On Monday morning, Sprint (NYSE: S ) announced the launch of its brand new 4G network. The telecom began offering high-speed mobile phone and handheld connected device service in 61 markets, most of them centered in the Northeastern United States and branching out from New York City. The release of brand new smartphones, like the HTC EVO 4G and Samsung Epic 4G, accompanied the launch and Sprint began selling the Overdrive 4G, a new model of its portable WiFi hotspot device that the company emphasized as an accessory for Apple Inc. ‘s (NASDAQ: AAPL ) iPad. The launch of the network also represented a clear victory over Sprint’s fiercest competitors, Verizon Wireless (NYSE: VZ ) and AT&T (NYSE: T ), whose 4G networks won’t launch until sometime next year. Twenty-four hours later, tough, Sprint shares dropped -2% down to $4.05 where they’re still hovering today. Why are analysts like William Blair & Co. giving Sprint low ratings? Why didn’t the new network give them a bump? As a new Wall Street Journal article points out, the merits of a 4G network are not clear to consumers, limiting the power of Sprint’s marketing push touting that the telecom is “bringing you the first 4G wireless network.” According to a recent survey of 1200 consumers conducted by Yankee Group, a massive 68% either didn’t understand what the term meant or hadn’t heard it before. 57% weren’t even familiar with the 3G branding that has been the crux of mobile service marketing for almost two years. Consumer confusion is understandable. The major telecoms themselves don’t have a uniform definition for what constitutes fourth generation mobile technology. How is it that Sprint can claim to have launched the first 4G network when T-Mobile USA claims to have “America’s largest 4G network?” Easily. “4G” in both cases is little more than a brand. Neither network meets that standard data transfer speeds to qualify as 4G according to the International Telecommunications Union, the United Nations agency in charge of setting global for communications tech including telecoms’ wireless networks. The ITU has said that a network must tout an average data transfer speed of 100 megabits per second to qualify as fourth generation. Sprint’s new 4G network, built with Clearwire (NASDAQ: CLWR ) using wireless broadband standard WiMax, only allows for download speeds of 6 megabits per second. T-Mobile USA’s 4G branded network, using HSPA+ technology, averages 8 megabits per second. In their push to lure in new subscribers with advanced technology using vague buzz words, T-Mobile and Sprint have fostered a confusing landscape for consumers and investors alike. The market should only get more confusing next year, when AT&T and Verizon launch their “4G” networks that use HSPA+ and LTE technology respectively. It’s unknown what download speeds those telecoms’ networks will accommodate—though given its shared technology, AT&T’s can be expected to be in the same range as T-Mobile USA’s—but neither will likely meet the ITU’s standard for 4G speed. As of now, only WiMax 2 and LTE-Advanced technology are recognized as meeting the 100 megabit per second threshold. The take away: investors should not put too much stock in network advancements based on marketing and branding. Smartphone and connected handset technology is growing steadily and any next-gen network shouldn’t be a factor for consumers for at least another twelve months. The 4G network branding won’t help Sprint or T-Mobile USA challenge AT&T and Verizon Wireless right now. Put it this way: Do not buy Sprint. As of this writing, Anthony Agnello did not own a position in any of the stocks named here.

tdp2664

gol2664

InvestorPlace

Gold, Mining, silver, index, prices, today, oil, crude, dow jones, nasdaq, s&p 500, TSX, barrick gold, toromocho, CUP, goog, msft, aapl, finance, yahoo, bing, google,currency converter, currency, rates, currency tool, currency trading, currency transfers, foreign exchange, conversion, , live currency rates, mid-market, obsolete, precious metals, rate calculations, save money, save time, special units, tips, trade currency, up to the minute, world currency, xe trade, currency symbols

Thursday, November 4, 2010

4G Claims Confuse Consumers in Evolving Mobile Market

Market News: Boeing Co. (NYSE:BA), Johnson & Johnson (NYSE:JNJ), BP plc (NYSE:BP)

