation since the Paris-based company Vivendi acquired U.S. Filter in 1999. Today, the water business is the third-largest industry in the world, behind oil and gas production and electricity generation. Due to climate changes and increased demand worldwide, the need for pure water, as well as every technology and infrastructure related to the purification, drainage, treatment, and the search for water is now a priority among many of the world's developed and developing nations. This includes new ways to re-claim contaminated water in remote areas. For instance, decentralized treatment plants are becoming more popular in emerging and developed nations. New efforts are also needed to build storm water infrastructure, especially to treat runoff in the form of fertilizers, pesticides, and organic compounds, which are major contributors to impaired water quality. Water is also essential to modern technology manufacturing. For example, it takes 2,300 gallons of water to fabricate one six-inch semi-conductor wafer, according to Steve Hoffmann, author of the book, Planet Water: Investing in the World's Most Valuable Resource. Obtaining clean water is a worldwide problem. The World Health Organization estimates that 1.1 billion people cannot easily find clean drinking water, while 40% of the world's population lives in areas without adequate sanitation. This helps explain why 50% of the world's hospital beds are being used to treat patients suffering from water-borne and water-related diseases. An estimated 4,500 children per day die from the lack of water and sanitation services. Since water is essential and becoming more scarce, governments worldwide will be required to spend more on building water infrastructures and related water treatment services. One estimate by the Organization of Economic Co-operation and Development (OECD) estimates that $15 trillion will be needed for just 20 OECD member nations, plus Brazil, Russia, India and China. In the U.S., water is regulated by many different agencies, including the Environmental Protection Agency (EPA), as well as state agencies. These regulations cover everything from water quality to water runoff and setting standards for sewage treatment and water runoff. ETF Investment Opportunities and Risks For investors, the water industry can be broken down between companies which provide drinking (potable) water and wastewater treatment. Each industry segment has different treatment, plant design and regional requirements. A more refined breakdown for investors was made by the Palisades Water Indexes, which further breaks the industry down according to its functionality. These categories are: water utilities, treatment, analytical, infrastructure, resource management and multi-business. Each of these main categories is then broken down into subsectors. Investors can buy exchange traded funds (ETFs) based on water indexes, as well as stocks of companies engaged in all aspects of the water industry. The popular ETFs are based on the Palisades Water Indexes, the S&P Global Water Index, and the ISE Water Index. Each index has different weighting methods, underlying stocks, re-balancing and company re-placement schedules. In addition, there are about 16 mutual, private equity and hedge funds focusing on companies in the global water industry. Like other ETFs, investors should understand the composition and weighting methodology of companies in each major index since that drives performance. Many large water companies are non-U.S. and operate worldwide in many sub-sectors of the water industry. When an index is constructed, these weightings can be made according to market capitalization, fundamental, equal dollar or hybrid. Investors should also know how often the index is re-balanced and re-constituted with new companies added or subtracted from the index. Partial List of Water ETFs and Mutual Funds While some investment experts consider water to be "the new oil," individual investors should carefully consider the risks and rewards of this very liquid and new investable asset category. Here is a partial list of ETFs specifically related to the water industry worldwide: PowerShares Water Resources Portfolio ETF (NYSE: PHO ) PowerShares Global Water Portfolio ETF (NYSE: PIO ) Guggenheim S&P Global Water Index (NYSE: CGW ) First Trust ISE Water Index Fund (NYSE: FIW ) SPDR FTSE Macquerie Global Infrastructure 100 (NYSE: GII ) Here is a partial list of the mutual funds specifically related to the water industry worldwide: Calvert Global Water Fund ( CFWAX ) Allianz RCM Global Water Fund ( AWTAX ) PFW Water Fund ( PFWAX ) Kinetics Water Infrastructure Advantaged Fund ( KWIAX )

tdp2664

gol2664

InvestorPlace

Magic Software Enterprises Ltd. (NASDAQ: MGIC) Jumps On Solid Earnings

Magic Enterprises Ltd. (NASDAQ:MGIC) rose by 41 cents or by 14.14% to trade at $3.31 after the Company reported net income of $2.5 million, or $0.08 per fully diluted share an increase of 167% from the last year earnings of $0.03 per share in the same period. Magic Software was trading at a volume of 1.84 million against the average daily volume of 0.052 million after hitting the 52 week high o $3.72. Third quarter revenues increased 66% from $13.5 million to $22.4 million as compared to the last year revenue for the same period. Operating income for the third quarter tripled to $2.5 million compared to $0.8 million in the same period last year. Total cash, cash equivalents and short-term investments net of short term bank credit as of September 30, 2010 was $25.7 million. This increase was attributable to an increase in new customers and license sales for uniPaaS and iBOLT, particularly in Japan, Netherlands and U.S as quoted by the chief executive officer Guy Bernstein, "I am very pleased to report robust growth and continued improvement in all our operations for the third quarter. This has been driven by greater demand for our professional services and improved license sales of our uniPaaS RIA application platform that among enterprises and independent software vendors worldwide." Magic Software Enterprises Ltd. (NASDAQ: MGIC) is a global provider of on-premise and cloud-enabled application platform solutions – including full client, rich internet applications (RIA), mobile or Software-as-a-Service (SaaS) modes – and business and process integration solutions.

tdp2664

Newsworthy Stocks

US Stocks Fall After Fed Statement; DJIA Down 54

dow2664

US Stocks Fall After Fed Statement; DJIA Down 54 MarketWatch – 3 hours ago By Jonathan Cheng US stocks swung in and out of positive territory, sinking deeper into the red after the Federal Reserve said it would buy $600 billion in longer-term securities by the middle of …

US Stocks Fall After Fed Statement; DJIA Down 54

Early Market News: Cisco Systems Inc. (NASDAQ:CSCO), Walt Disney Co. (NYSE:DIS), MetLife (NYSE:MLG)

Here are several more stock briefings which could affect stocks in trading later today. The following stocks should see some movement: Cisco Systems Inc. (NASDAQ:CSCO), Walt Disney Co. (NYSE:DIS), MetLife (NYSE:MLG). Here is a more detailed look at the news that will affect each company when trading continues. Cisco Systems Inc. (NASDAQ:CSCO) Cisco Systems (NASDAQ:CSCO) has been ranked number 7 among leading green companies. According to the U.S. Environmental Protection Agency (EPA) and its green power partnership, twenty-nine percent of Cisco Systems (NASDAQ:CSCO)'s total electricity usage is from green sources such as wind and biomass. Intel is No. 1 at 51% electricity usage from green power sources such as biogas, biomass, geothermal, small hydro, solar and wind. Those choosing to purchase green power in an amount exceeding 100% of their U.S. organization-wide electricity use are listed as green companies, the EPA list states. Walt Disney Co. (NYSE:DIS) Walt Disney (NYSE:DIS) Studios has recently begun to promote several of its films from 2010. For Walt Disney (NYSE:DIS), this includes Alice in Wonderland, Toy Story 3 / Day & Night, Secretariat, Tangled and TRON: Legacy. These cinematographical jewels are filled with behind-the-scenes photos, videos and more. So much more. there are also a few gems that are yet to be formally introduced to the public at large, which includes Daft's Punk original score TRON: Legacy, 'I see the light' performed by Mandy Moore and Zachary Levi from Disney's Tangled and even the screenplay Toy Story 3. MetLife (NYSE:MLG) MetLife, Inc (NYSE:MLG) has announced that it has been named as ENERGY STAR Leaders. The Environmental Protection Agency (EPA) has named the company for the energy efficiency management of all fourteen corporate owned and/or operated buildings in its portfolio. The EPA’s ENERGY STAR Leaders program recognizes organizations that have improved the energy efficiency of their portfolios by 10 percent or more. MetLife’s energy management policy, as well as other sustainability initiatives, has enabled the company to reduce its energy consumption by more than 16% since 2006. The EPA recently certified MetLife (NYSE:MLG)'s office in Bloomfield, Connecticut as an ENERGY STAR rated facility. We may see more movement when trading continues for Cisco Systems Inc. (NASDAQ:CSCO), Walt Disney Co. (NYSE:DIS) and MetLife (NYSE:MLG).