Several breaking news stories will affect stock prices as trading continues today. The following stocks should see some movement: Boeing Co. (NYSE:BA), Johnson & Johnson (NYSE:JNJ), BP plc (NYSE:BP). Here is a more detailed look at the news that will affect each company when trading continues. Boeing Co. (NYSE:BA) Boeing (NYSE:BA) has decided to demonstrate new situational awareness application for portable devices. Boeing (NYSE:BA) will demonstrate its Data Master Lite (LT) situational-awareness application for military and civilian users of the latest portable devices. Dewey Houck, the director of Mission Systems of Boeing (NYSE:BA)'s Intelligence & Security Systems said that, "With the flexibility inherent in mobile platforms, this new application adds a better level of situational awareness to our customers' most critical missions. With its ability to quickly search for and retrieve critical information, Data Master LT gives intelligence analysts access to timely, relevant geospatial information that, in turn, provides a foundation for situational awareness." Johnson & Johnson (NYSE:JNJ) Johnson & Johnson (NYSE:JNJ) has announced a global restructuring initiatives for a sustainable growth. Johnson & Johnson (NYSE:JNJ) has taken steps to prioritize its innovation efforts around the many growth opportunities in health care and to execute aggressively on bringing new products to market. William C. Weldon, the Chairman and Chief Executive Officer of Johnson & Johnson (NYSE:JNJ) said that, "Johnson & Johnson (NYSE:JNJ) has long adhered to a broad-based operating model and set of sound management principles that have driven our success. Today, we are announcing a series of actions and plans designed to ensure that our company remains well-positioned and appropriately structured for sustainable, long-term growth in the health care industry." BP plc (NYSE:BP) The UK has awarded several licenses to BP plc (NYSE:BP) for exploration. This is the largest license award that BP plc (NYSE:BP) has received in the UK for more than a decade. Among the seven, five blocks were operated by BP plc (NYSE:BP) and the other two were operated by a partner. Trevor Garlick, the Regional President of BP plc (NYSE:BP) in the North Sea said that, "These licence awards are a significant success for BP plc (NYSE:BP) and a further boost to the long-term future of our North Sea business. With six major projects currently underway in the UK and Norwegian sectors, BP plc (NYSE:BP) is investing strongly in the North Sea to develop today's resource base and we are also building a complementary portfolio of future opportunities." We could possibly see more movement when trading continues for Boeing Co. (NYSE:BA), Johnson & Johnson (NYSE:JNJ) and BP plc (NYSE:BP).

tdp2664

E money daily

Stocks In News (ONXX, ARO, ROST)

Onyx Pharmaceuticals, Inc. (NASDAQ:ONXX) soared 7.15% to $28.61. Late Wednesday, Onyx said it earned $42 million, or 66 cents a share, in the quarter, compared with $8 million or 14 cents a share, for the year-ago period. Revenue shot up to $123 million from $69 million, boosted by $59 million in license revenue derived from the company's new collaboration with Japanese drug maker Ono Pharmaceutical Co. The stock went down more than 2% year-to-date. Aeropostale, Inc. (NYSE:ARO) went up 1.47% to $24.20. The company said its October same-store sales fell 2%, compared to the Wall Street target for an increase of 3.1%, according to a survey by Thomson Reuters. Total sales for the month grew by 5% to $146.1 million. The company expects third-quater earnings of 62 cents a share, including a previously disclosed charge of 4 cents a share, compared to the Wall Street target of 66 cents a share in a survey of analysts by FactSet Research. The 52-week range of the stock is $19.10-$32.24. Ross Stores, Inc. (NASDAQ:ROST) rallied 5.16% to $63.61. The company estimated on Thursday that fiscal third-quarter earnings would rise 20% to 21%, to $1.01 to $1.02 a share from 84 cents in the year-earlier period. For the quarter ended Oct. 30, sales rose 7.5% to $1.87 billion, with same-store sales up 3%. A survey of analysts by FactSet Research was estimating profit of 92 cents a share on sales of $1.84 billion. For October, same-store sales rose 4%, while a survey of analysts by Thomson Reuters was looking for a rise of 0.8%. Total sales for the month rose 7.7% to $600 million.

tdp2664

Newsworthy Stocks

Top 10 Gold/Silver Stocks with Highest Return on Equity: CDY, PLG, BVN, CGC, RIO, SVM, GTU, NEM, MGH, DROOY (Nov 04, 2010)

Below are the top 10 Gold/Silver stocks with highest Return on Equity (ROE) ratio for the last 12 months, UPDATED TODAY before 4:30 AM ET. ROE shows a company's efficiency in making profits from shareholders' equity. It is equal to net profits divided by shareholders' equity. One Chinese company (SVM) is on the list.

Cardero Resources Corp. (USA) (AMEX:CDY) has the 1st highest Return on Equity in this segment of the market. Its ROE was 65.03% for the last 12 months. Its net profit margin was N/A for the same period. Platinum Group Metals Limited (USA) (AMEX:PLG) has the 2nd highest Return on Equity in this segment of the market. Its ROE was 44.99% for the last 12 months. Its net profit margin was N/A for the same period. Compania de Minas Buenaventura SA (ADR) (NYSE:BVN) has the 3rd highest Return on Equity in this segment of the market. Its ROE was 30.09% for the last 12 months. Its net profit margin was 73.95% for the same period. Capital Gold Corporation (AMEX:CGC) has the 4th highest Return on Equity in this segment of the market. Its ROE was 27.67% for the last 12 months. Its net profit margin was 19.78% for the same period. Rio Tinto plc (ADR) (NYSE:RIO) has the 5th highest Return on Equity in this segment of the market. Its ROE was 26.47% for the last 12 months. Its net profit margin was 20.28% for the same period.

Silvercorp Metals Inc. (USA) (NYSE:SVM) has the 6th highest Return on Equity in this segment of the market. Its ROE was 23.26% for the last 12 months. Its net profit margin was 49.70% for the same period. Central Gold-Trust (AMEX:GTU) has the 7th highest Return on Equity in this segment of the market. Its ROE was 22.48% for the last 12 months. Its net profit margin was 98.53% for the same period. Newmont Mining Corporation (NYSE:NEM) has the 8th highest Return on Equity in this segment of the market. Its ROE was 18.27% for the last 12 months. Its net profit margin was 31.23% for the same period. Minco Gold Corporation (ADR) (AMEX:MGH) has the 9th highest Return on Equity in this segment of the market. Its ROE was 17.69% for the last 12 months. Its net profit margin was N/A for the same period. DRDGOLD Ltd. (ADR) (NASDAQ:DROOY) has the 10th highest Return on Equity in this segment of the market. Its ROE was 17.41% for the last 12 months. Its net profit margin was 11.91% for the same period.

tdp2664

China Analyst

Top 10 Gold/Silver Stocks with Highest Return on Equity: CDY, PLG, BVN, CGC, RIO, SVM, GTU, NEM, MGH, DROOY (Nov 04, 2010)

Dow back to pre-Lehman level

dow2664

Dow back to pre-Lehman level MarketWatch – 5 hours ago By MarketWatch NEW YORK (MarketWatch) — So the Dow Jones Industrial Average is back where it was just before Lehman Brothers filed for bankruptcy more than two years ago. After a 219-point rally … Dow Jones Index Reaches Pre-Lehman Collapse Levels – DNAinfo

Federal Unemployment Benefit Extension Needed; 3 Tiers 99 weeks Needs Revised; Deadline Near to File Unemployment Papers

dow2664

The Unemployment rate across the United States continues to remain at high levels. Trending for the national unemployment rate peaked late 2010 and has not wavered much from that point. Currently, the national unemployment rate in the United States is hovering around 9.6% which is about 5% higher than it was just over two years ago. Unemployment benefits need to be extended but Democrats and Republicans will have to cooperate to pass an extension of unemployment benefits. An unemployment extension could add additional weeks to the 99 weeks that are already provided and if there is no congressional movement on this topic, then benefits could expire come the end of November. More specifically, two million people will have to find another way to pay their bills and put food on the table next month if Congress does nothing in the next several weeks to extend unemployment benefits coverage. According to the National Employment Law Project, the deadline to file for federal unemployment checks expires on November 30th and if this deadline is not moved back, almost 1 million people in America will stop receiving unemployment checks from the government within four days. The economy is barely moving towards recovery now and if an extension is not provided, then we might have to add over three million more people to the list of individuals living in poverty. Republicans have recently gained more power in the House and talk of fiscal responsibility and not adding to the national budget deficit. Republicans have also blocked attempts at unemployment extensions several times this past year due to the above listed reasons. Now that Republicans have gained control of the House and added seats in the Senate, extending benefits to those in need might be even more difficult. Author: Stephen Johnson