tdp2664

E money daily

Buy Gold, Everybody’s Doing It

The bull market in gold and gold stocks keeps chugging along leaving many investors behind, standing on the platform watching those dollars they could have made head off into the distance. And those investors still at the station are precisely why it will continue. In August 2009, I predicted that we would enter a five-year period of a massive move up in gold and gold stocks . Gold was $900 an ounce at the time, and is now at $1,360. In addition to Elliott Wave theory, which is the linchpin for all of my short- and long-term market predictions, I based my forecast on human behavioral patterns that go back centuries, namely the crowd mentality. Everyone hates stocks or sectors when they are down, and loves them when they are up or going up. Investors like to chase stocks and sectors when they are up high and running near parabolic, but they don’t like to buy large dips or consolidations ahead of moves. This is why I use Elliot Waves. Elliott Wave patterns and a few other indicators sprinkled in can give you a heads up on when the crowd is about to jump in, so you can basically front-run the crowds. But back to the gold bull market. The reason I knew in August 2009 that from $900 gold we would enter a massive five-year bull run was due to crowd patterns. To refresh, I see gold as being in a Fibonacci 13-year cycle up that started in 2001. For the first five years, only a few investors participated in the bull run, because for the prior 20 years, gold had not been a lucrative investment. By the time everyone realized in 2006 that gold mutual funds had compounded 30% a year for five years, it was too late. Of course, that is when everyone started buying gold mutual funds and stocks. The problem was the first move was over, and we had three Fibonacci years of chop with no net gains. The crowd gave up around the summer of 2009, and that is when I forecasted a huge five-year move to come. So far, gold is up over 50% in 13 months and gold stocks are up considerably more. The junior stocks started expanding in volume and price months ago, and that should have been yet another wake-up call to investors. Near-term, I’m looking for this current power Elliott Wave to land around $1,485-$1,492 an ounce before we get a strong correction, and the recent pivot at $1,312 was yet another short-term bottom, which will be followed by the last leg up since the $1,155 lows this summer. Investors are now waking up and buying gold and gold stocks, and this is part of the recognition period during the last five years of the 13-year cycle when more and more participants get involved. This is why I say this gold bull is just warming up, and by the time it peaks out, it will be like 1999 in tech stocks. The demand for gold overseas, especially in China, is likely to continue for many years to come, so don’t be fooled by the various wave dips in sentiment. The Overall Bull Market Ain’t Over Yet Either The broader market’s story since the March 2009 lows is similar to gold’s. The bears have continued to focus on jobs reports and other ephemeral data and not the big picture. My opinion is the great bear cycle ended in March 2009, at 666 on the S&P 500, at least for a multi-year cycle up. When we hit 666, it was an exact 61.8% Fibonacci retracement of the 1974 S&P 500 lows to the 2000 highs. It took about eight to nine years to correct that 26-year move, and the pattern fits with a “Wave 2″ pessimistic Elliott Wave bottom. That is why the move since 666 has been stunning — because nobody saw it coming. The correction we had this summer, which I forecast in mid-April, ended on July 1 at 1,010 on the S&P 500. The 1,010 level was a 38% Fibonacci retracement of the March 2009 to April 2010 Fibonacci 13-month rally, and a 38% retracement of the 2007 highs to 2009 lows. Those types of patterns are not random and, in fact, are big clues to get long the market. The problem is those patterns are hidden amongst the noise of the markets, CNBC, and all of that useless data. Currently, we are in a third Elliott wave up, which began at the 1,040 S&P 500 pivot, and my forecast since has been for 1,205-1,220 before a corrective fourth wave down. Before it’s all over, the S&P 500 may well test the 2007 highs on this new cycle up from March 2009. Subscribers to my Web site get weekly updates and regular intra-week commentary as needed. Learn more at TheTechnicalTraders.com .

tdp2664

gol2664

InvestorPlace

Notable NASDAQ Stocks (SONS, DELL, GOOG)

Sonus Networks, Inc. (NASDAQ:SONS) slumped 17.19% to $2.65. Third-quarter net loss was $22.3 million, or 8 cents a share, compared with net profit of $311,000, or breakeven a share, a year ago. Analysts polled by Thomson Reuters were expecting the company to break even and revenue of $58.2 million. The stock went up more than 24% year-to-date. Dell Inc. (NASDAQ:DELL) added 0.80% to $14.48. Yesterday, the company announced that it has agreed to acquire Software-as-a-Service Boomi to help businesses reap the full value of cloud computing. The terms of the transaction were not disclosed. The 52-week range of the stock is $11.34-$17.52. The stock went down more than 2% year-to-date. At today`s closing market price, the market capitalization of the company stands at $28.16 billion. Google Inc. (NASDAQ:GOOG) went up 0.74% to $620.18. Yesterday, the company announced that on October 7, 2010, federal district court Judge James Ware preliminarily approved a class action settlement related to the launch of Google Buzz last February. The settlement resolves a lawsuit filed by Gmail users who alleged that Buzz's launch violated their privacy. At today`s closing market price, the market capitalization of the company stands at $197.66 billion. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Top 10 Best-Rated U.S.-Listed Chinese Stocks: VIT, CISG, HOLI, SVN, ALN, CBEH, CRIC, CAST, CMFO, CPC (Nov 03, 2010)

Below are the top 10 best-rated U.S.-listed Chinese stocks, UPDATED TODAY before 4:30 AM ET, based on the number of positive ratings by brokerage analysts.

VanceInfo Technologies Inc. (NYSE:VIT) is the 1st best-rated stock in this segment of the market. It is rated positively by 100% of the 10 brokerage analysts covering it. CNinsure Inc. (NASDAQ:CISG) is the 2nd best-rated stock in this segment of the market. It is rated positively by 100% of the 6 brokerage analysts covering it. Hollysys Automation Technologies Ltd (NASDAQ:HOLI) is the 3rd best-rated stock in this segment of the market. It is rated positively by 100% of the 6 brokerage analysts covering it. 7 DAYS GROUP HOLDINGS LIMITED(ADR) (NYSE:SVN) is the 4th best-rated stock in this segment of the market. It is rated positively by 100% of the 6 brokerage analysts covering it. American Lorain Corporation (AMEX:ALN) is the 5th best-rated stock in this segment of the market. It is rated positively by 100% of the 5 brokerage analysts covering it.