Time Warner Cable Inc. (TWC) Finishes Higher After Q3 Results

Time Warner Cable Inc. (NYSE: TWC) shares rallied today after the company announced its third-quarter financial results. The stock ended the day 4.48% higher at $62.33, on above average volume of 6.49 million. The stock touched a 52-week high of $63.98 today. It has a 52-week range of $39.65-$63.98. The company today reported its third-quarter financial results, with net revenues at $4.7 billion as compared to $$4.4 billion in previous year, an increase of 5.2%. The company's subscription revenues grew 4.5% year-over-year to $4.5 billion, driven by a 3.5% increase in residential subscription revenues and a 21.6% increase in commercial subscription revenues. Advertising revenues increased 22.5% to $223.0 million. The net income reported was $360.0 million, or $1.00 per basic and diluted common share, as compared to $268.0 million, or $0.76 per basic and diluted common share, in the previous year. The third quarter saw high-speed data subscribers grow by 104,000 and digital phone subscribers increase by 34,000, while video subscribers declined by 155,000, resulting in a net loss of 17,000 primary service units. The double play subscriber net additions were 15,000 and triple play subscriber net additions were 14,000 in the third quarter, and bundled subscribers totaled 8.6 million, or 59.4% of total customer relationships, as of September 30, 2010. Time Warner Cable is a cable operator in the United States. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Silver, Silver, Silver

Silver Prices just keep on rising. But how much further could they go to catch gold…?

LAST MONTH gold broke into new record territory – reaching an all-time high of $1387 per ounce on October 14, writes David Galland, managing director of Casey Research…just before gold broke to new highs above $1390 at the start of November.

A new record in nominal terms, that is. To top the previous high in inflation-adjusted Dollars, gold will have to approximately double from there.

Silver, however, has barely made it halfway back to its prior nominal high of $49.45 an ounce, achieved on January 21, 1980. In order to break into new territory in inflation-adjusted Dollars (using the same CPI calculation methodology used in 1980), silver would have to rise to over $250 an ounce – more than ten times where it is today.

Here are some other useful facts about silver:

- Due to the fact that silver’s industrial applications result in destroying the stuff, there is currently a total of only 1,234,590,000 “investable” ounces of silver in above-ground supplies;

- At $21 per ounce, the total value of aboveground silver comes to only about $26 billion;

- By contrast, because pretty much every ounce of gold ever mined still exists, there are a total of 4,585,620,000 “investable” ounces of gold in aboveground stocks. At $1,330 per ounce, that comes to $6 trillion worth;

- Thus, the Gold/Silver Ratio is currently about 63:1, yet the total value of all the investable gold on the planet is about 235 times that of silver;

- For the record, the ratio of silver to gold in the earth’s crust is 17:1. That’s in the ballpark of the 15:1 average silver/Gold Price ratio that has held sway over the centuries.

Kicking off his presentation at our recent Gold & Resource Summit, Bob Quartermain, the powerhouse behind Silver Standard (SSO), stated that if the audience took nothing else away from his talk, it should be that the demand for silver well exceeds new mine supply, and has for some time.

For instance, in 2009 total silver demand topped 889 million ounces, outstripping new mine supplies of 710 million ounces. The difference was made up by scrap recycling.

Of course, the real pressure going forward is from Silver Investment demand, which has been a fraction of that for gold. If history is any guide, however, as gold becomes viewed as being too expensive for the “common man”, silver sales will soar.

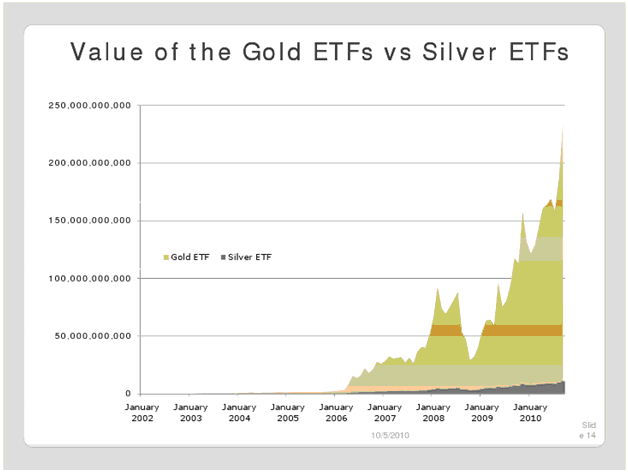

The following chart from Quartermain’s presentation helps put things into perspective.

Furthermore, if you agree with our contention that the economic crisis will continue, and that China’s propped-up manufacturing sector will come under serious pressure, it’s also logical to assume that demand for industrial metals such as lead, zinc, and copper will fall. That’s important in the discussion of silver, because only 30% of silver’s production comes from primary producers (i.e., silver mines), with the balance produced only as a byproduct of other minerals.

Of the total new mine supply, fully 57% is associated with base metals production.

As it, too, has industrial applications, demand for silver from manufacturers will also falter, but given the existing deficit in supplies, the surge in investor demand, and silver’s growing use as a “green” metal (50 to 60 million ounces used up in solar energy applications in 2010 alone) and as an antibacterial agent, the overall supply/demand picture remains favorable.

The truly miniscule amount of silver available above ground and its relatively modest price gains over the course of the precious metals bull market so far are what set the stage for it to play a quick game of catch-up to gold in the months just ahead.

And when Silver Prices do a runner, the handful of pure play silver mining companies – producers and juniors that have identified large deposits – will do the equivalent of a moon shot.

Just a heads up on something to pay attention to, especially on days when the precious metals take a breather from their steady ascent.

Buying Silver today…?

gol2664

Notable NYSE Stock Gainers (TJX, SKS, SSI)

The TJX Companies, Inc. (NYSE:TJX) added 0.23% to $46.93. The company said Thursday it expects third-quarter earnings at the high end of its range of 89 cents a share to 91 cents a share. Wall Street analysts expect earnings of 89 cents a share, according to a survey by FactSet Research. TJX said its October same-store sales were flat, compared to the forecast for a drop of 0.9% in a survey by Thomson Reuters. The stock went up more than 27% year-to-date. Saks Incorporated (NYSE:SKS) went up 3.88% to $11.78 after it created its fresh 52-week high of $11.82. The company said Thursday its October same-store sales increased by 8.1%, ahead of the forecast of 2% in a survey of analysts by Thomson Reuters. Saks said its total sales rose to $233.9 million from $219.9 million. The 52-week range of the stock is $5.44-$11.82 and is up more than 73% year-to-date. Stage Stores, Inc. (NYSE:SSI) rose 1.43% to $14.15. The company reported that for October, comparable-store sales fell 3.5%. A survey of analysts by Thomson Reuters produced a consensus estimate of same-store sales up 1.5%. Total sales fell 1.1% to $100 million. For the third quarter ended Oct. 30, same-store sales slipped 0.3% while total sales rose 2.1% to $332 million. The stock went up more than 9% year-to-date.

tdp2664

Newsworthy Stocks

Potash Corp. (POT) Falls After Canadian Government Rejects BHP Billiton Deal

Potash Corp. (NYSE: POT) shares fell in today's trading after the Canadian government rejected BHP Billiton's (ADR) (NYSE: BHP) takeover bid for the company. The stock ended the day 2.43% lower at $141.97, on above average volume of 35.91. The stock touched an intra-day low of $139.39. It has a 52-week range of $83.85-$153.29. On Wednesday, the Canadian government rejected BHP Billiton's $39 billion takeover offer for Potash, saying that there are no net benefits for the country if the deal went through. BHP offered to acquire Potash at $130 per share back in August, but the deal faced resistance from the province of Saskatchewan, where Potash is based. Potash Corporation of Saskatchewan is an integrated fertilizer and related industrial and feed products company. The company owns and operates five potash mines in Saskatchewan and one in New Brunswick. It also holds mineral rights at the Esterhazy mine and potash is produced under a mining and processing agreement with a third party. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Dow Jones Rockets To Highest Mark In 2 Years

dow2664

Dow Jones Rockets To Highest Mark In 2 Years CBS New York – 5 hours ago WASHINGTON (AP) — Global stock markets staged an explosive rally Thursday, embracing a move by the Federal Reserve to try to rejuvenate the US economy by buying $600 billion in Treasury bonds … Stocks leap worldwide in response to Fed move – Minneapolis Star Tribune