China Integrated Energy, Inc. (NASDAQ:CBEH) is the 6th best-rated stock in this segment of the market. It is rated positively by 100% of the 5 brokerage analysts covering it. China Real Estate Information Corp (NASDAQ:CRIC) is the 7th best-rated stock in this segment of the market. It is rated positively by 100% of the 5 brokerage analysts covering it. Chinacast Education Corporation (NASDAQ:CAST) is the 8th best-rated stock in this segment of the market. It is rated positively by 100% of the 4 brokerage analysts covering it. China Marine Food Group Ltd (AMEX:CMFO) is the 9th best-rated stock in this segment of the market. It is rated positively by 100% of the 4 brokerage analysts covering it. Chemspec International Ltd (NYSE:CPC) is the 10th best-rated stock in this segment of the market. It is rated positively by 100% of the 4 brokerage analysts covering it.

tdp2664

China Analyst

Top 10 Best-Rated U.S.-Listed Chinese Stocks: VIT, CISG, HOLI, SVN, ALN, CBEH, CRIC, CAST, CMFO, CPC (Nov 03, 2010)

Freddie Mac reports Mortgage and Lending; Low Interest Rates via Federal Reserve’s Policy Statement may Help Refinance and Stop Foreclosure

dow2664

The Fed’s policy statement could aid in halting the foreclosure process for some. Freddie Mac hopes the report can lower interest rates and increase rate of loan payoffs. The market has shown a general stagnation over the past several days due to self induced trading paralysis ahead of the Federal Reserve’s policy statement. The Fed policy report aimed to detail plans to purchase Treasury bonds and many worried about the overall scope and sequence of the plan. The current Fed verdict is in and the policy report revealed that the Federal Reserve will purchase $600 billion in Treasury bonds. The purchase will be phased in over time at approximately $75 billion a month. The phase in period will be between now and June 30th 2011. This move will keep interest rates lower for the long term. Interest rates lower for the long term is just the news that the housing sector has been loking for and desperately needs. The housing sector has seen a lack of substantial positive movement in quite some time and reports contniue to show data hovering in the red with little sign of moving out of the cellar any time soon. Freddie Mac reports that it has lost $2.5 billion in the third quarter and also states that it could be a “considerable” amount of time before thehousing market recovers. Freddie Mac recently requested an additional $100 million in U.S. Treasury Department aid after reporting this third quarter’s losses. In the three months ending September 30th, Freddie Mac had $5.6 billion in unpaid loans out there with lenders. Lower interest rates and the ability to refinance to stop foreclosure may be beneficial to the lending giant. The Fed policy report today will hopefully be a positive catalyst. Author: Stephen Johnson

The U.S. Stock Market Showed Upward Trend: Top Gainer at NYSE are SKH, CAB, WTI and DHX

With the gain of Republicans in midterm elections the U.S. stock index futures rolled back. According to the analysts the election results could mature stocks with profit margins as the S&P 500 index raised up to 14% since September. With the persistent U.S. dollar weakness and strong earnings led an increased demand for equity trade witnessed a high U.S. stock index level achieved on Wednesday during the last five months. The DOW JONES index advanced 64.10 points or 0.58% to close at 11,188.72. The NASDAQ index advanced 28.68 points or 1.14% to close at 2,533.52 whereas the S&P 500 index also advanced 9.19 points or 0.78% to close at 1,193.57. Top gainers at NYSE were SKH, CAB, WTI and DHX Skilled Healthcare Group, Inc. NYSE:SKH remained at top in the percentage gainers, advanced 21.63% to close at $4.78 with the total traded volume of 3.35 million shares for the day. The 52week range remained in between $1.43 – $8.23. On November 01, 2010 Company announced its third quarter earnings report. Revenues for quarter ended September 30, 2010 was $209.2 million, got an increase of 11.6 percent, comparatively with the consolidated revenue of $187.5 million in the third quarter of 2009. In results announcement ceremony, company's chairman and chief executive officer of Skilled Healthcare Group, Inc Boyd Hendrickson happily declared that these strong revenues were backed up by hospice and home health acquisition in May and from long-term care business. Cabela’s Incorporated NYSE:CAB advanced 20.73% to close at $22.07 with the total traded volume of 3.46 million shares for the day, the 52week range remained in between $11.65 – $22.22. On 2nd November 2010 a total of 208 put options and 937 call options were traded. The put/call ratio remained 0.22; resulting a 4.50 call options traded for each put option. W&T Offshore, Inc. NYSE:WTI jumped 19.42% to close at $12.85 with the total traded volume of 3.92 million shares for the day, the 52week range remained in between $8.15 – $13.27. Company reported profit in the third quarter due to lower costs and expenses. Company earned 43% per share. DICE HOLDINGS, INC. NYSE:DHX advanced 18.92% to close at $10.75 with the total traded volume of 417,562 shares for the day, the 52week range remained in between $5.22- $10.92. According to results of third quarter 2010 company had increased its revenues by 29% to $34.4 million; year-over-year, than $26.7 million in the comparable quarter of 2009. Top losers at NYSE were GKK, CKP, XRS and ENR Gramercy Capital Corp. NYSE:GKK was at top in losers, declined 17.39% to close at $2.09 with the total traded volume of 1.09 million shares for the day, the 52week range remained in between $1.00 – $4.61. Crude oil price at New York Mercantile surged 0.41% to close at $84.24 per barrel on the latest data.

tdp2664Penny Stock Live

RealD (NYSE:RLD) Hits New High On Solid Earnings

RealD (NYSE:RLD) shares jumped by 21.39% as the company reported solid revenue figures of $65.3 million, compared to $38.7 million for the second quarter of fiscal 2010; an increase of 69 percent led by the strength of the RealD platform and increased global presence. The shares of licensor of three-dimensional (3D) technologies hit a new 52 week high of $27.76 and was trading at a volume of 1.97 million which was 5.8 times the average trading volume of 0.338 million shares. The Company posted GAAP net earnings of $5.21 million or $0.12 per share as compare to GAAP net loss of $0.22 per diluted share. It generated $1.0 million in cash from operating activities and closed the period with overall cash, cash equivalents and marketable securities of $54.3 million. Consumer demand for a premium 3D visual experience continues to accelerate as indicated in the reported Adjusted EBITDA for the second quarter of fiscal 2011 was $16.5 million, compared to $3.9 million for the second quarter of fiscal 2010, an increase of 327 percent. The Company had deployed approximately 9,300 RealD enabled screens, comprised of 5,600 domestic (United States and Canada) RealD-enabled screens and 3,700 international RealD-enabled screens, and representing an increase of 182% from 3,300 screens at September 25, 2009 and an increase of 24% from approximately 7,500 screens at June 25, 2010. RealD is a leading global licensor of 3D technologies. RealD’s extensive intellectual property portfolio is used in applications that enable a premium 3D viewing experience in the theater, the home and elsewhere. RealD licenses its RealD Cinema Systems to motion picture exhibitors that show 3D motion pictures and alternative 3D content.

tdp2664

Newsworthy Stocks

IMF Gold: Nearly Sold Out

Why did emerging Asian central banks Buy Gold from the IMF…?

The INTERNATIONAL MONETARY FUND just announced that it sold 32 tonnes of Gold Bullion in September, writes Julian Phillips of GoldForecaster.

This included the 10 tonnes of Gold Bullion sold to Bangladesh, leaving around 71 tonnes left to go from the IMF’s total 403 tonnes first slated for sale in early 2009.

We have passed October now, so if the IMF sold a similar amount of gold last month, then we are down to just below 40 tonnes remaining. If they continue this pace of selling in November, the IMF will only be left with less than 10 tonnes to sell in December and will complete their sales before the end of this year.

We have no reason to believe that central banks in the emerging world will then cease buying, so where will they get future stock from? These buyers are not price sensitive, so will have to attempt to Buy Gold in the open market, where they cannot buy their own local production. If more central banks than are present now in the open market arrive, they will not be able to use the ‘limit’ order system to Buy Gold only when offered. The bullion banks will be able to ask for better offers simply by placing it in the gold Fixing and waiting for the best offer to arrive. This will turn central bank buyers from ‘passive’ buyers into ‘active’ ones.

It would be easy to assume that East Asian central banks will not buy more gold once the IMF completes its sales. Central banks have been the main buyers of this gold, with three central banks taking 222 tonnes between them and unknown buyers taking the balance in unannounced deals. We have to ask, did the central banks take this gold because it was just there, presented in a way that they could acquire it without disturbing the Gold Price? Or did their belief in a future time when gold would help them in dark days influence their decision?

Alternatively, these central banks bought the IMF’s gold because it is a good investment and counters the decline in currency values they fear might happen. All these motives are good ones, and together they justify conservative central banks Buying Gold again in 2011 and beyond.

However, there is one aspect that has not really been considered. You will note that the central banks that bought this gold were from the Asian emerging nations. Primarily they were nations stemming from or part of the Indian sub-continent. These nations have always respected gold and considered it money without wavering over the centuries. They have never been totally convinced that paper money is ‘as good as gold’, as the West has.

These rising Asian powers are all part of the emerging east and are fully aware that wealth and power is moving eastward. It is a completely logical step to believe that the power that the US Dollar now holds will move eastwards to some extent. With the stresses and strains this process will entail, it is likely that eastern currencies, to some extent will rise in importance, as the Dollar declines. It makes sound investment sense now to lower their dependence on the US Dollar and diversify into other currencies. But which ones? The future is so uncertain one cannot be sure of the value of any other currencies. It makes good sense to turn to gold, which history has shown rises in value and usefulness in such days.

Will central banks cease Buying Gold after the IMF sales are complete? Even now that they have these amounts in their reserves, we think not, but any desire to buy more will have to be tempered by the effect their buying in the open market will have on prices. As we discussed above, the concept of ‘limit’ buying will have to give way to a more direct and active approach if gold is to be bought successfully. If there are several central banks present in the market at the same time (we hear that Bangladesh is in the open market still)] they will never chase Gold Prices, but will lift the limits on their buying so as to cause a slightly faster rise. This will allow other investors to come into the market but they will have to chase what remaining stock there is with higher prices.

Start building your own private gold reserves with a free gram at world No.1 BullionVault now…

gol2664

OpenTable Inc (NASDAQ: OPEN) Hits New High

OpenTable Inc NASDAQ: OPEN) shares jumped by 10.78% following the Company's reporting of net income of $3.8 million, or $0.16 per diluted share, in Q3 2010 compared to $0.9 million, or $0.04 per diluted share, in Q3 2009. It is trading at a price of $68.02 at a volume of 4.44 million as against its average volume of 0.557 million shares. Non-GAAP consolidated net income for Q3 2010, which excludes tax-affected stock-based compensation expense and tax-affected acquisition related expense, was $5.6 million, or $0.23 per diluted share. Consolidated net revenues for Q3 2010 was $24.5 million, a 44% increase over Q3 2009, following seated diner revenue of 15.9 million, a 54% increase over Q3 2009. Reservation revenues were $11.4 million in Q3 2010, up 61% over Q3 2009 revenues of $7.1 million. Reservation revenues primarily increased as a result of the increase in seated diners. Installation and other revenues were $2.1 million in Q3 2010, up 157% over Q3 2009 revenues of $0.8 million. Installation and other revenues increased primarily as a result of an increase in revenue from other product offerings, including advertising sales, web service licensing, featured private dining listings and third-party restaurant coupon sales. We delivered very strong growth across every key financial metric in the third quarter,” said Matt Roberts, CFO of OpenTable. “The business continues to deliver significant operating margins even as we invest for long-term growth.” OpenTable is a leading provider of free, real-time online restaurant reservations for diners and reservation and guest management solutions for restaurants. The OpenTable network delivers the convenience of online restaurant reservations to diners and the operational benefits of a computerized reservation book to restaurants.

tdp2664

Newsworthy Stocks

Silver Price Correction

A correction in gold and especially Silver Prices has been long overdue…

LAST TIME I saw a precious metals correction reaching its end was about two years ago, writes Chris Weber of the Weber Global Opportunities Report in Daily Wealth.

At that time, the Gold Price hit a low of $693 and silver $9.63. Since then, gold has risen over 40%, but silver has soared 158%. This is an extraordinary occurrence in just two years.

Two weeks ago, I thought both metals, and especially silver, were due for a rest, and perhaps a correction.

Silver reached $24.75 on October 14. I expected a back-off to begin. But so far, we’ve had very little. Silver briefly touched as low as $23. That is a 7% fall. In the universe of silver, this is nothing. And then the rise resumed. As I write this, silver reached a new high of $24.91, surpassing October 14th’s $24.75 per ounce.

This all feels unprecedented to me. Gold has not been giving people an advantageous entry point for a long time now. But silver is supposed to crash at certain times. It can almost be relied upon to do this.

Not this time – at least, not so far. Given an opportunity to correct or even consolidate its prior gains, the Silver Price barely takes a breath and then reaches new highs.

Why? Some say silver shorts are covering. But why now? Why this time? Silver Prices refused to fall, and then rose. So of course, under these circumstances, anyone selling the metal short will cover their position, Buying Silver to close out their trade before their losses grow.

But no answer I’ve heard is satisfying. I just take the price action as the news. And the news is that this is bullish behavior the likes of which I don’t think I even saw back in the last bull market of the 1970s.

Of course, over the life of that bull market, silver soared from $1.29 to $48 per ounce – a rise of 3,600%. So far this time, silver has only risen from $4.03 to $24.91. That’s “just” 518% during a similar time period.

But the feeling this time is different. Silver has only had one typical correction: from $23 to just under $10 in mid-2008. But while the percentage correction was typical (over 50%), it was all over in just seven months. A huge and powerful bull then quickly returned silver to new highs. And so far, this time, when I expected a real rest, silver isn’t having it at all.

It is possible that average investors now think that gold is too expensive for them and see silver as something they should have. For a few hundred Dollars or the equivalent in other currencies, silver is regarded as within the budgets of all investors, be they from India or Indiana, from China or Chinon.

Can you imagine what would happen if every investor on earth became convinced that they needed to Buy Silver? My old forecast of $187 per ounce may start to not look so wild.

One other thing has happened recently that I haven’t seen mentioned. Silver has now clearly overtaken gold as the best-performing asset class since 2000. Gold has risen from $256 to $1,365. That is a rise of 433%. Silver has risen from $4.02 to $24.91. That is a rise of 520%.

As important, those advising silver accumulation have been few in number, and remain so.

For those who have been waiting to Buy Silver or add to their holdings, there is no guarantee we’ll have any big correction, or even a consolidation. I’m forced to advise people to simply buy or add without trying to time their purchases.

In general, this is what you should do in a bull market, but I had until now thought I was clever enough to attempt to time purchases a little. I no longer consider myself so clever. So my advice is to bite the bullet and accumulate at least some physical silver.

Buy Physical Silver at the lowest prices – live online – by using BullionVault…

gol2664

Early Market News: Dell (NASDAQ:DELL), Verizon Communications Inc. (NYSE:VZ), IBM (NYSE:IBM)

Here are more news stories which could affect stocks on world markets in trading later today. The following companies should see some movement: Dell (NASDAQ:DELL), Verizon Communications Inc. (NYSE:VZ), IBM (NYSE:IBM). Here is a more detailed look at the news that will affect each company when trading continues. Dell (NASDAQ:DELL) Dell (NASDAQ:DELL) has planned to buy Pennsylvania based software company Boomi Inc. Acquisition of Boomi Inc, the experts in cloud computing software technology, is expected to boost up Dell's (NASDAQ:DELL) ability to provide software over computer networks and reduce costs with the use of data centers. Steve Felice, president of Dell’s NASDAQ:DELL) consumer, small and midsize business segment, said, “Twenty-six years ago we helped accelerate the move to client-server computing; today we’ll help drive a similar transformation with customers turning to the cloud to drive costs down and innovation up.” Verizon Communications Inc. (NYSE:VZ) United Parcel Service (NYSE:UPS) has released new published rates for its shipments in 2011. A net increase of 4.9% for United Parcel Service (NYSE:UPS) ground packages and an increase of 4.9% on all air express and US origin international shipments has been made by the company. Report says that increased shipment rates implemented by United Parcel Service (NYSE:UPS) is a way to recover revenue lost as the company faces a global economic downturn. The increased rate is expected to be effective from Jan 3rd. IBM (NYSE:IBM) IBM (NYSE:IBM) has sponsored PostgreSQL Community Conference. PostgreSQL, the largest independent open source database company in the world has announced that IBM (NYSE:IBM) has signed as a Gold sponsor for the industry’s largest PostgreSQL conference. The conference will start from Nov. 2-4 at the Sir Francis Drake Hotel in San Francisco. It is the best platform for the PostgreSQL community to come together for sharing recent advancements. The keynote will be delivered by Microsystems co-founder and open-source advocate Scott McNealy Ed Boyajian, CEO at EnterpriseDB said “IBM’s sponsorship of PG West confirms that PostgreSQL is ready and well-suited for enterprise environments.” We may see more movement when trading continues for Dell (NASDAQ:DELL), Verizon Communications Inc. (NYSE:VZ) and IBM (NYSE:IBM).