Dow Jones Rockets To Highest Mark In 2 Years

4 Water Mutual Funds to Buy Now

In addition to ETFs, investors can access the water industry sector through mutual funds. Here is a list of some of the more noteworthy funds in this sector: Calvert Global Water Fund ( CFWAX ) Managers: Craig Bonthron and Jens Peers Total assets: $42 million Total annual Fund operating expenses: 5.78% Load: 4.75% Status: open Minimum initial investment: $2,000 Calvert Global Water Fund holds 30% of its assets in water utilities, 40% in infrastructure companies, and 30% in water technologies. About 65% to 70% of the 100 to 105 water stocks in the Fund are identified worldwide are pure plays, which derive over 50% of their revenue from water-related activities. Individual positions tend to be small- and mid-cap stocks, while the larger-cap names usually include other components besides water. Top Holdings (as of September 2010): American Water Works (NYSE: AWK ), Severn Trent, Pentair (NYSE: PNR ), United Utilities Group ( UUGRY ), Kurita Water Industries ( KTWIY ), Danaher Corp. (NYSE: D HR ), Agilent Technologies (NYSE: A ), Aqua America (NYSE: WTR ), Tetra Tech (NYSE: TTI ). Allianz RCM Global Water Fund ( AWTAX ) Managers: Vipin Ahuja and Andreas Fruschki Total assets: $54 million Maximum Sales Charge: 5.50% Net Expense Ratio : 1.80 Minimum initial investment: $1,000 Investment Objective: Focuses primarily on water utilities in view of the relative shortage of other pure-play water stocks. Invests in companies engaged in businesses related to the quality, availability or demand for water — a sector marked by rising demand and dwindling supply. The fund expands its investment universe beyond its benchmark, seeking opportunities across all stages of water-related technologies. Fund uses a bottom-up stock selection of 25 to 50 stocks for the portfolio. Top Holdings (as of September 2010): Gerberit AG, Nalco Holding (NYSE: NAL ), Andritz AG, Danaher Corp. (NYSE: DHR ), ITT Corp. (NYSE: ITT ), United Utilities Group PLC, Kurita Water Industries, Severn Trent PLC, Arcadis NV, Aqua America (NYSE: WTR ). PFW Water Fund ( PFWAX ) Managers: Ben Murillo Jr., Richard Capalbo, Rod Hagenbuch Total assets: $17 million Expenses: 1.50% Load: 5.75 % Status: open Minimum initial investment: $2,500 Investment Objective: Seeks to invest at least 80% of assets in water-related companies that derive at least 50% of their income or profits from, or devotes at least 50% of its resources to the production or delivery of water-related products or services that influence the quality or availability of water. Companies may be involved in the production, collection, treatment and distribution of water to domestic and industrial users; purification, desalination, or disinfection of water; the collection, treatment or disposal of domestic and industrial liquid wastes; or provide equipment, consulting and engineering services in connection with water. Top Holdings: (as of August 2010): J.G. Boswell (OTC: BWEL ), Nalco Holding (NYSE: NLC ) , Watts Water Technologies (NYSE: WTS ) , Calgon Carbon (NYSE: CCC ), Energy Recovery (NASDAQ: ERII ), Aqua America (NYSE: WTR ), Consolidated Water (NASDAQ: CWCO ), Ameron International (NYSE: AMN ), Met Pro Corp. (NYSE: MPR ), Entegris (NASDAQ: ENTG ), Gorman-Rupp (AMEX: GRC ), Muller Water Products. Kinetics Water Infrastructure Advantaged Fund ( KWIAX ) Managers: James Davalos, Peter Boyle, David Kingsley, Murray Stahl Total assets: $ 26 million Expenses: 1.89 Load: 5.75 % Status: open Minimum initial investment: $2,500 Top Holdings (as of June 2010): Ameron International (NYSE: AMN ), URS Corp. (NYSE: URS ), Geberit AG, First American Prime Obligation, ESCO Technologies (NYSE: ESE ).