tdp2664

E money daily

Notable NYSE Stocks (PHM, CVS, TWX)

PulteGroup, Inc. (NYSE:PHM) plunged 7.68% to $7.45 after it made its fresh one-year low of $7.32. The company posted a third-quarter loss of $995 million, or $2.63 per share, compared with a loss of $361.4 million, or $1.15 per share, a year earlier. Revenue from home sales was $1 billion, down 3 percent. The stock went down more than 25% year-to-date. CVS Caremark Corporation (NYSE:CVS) surged 1.11% to $30.87 on unusual volumes. The company said Wednesday its third-quarter earnings fell to $808 million or 59 cents a share, from $1.02 billion, or 71 cents a share, in the year-ago period. Adjusted income totaled 65 cents a share in the latest period. Revenue fell 3% to $23.9 billion. The company was expected to earn 64 cents a share, on revenue of $23.9 billion, according to a survey by FactSet Research. The company narrowed its 2010 profit view to a range of $2.68 to $2.70 a share, from its earlier estimate of $2.68 a share to $2.73 a share. The stock made its new 52-week high of $82.45. The stock went down more than 5% year-to-date. Time Warner Inc. (NYSE:TWX) went down 1.05% to $32.07. The company reported on Wednesday that third-quarter net income fell 21% on 1.8% higher revenue. Earnings fell to $522 million or 46 cents a share, from $662 million, or 55 cents, in the year-earlier quarter. Adjusted profit from continuing operations was 62 cents against 53 cents. A survey of analysts by FactSet Research produced consensus estimates of 53 cents a share of profit on $6.43 billion of revenue. At today`s closing market price, the market capitalization of the company stands at $36.05 billion. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Analyst Actions on Chinese Stocks: ADY, ASIA, CEA, CTRP, FSIN, HMIN, HOGS, HTHT ... (Nov 3, 2010)

Below are today's Analyst Actions on U.S.-Listed Chinese Stocks.

Roth Capital Partners maintained Neutral rating and $8.50 price target on American Dairy, Inc. (NYSE:ADY).

Deutsche Bank maintained Buy rating and $26 price target on AsiaInfo-Linkage, Inc. (NASDAQ:ASIA). UBS reiterated Buy rating on AsiaInfo-Linkage, Inc. (NASDAQ:ASIA), and maintained $30 price target. Bank of America maintained Buy rating and HK$6.60 price target on the Hong Kong-listed shares of China Eastern Airlines Corp. Ltd. (NYSE:CEA). Deutsche Bank downgraded Ctrip.com International, Ltd. (NASDAQ:CTRP) from Hold to Sell, and maintained $39 price target. Goldman Sachs maintained Neutral rating on Ctrip.com International, Ltd. (NASDAQ:CTRP), and raised price target from $42 to $46. Morgan Stanley maintained Overweight rating on Ctrip.com International, Ltd. (NASDAQ:CTRP). Roth Capital Partners downgraded Fushi Copperweld, Inc. (NASDAQ:FSIN) from Buy to Neutral, and cut price target from $15 to $11.50. Global Hunter Securities reiterated Buy rating and $15 price target on Fushi Copperweld, Inc. (NASDAQ:FSIN). Roth Capital Partners maintained Buy rating and $55 price target on Home Inns & Hotels Management Inc. (NASDAQ:HMIN). Morgan Joseph maintained Buy rating on Zhongpin, Inc. (NASDAQ:HOGS). Roth Capital Partners maintained Neutral rating and $25 price target on China Lodging Group, Ltd (NASDAQ:HTHT). UBS maintained Buy rating on LDK Solar Co., Ltd. (NYSE:LDK), and raised price target from $12 to $15. RBS maintained Hold rating and $5.70 price target on Melco Crown Entertainment Ltd (NASDAQ:MPEL). CLSA maintained Buy rating on Melco Crown Entertainment Ltd (NASDAQ:MPEL), and raised price target from $8 to $8.50. Deutsche Bank maintained Buy rating and $32 price target on Mindray Medical International Limited (NYSE:MR). Samsung Securities initiated coverage of NetEase.com, Inc. (NASDAQ:NTES) with Buy rating and $46 price target. HSBC reiterated Underweight rating on Semiconductor Manufacturing Int'l (NYSE:SMI), and raised price target from $3 to $3.6. JPMorgan maintained Neutral rating on Semiconductor Manufacturing Int'l (NYSE:SMI), and raised price target from HK$0.55 to HK$0.60 on the company's Hong Kong-listed shares. Auriga USA reiterated Buy rating and $8.50 price target on China Digital TV Holding Co., Ltd. (NYSE:STV). Roth Capital Partners maintained Buy rating and $22 price target on 7 Days Group Holdings Limited (NYSE:SVN). Barclays Capital maintained Equal Weight rating and $14 price target on Yingli Green Energy Hold. Co. Ltd. (NYSE:YGE). Deutsche Bank maintained Buy rating on Yingli Green Energy Hold. Co. Ltd. (NYSE:YGE), with $19.3 price target. Piper Jaffray reiterated Overweight rating and $14 price target on Yingli Green Energy Hold. Co. Ltd. (NYSE:YGE). RBS initiated coverage of Yanzhou Coal Mining Co. (NYSE:YZC) with Buy rating and HK$27 price target on the company's Hong Kong-listed shares.

tdp2664

China Analyst

Analyst Actions on Chinese Stocks: ADY, ASIA, CEA, CTRP, FSIN, HMIN, HOGS, HTHT … (Nov 3, 2010)

Cards Stacked Against Cisco Ahead of Earnings

Sometimes it’s hard to go against a well-established company. After all, stocks generally rise over time, and there’s a tendency to believe in known names. But you have to look past the reputation and examine the numbers. Such is the case with Cisco Systems, Inc . (NASDAQ: CSCO ). The company reports earnings after the close next Wednesday, Nov. 10. The thing about Cisco is it doesn’t miss earnings estimates. Period. Our data goes back to January 2005, and there isn’t a miss to be found. The problem, of course, is that the market is pretty well trained to expect a “surprise” of a few pennies every quarter. So beating is no big deal; it’s a given. What concerns us is that the whisper number is much higher than the analyst estimate – 45 cents compared to 34 cents. That’s a huge difference. In fact, the biggest difference we’ve seen in the past two years is just five cents, so this is a red flag. Beyond the numbers, CSCO simply doesn’t perform well after earnings. Looking back, the stock has dropped within the two weeks after six of the past eight reports. The average move two weeks after these eight reports is a decline of about 5%. Keep in mind that these drops followed earnings beats. On the charts, the stock is finding staunch resistance at the 200-day moving average after a 20% rally off the late August low. On the other hand, the 20-day is providing support. Peak November call open interest lies at the $24 strike (2% above the current share price), while peak put open interest rests at the $22 strike (6.4% below the current price). So we’re seeing more downside potential. Sentiment toward CSCO is largely positive. Short interest is negligible, the put/call ratio is near the middle of its yearly range, and 26 of 35 covering analysts rate the stock a “buy” (with just one brave sole giving it a “sell”). This optimism creates some vulnerability for the stock should earnings not impress. Adding it all up, it appears the cards are stacked against CSCO this quarter. Cisco will no doubt beat the earnings estimate, but unfortunately for smooth-talking CEO John Chambers and company, that may not be good enough this time around. Buy the CSCO Dec 24 Puts to allow the expected post-earnings decline to play out.

tdp2664

gol2664

InvestorPlace

Randgold Resources Bearish Moving Average Crossover Alert (GOLD)

gol2664

Randgold Resources Bearish Moving Average Crossover Alert (GOLD) Comtex Smartrend – 5 hours ago By Chip Brian Today, shares of Randgold Resources (NASDAQ:GOLD) have crossed bearishly below their 10-day moving average of $93.81 on volume of 405 thousand shares. This may provide swing traders … Randgold Resources (GOLD) Down 2.5% Along With Falling Gold Prices – Market Intelligence Center

Gold and Silver and Copper Price Per Ounce fall; Federal Reserves Policy Report effected Commodity and Dollar for November 3rd, 2010

dow2664

Gold price rate per ounce today fell and this is surprising given the fact that, as expected, the dollar was subject to devaluation due to the Federal Reserve’s policy statement. Silver was subject to the lower trending today as well. The current Fed verdict is in and the policy report revealed that the Federal Reserve will purchase $600 billion in Treasury bonds. The purchase will be phased in over time at approximately $75 billion a month. The phase in period will be between now and June 30th 2011. This move will keep interest rates lower for the long term. With this news, the dollar fell today against the euro, the British pound and gained against the Japanese yen. Still trends pushed commodity prices lower. Gold settled down today at $1,337.60 an ounce and silver fell to $24.44 and ounce. Specifically, gold for December delivery fell $19.30 today and settled at $1,337.60 an ounce. The Fed’s announcement of detailed quantitative easing is expected to weaken the greenback further and as historical data will show, commodities often rise as a result. Copper was in the red today as well though at $3.78 per ounce and Platinum was trending red at end of day close also. Platinum’s end of day close trade price was $1,697.20. Author: Camillo Zucari

Exclusive Interview with Ken Fisher Part 2 - Elections, California's Future

dow2664

Ken Fisher is a money manager, Forbes columnist, and on the list of the Forbes 400 Richest Americans. His latest book, Debunkery: Learn It, Do It, and Profit from It-Seeing Through Wall Street’s Money-Killing Myths was just published. He is also author of several other books, including The Ten Roads to Riches: The Ways the Wealthy Got There (And How You Can Too!) and How to Smell a Rat: The Five Signs of Financial Fraud Ken Fisher Interview Part 2 Please note: Interview took place on Wednesday, October 27, 2010 Stockerblog: I’m going to get back to the bunks shortly but I read recently that you’re moving your offices or some of your offices to the State of Washington? Fisher: We have 325 people in the state of Washington., and we started moving people into Washington three years ago. We’re building a building in Washington because traditionally we like to own our own real estate and not to be in leased space. At this point in time, we now have about a third of our employees in Washington and we are not doing anything that I consider as very radical. Stockerblog: What this was leading to was, I was wondering what you think is the future of California, not from a political standpoint but a financial standpoint in the next couple years. Fisher: In the next couple years, California will largely continue on the trend that is has been on. Let’s just think that through. Forgetting about other things, the driving feature in California for some period of time now, forgetting about budgets per se, has been to slightly lose population While shifting the demographic of the citizenry and the voter base, away from productives towards non-productives. That becomes a momentum unto itself because the productives move out of the state of California and the non-productives into California, the non-productive become dependant, if you will, on the professional political class, which provides more support for more big government which requires more spending which requires more taxes and/or bigger deficits., either way, which again drives more productives away. Until you break that cycle, which is not easy to do, and if not done quickly, California continues down the same basic path. So if you look at this year, which is on a national basis, is a year that is aiming towards more fiscal responsibility, supposedly, or more conservative people being elected, House of Representatives almost certainly going to Congress, governorships shifting heavily away from Democrats towards Republicans, California isn’t going there at all. California is going to elect or in a sense you could say re-elect Jerry Brown governor. [Ed. note: Interview was Oct. 27] The legislature is going to remain heavily Democratic. The same dilemmas that Arnold Schwarzenegger faced as governor Jerry Brown is going to face as governor. If you look for example at it from a different way and this is somewhat telling, if you look at the House races across the country that are thought of as toss-up races, the ones that could go either way, not a one of them is in California. California isn’t shifting so its basic problems will remain the same. Its socio-political world has continued to tilt away from productives a little bit each year toward more unproductives a little bit each year, which maintains and establishes the voting populace at a little more dependant on the professional political platform. Stockerblog: I think the fear from investors is, could the state go bankrupt, is that even a possibility, and if that did happen, then what? Fisher: You asked about the next few years. The state is not going to go bankrupt in the next few years. The state’s going to have severe budget problems in the next few years. Might the state eventually go bankrupt? Yea, but not in the next few years. I will make one point, that’s an observation that so far does not seem to get the light of day. In November, I turn sixty, and in my lifetime, my adult lifetime, there has never been a November election in California that did not have multiple bond issue initiatives on the ballot. For the first time in my adult life, there are no bond issues on the California ballot and nobody seems to notice that. The San Francisco Comical hasn’t written about it, the LA Slimes hasn’t written about it. That’s an interesting sign. It’s a sign to me that California isn’t going bankrupt anytime soon, but that’s also a sign that’s good that they can’t sell any bond issues anyway. End of Part 2 The Debunkery book is available at Amazon . Ken Fisher obviously doesn’t give individual stock recommendations in his interviews, but some stocks he likes that were mentioned in his recent Forbes columns are available in the form of a free Excel list at WallStreetNewsNetwrok.com. Part 1 of this interview is available HERE . By Fred Fuld at Stockerblog.com Disclosure: Interviewer doesn’t own any of the stocks mentioned in this interview series at the time the article was written. Copyright 2010. All rights reserved. Reproduction of this interview prohibited without permission. All opinions are those of Ken Fisher, and do not represent the opinions of Stockerblog.com or the interviewer. Neither Stockerblog nor the interviewer nor the interviewee are rendering tax, legal, or investment advice in this interview. If you want tax, legal, or investment advice, contact the appropriate professional.

Exclusive Interview with Ken Fisher Part 2 – Elections, California’s Future

Closing Update: Fed Move Spurs Eventual Stocks Gains - DJIA At Sept. 2008 Highs

dow2664

Closing Update: Fed Move Spurs Eventual Stocks Gains – DJIA At Sept. 2008 Highs istockAnalyst.com – 1 hour ago -NYSE up 26.27 (+0.4%) to 7,608.41 -DJIA up 26.41 (+0.2%) to 11,215 -S&P 500 up 4.39 (+0.4%) to 1,198 -Nasdaq up 6.75 (+0.3%) to 2,540 GLOBAL SENTIMENT Hang Seng up 2% Nikkei up 0.06% FTSE down 0 …

Closing Update: Fed Move Spurs Eventual Stocks Gains – DJIA At Sept. 2008 Highs

New Support and Resistance Zones

The stock market made a huge run in the past two months with the S&P 500 up almost 14%. But momentum is now slowing, and with the Fed’s QE2 response to a lagging economy in question, it looks like it is time for stocks to take a rest. For the S&P 500, the pullback will most likely be contained at the lower end of the 1,150 to 1,175 zone of support, but stocks could pull back all the way to the breakout at 1,130. For the Dow, the numbers look like 10,700 to 10,900. And the Nasdaq could drop to 2,320 to 2,425 with the first support line at 2,450. If a correction occurs, investors should use the opportunity to jump aboard what looks like a train that could quickly accelerate once the April high at S&P 1,220 is topped. If you have questions or comments for Sam Collins, please e-mail him at samailc@cox.net .

tdp2664

gol2664

InvestorPlace

US Stocks Down In Morning Session (ERTS, WYNN, HAR)

Electronic Arts Inc. (NASDAQ:ERTS) dropped 4.32% to $15.50. The company reported a net loss for the fiscal second quarter ended September 30 of $201 million, or 61 cents a share, versus a net loss of $391 million, or $1.21 a share, in the year-ago period. Excluding items, EA’s had a profit of 10 cents a share, better than the average analyst estimate for a loss of 10 cents, according to Thomson Reuters. The 52-week range of the stock is $14.06-$20.24. Wynn Resorts, Limited (NASDAQ:WYNN) lost 1.97% to $110.35. The company lost $33.5 million, or 27 cents a share, on the period – a turn form a profit of $34.2 million, or 28 cents a share, in the same quarter of 2009. On an adjusted basis, the company would have earned 39 cents a share, up from 33 cents. Revenue soared to $1 billion from $773.1 million, due largely to a nearly 50% increase in revenue from Macau. The average estimate of analysts polled by FactSet Research had been for Wynn to earn 40 cents a share on revenue of $990 million. At current market price, the market capitalization of the company stands at $13.63 billion. Harman International Industries Inc./DE/ (NYSE:HAR)) dropped 1.01% to $37.20. Fiscal first-quarter net income from continuing operations was $25 million, or 35 cents a share, versus a net loss from continuing operations of $4 million, or 8 cents a share, in the same period a year earlier, the company said. Sales climbed 12% to $837 million — a 19% increase in local currency. The company also opened its first flagship store in Shanghai. Harman shares jumped 15% to $38.63 in morning trading Tuesday. That left the stock up 9.5% so far this year.

tdp2664

Newsworthy Stocks

Opening View: DJIA Traders Applaud Election Results, but Hold Fire Waiting on Fed

dow2664

Opening View: DJIA Traders Applaud Election Results, but Hold Fire Waiting on Fed Schaeffers Research – 2 hours ago by Joseph Hargett (jhargett@sir-inc.com) 11/3/2010 8:18 AM The Dow Jones Industrial Average (DJIA) appears poised to extend Tuesday's cautious gains, as Wall Street cheers last night's Republican …

Opening View: DJIA Traders Applaud Election Results, but Hold Fire Waiting on Fed

Early Market News: BAE Systems plc (LON:BA), Imperial Tobacco Group plc (LON:IMT), Tesco PLC (LON:TSCO)

Here are more news stories which could affect stocks on world markets in trading later today. The following companies should see some movement: BAE Systems plc (LON:BA), Imperial Tobacco Group plc (LON:IMT), Tesco PLC (LON:TSCO). Here is a more detailed look at the news that will affect each company when trading continues. BAE Systems plc (LON:BA) BAE Systems plc (LON:BA) has shown its pleasure at the signing of a defense deal between the UK and France. On behalf of the treaty, BAE Systems plc (LON:BA) has also entered into talks with French jet manufacturer Dassault Aviation SA regarding the development of military unmanned aircrafts. A BAE Systems plc (LON:BA) spokesman said: “We welcome the outcome of UK-France summit, this is an important milestone in terms of the development of our ongoing unmanned aircraft capability, but it represents a significant investment in the future of our UK and French military aerospace capability." Imperial Tobacco Group plc (LON:IMT) Profits have jumped at Imperial Tobacco Group plc (LON:IMT) due to an increase in prices. As the company raised its prices, more economy-brand products have been sold and its full year earnings have jumped up to 8%. The net profit of Imperial Tobacco Group plc (LON:IMT) rose up to £1.5 billion ($2.41 billion) from £663 million. Alison Cooper, Chief Executive Officer of Imperial Tobacco Group plc (LON:IMT) said, “We have a portfolio that is very much aligned to where the consumer is going in these environments and we delivered some excellent brand and product performances in both mature and emerging markets.” Tesco PLC (LON:TSCO) Tesco PLC (LON:TSCO) has reported exceptional profit margins in Ireland. Apart from South Korea, the retail giant Tesco PLC (LON:TSCO) makes more profits in Ireland than in any other part of its global empire. According to the report given by UK stockbroker Shore Capital, Tesco PLC (LON:TSCO)'s Ireland profit margin will increase to over 7 per cent in the current financial year. Tesco PLC (LON:TSCO) says that, "Tesco, in common with most of its retail rivals, does not provide separate profit figures for its Irish business." Clive Black, an analyst with Shore Capital, said that profit margins in the Irish retail trade tend to be high. Expect more movement when trading continues for BAE Systems plc (LON:BA), Imperial Tobacco Group plc (LON:IMT) and Tesco PLC (LON:TSCO).

tdp2664

E money daily

Top Volumes Gainers at NYSE Services Sector (S, Q, FTR, EK, ODP)

Dear PSL members Sprint Nextel Corporation (NYSE: S) plunged 0.97%, closing the day at $4.10 with the over all traded volume of 76.94 million shares for the day. Its market capitalization is $12.26 billion. Sprint Nextel Corporation offers wireless and wireline communications products and services to consumers, businesses, and government users in the United States, Puerto Rico, and the U.S. Virgin Islands. Qwest Communications International Inc. (NYSE: Q) gained 0.91%, closing the day at $6.67 with the over all traded volume of 20.66 million shares for the day. Its market capitalization is $11.60 billion. Qwest Communications International Inc. provides data, Internet, video, and voice services in the United States and internationally. Frontier Communications Corp (NYSE: FTR) surged 1.62%, closing the day at $8.80 with the over all traded volume of 8.22 million shares for the day. Its market capitalization is $8.73 billion. Frontier Communications Corporation provides regulated and unregulated voice, data, and video services to residential, business, and wholesale customers in the United States. Eastman Kodak Company (NYSE: EK) jumped 4.54%, closing the day at $4.72 with the over all traded volume of 6.88 million shares for the day. Its market capitalization is $1.27 billion. Eastman Kodak Company provides imaging technology products and services to the photographic and graphic communications markets worldwide. Office Depot, Inc. (NYSE: ODP) dropped 0.45%, closing the day at $4.43 with the over all traded volume of 6.83 million shares for the day. Its market capitalization is $1.23 billion. Office Depot, Inc., together with its subsidiaries, supplies a range of office products and services.

tdp2664Penny Stock Live

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES November 3rd, 2010; Futures

dow2664

The market trending was strongly positive yesterday as traders anticipated mid-term election results and possible Federal Reserve action plans. Stock trend lines carried high into the green as traders anticipated the scope and sequence of an additional economic stimulus package due to be detailed later today. The Federal Reserve will meet to discuss an action plan that aims to support economic recovery via the purchase of Treasury bonds. Also today, the Commerce Department will provide a report on factory orders in October. In addition to these reports on Wednesday, auto sales will post. Today starts with the election results news. The big picture shows that Congress is divided as the GOP takes the House and the Democrats hold the Senate. Stocks are likely to continue trending into the green today as Republicans are viewed as more business friendly. Positive trending is also likely due to the conclusion from the Feds two-day policy meeting that will come today. The expectation from the Feds meeting is that Treasuries will be purchased in total of $500 billion worth and spread out in $100 billion monthly increments. Interest rates will lower and the hope is that lending and ultimately spending will increase. The dollar will likely lose ground however. It has recently eased against the euro, Japanese yen and British pound. Later this week on Thursday, the Labor Department will release statistics on the initial jobless claims. Pending Home Sales are due out on Friday from the National Association of Realtors. As home sales are often a positive indicator of the general health of the economy, hopes are that signs will point toward home sales improvements. Pre-Market trading reveals that stock futures are positioned mixed today. The Nasdaq and S&P 500 are up while the Dow Jones is slightly down. World markets are trending mostly green across the board right now. Author: Frank Matto

Top 10 Rebounding Consumer Electronics Stocks: ICOP, ATV, IFON, DTSI, KOSS, MSN, NTE, NIV, MCZ, HGG (Nov 02, 2010)

Below are the top 10 rebounding Consumer Electronics stocks, UPDATED TODAY before 4:30 AM ET. These companies are interesting turnaround stories. Two Chinese companies (ATV, NTE) are on the list.

ICOP Digital, Inc. (NASDAQ:ICOP) is the 1st best rebounding stock in this segment of the market. It has risen 122% from its 52-week low. It is now trading at 30% of its 52-week high. Acorn International, Inc. (ADR) (NYSE:ATV) is the 2nd best rebounding stock in this segment of the market. It has risen 71% from its 52-week low. It is now trading at 71% of its 52-week high. InfoSonics Corporation (NASDAQ:IFON) is the 3rd best rebounding stock in this segment of the market. It has risen 70% from its 52-week low. It is now trading at 53% of its 52-week high. DTS Inc. (NASDAQ:DTSI) is the 4th best rebounding stock in this segment of the market. It has risen 50% from its 52-week low. It is now trading at 94% of its 52-week high. Koss Corporation (NASDAQ:KOSS) is the 5th best rebounding stock in this segment of the market. It has risen 48% from its 52-week low. It is now trading at 69% of its 52-week high.

Emerson Radio Corp. (AMEX:MSN) is the 6th best rebounding stock in this segment of the market. It has risen 48% from its 52-week low. It is now trading at 41% of its 52-week high. Nam Tai Electronics, Inc. (NYSE:NTE) is the 7th best rebounding stock in this segment of the market. It has risen 47% from its 52-week low. It is now trading at 97% of its 52-week high. NIVS IntelliMedia Technology Group Inc (NYSE:NIV) is the 8th best rebounding stock in this segment of the market. It has risen 42% from its 52-week low. It is now trading at 64% of its 52-week high. Mad Catz Interactive, Inc. (USA) (AMEX:MCZ) is the 9th best rebounding stock in this segment of the market. It has risen 38% from its 52-week low. It is now trading at 80% of its 52-week high. hhgregg, Inc. (NYSE:HGG) is the 10th best rebounding stock in this segment of the market. It has risen 34% from its 52-week low. It is now trading at 71% of its 52-week high.

tdp2664

China Analyst

Top 10 Rebounding Consumer Electronics Stocks: ICOP, ATV, IFON, DTSI, KOSS, MSN, NTE, NIV, MCZ, HGG (Nov 02, 2010)

Good News for Long-Term Gold Investors

Both Gold Investment AND jewelry demand are rising…

WHEN LAST we looked at the fundamentals of gold supply and demand back in August, we commented that “the third quarter is traditionally a good one for gold demand (2009 aside),” writes Julian Murdoch at Hard Assets Investor.

“Perhaps higher demand – and higher prices – lie ahead.”

For the moment, all evidence points to that trend continuing, albeit at a modest pace. In the July-Sept. quarter of 2010, Spot Gold rose from $1242 per ounce to $1308. Since then, in just a month, gold has gone up another 4.7% to hit a high of $1369 per ounce. And although prices have since eased off a bit, the rise still suggests an acceleration of demand.

But why is gold back on such a tear, and why right now? Clearly, macroeconomic issues are at play; the Fed’s inevitable impending round of QE2, not the least among them. But is there more to the story here?

Last week, the World Gold Council released its quarterly digest of Gold Investment news, providing exactly the under-the-hood look gold investors need. While updated supply and demand numbers won’t be published for another few weeks, this investment report usually gives us a sneak preview of what the data dump will contain.

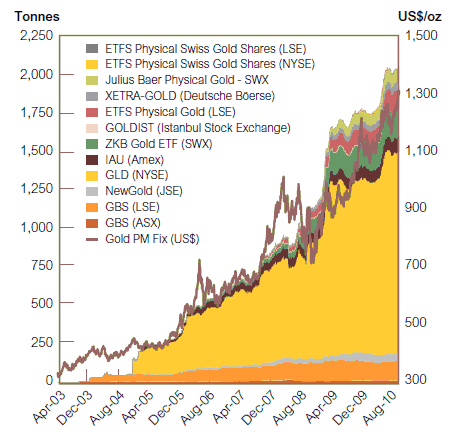

To see how gold demand has evolved from last quarter, a natural first step is to look at exchange-traded trust-fund demand, as precious metals ETFs (like GLTR, the new precious metals basket from ETF Securities) make it easier than ever to access the physical space.

Gold ETF investment may be up, but notice how purchasing flatlined last quarter. This contrasts with previous periods (like Q1 2009), which saw huge spikes in gold purchases from ETFs. But for last quarter, at least, that buying seems to have been quite modest, at 28.3 tonnes (bringing the total ETF holdings to 2,070.1 tonnes at September 30).

In fact, it doesn’t seem that the October rally has been spurred by ETF demand. Based on our calculations, last month, ETFs worldwide actually sold just under 8 tonnes of gold from their vaults.

But gold’s rising price must mean demand coming from somewhere. Our bet? Jewelry demand is traditionally a huge driver of Gold Prices, ranging on either side of 50% in any given year or month. And of that demand, India remains king

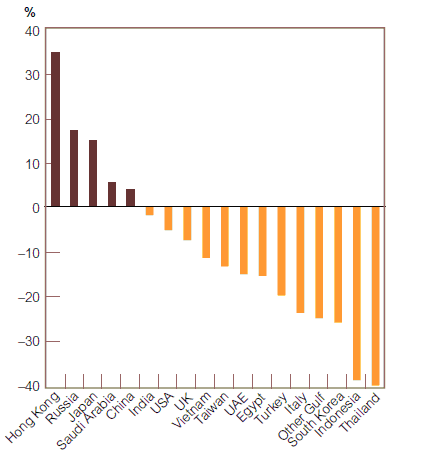

Considered some of the savviest buyers in the market, Indian consumers drive anywhere from 10% (in a bad quarter) to over a third of global jewelry demand. Still, entering the quarter, buying looked a little light in India, with year-over-year demand in the country actually slightly negative. But any slack had been more than made up for by other Asian countries, including Hong Kong, Japan and Russia:

While we don’t have hard numbers on how exactly the classic September-October pre-festival buying season panned out in India, we do have this nugget from the World Gold Council’s report…

“The first half of Q3 2010 witnessed robust sales in both rural and urban markets, supported by a normal monsoon season. However, with prices staying above the Rs 1,775.00/g (approx. Rs 57,000 per ounce) level for most of the third quarter, jeweler sales seem to have contracted in September. The WGC expects demand to pick-up further in the fourth quarter with the commencement of the main festive season from early October until November (Diwali-Dhanteras festival).”

It’s easy to miss the subtlety here. September usually marks the pickup in Indian demand, but a surge doesn’t always happen. In 2007, for example, Q3 Indian demand crashed along with the regional economy, while in 2008, Indian buying made a major resurgence ahead of the wedding and festival season. In 2009, the first half of the quarter started weak, as Gold Prices remained extremely high, but then demand surged in late September and into October.