tdp2664

gol2664

InvestorPlace

Market News: Wells Fargo (NYSE:WFC), AT&T Inc. (NYSE:T), Wal-Mart Stores Inc. (NYSE:WMT)

Here are some more breaking stock news briefs which could see some changes on the markets later. The following companies should see some movement: Wells Fargo (NYSE:WFC), AT&T Inc. (NYSE:T), Wal-Mart Stores Inc. (NYSE:WMT). Here is a more detailed look at the news that will affect each company when trading continues. Wells Fargo (NYSE:WFC) Wells Fargo (NYSE:WFC) has said that it has generated record net income. Wells Fargo & Company (NYSE:WFC) has reported that it gained a record income in third quarter earnings when compared with second quarter earnings. In the second quarter diluted earnings per common share was $0.56 but in the third quarter, it was $0.60. The net incomes were $3.06 billion and $3.24 billion respectively. Chairman and CEO John Stumpf said "Record earnings in the third quarter reflect the success of the Wachovia merger and the benefits of Wells Fargo's steady commitment to our core business of helping customers succeed financially". AT&T Inc. (NYSE:T) A new health unit is being developed by AT&T (NYSE:T). The unit is named as AT&T (NYSE:T) for Health. The company is expecting sales of around $4 billion in a year, with health care IT services spending nationally set around $33.9 billion this year and the company expecting a growth rate of 24 percent over the next four years. Randall Porter, AT&T (NYSE:T)'s assistant vice president of health care solutions said “By really focusing on these new services, new technologies in health care, partnering with health care-specific service providers and app providers, we think we have the opportunity to bring new innovative products to the market.” Wal-Mart Stores Inc. (NYSE:WMT) A guide to Christmas toys has been launched by Wal-Mart Stores Inc. (NYSE:WMT). Wal-Mart Stores Inc. (NYSE:WMT) has unveiled their new Christmas toys guide that will help parents to find the best toys for their kids during Christmas. In addition, it will help parents know the going market rate for the toys. Laura Phillips, the Senior Vice President of toys and seasonal merchandising at Wal-mart said, "We understand toys are at the top of every kid's wishlist, but knowing which toys to trust and choose can be challenging for parents. Our Top Toys list and the helpful tools we've introduced this year make it easier than ever to find this season's best toys at unbeatable prices." We may see more movement when trading continues for Wells Fargo (NYSE:WFC), AT&T Inc. (NYSE:T) and Wal-Mart Stores Inc. (NYSE:WMT).

tdp2664

E money daily

Top 10 Oil/Gas Production Stocks with Highest Return on Equity: GSX, MILL, GST, NEP, XCO, PSE, UPL, TECJQ, WTI, APU (Nov 04, 2010)

Below are the top 10 Oil/Gas Production stocks with highest Return on Equity (ROE) ratio for the last 12 months, UPDATED TODAY before 4:30 AM ET. ROE shows a company's efficiency in making profits from shareholders' equity. It is equal to net profits divided by shareholders' equity. One Chinese company (NEP) is on the list.

Gasco Energy, Inc. (AMEX:GSX) has the 1st highest Return on Equity in this segment of the market. Its ROE was 258.51% for the last 12 months. Its net profit margin was 69.93% for the same period. Miller Petroleum Inc (NASDAQ:MILL) has the 2nd highest Return on Equity in this segment of the market. Its ROE was 175.14% for the last 12 months. Its net profit margin was 2372.48% for the same period. Gastar Exploration Limited (USA) (AMEX:GST) has the 3rd highest Return on Equity in this segment of the market. Its ROE was 118.64% for the last 12 months. Its net profit margin was 377.76% for the same period. China North East Petroleum Hldng Ltd. (AMEX:NEP) has the 4th highest Return on Equity in this segment of the market. Its ROE was 97.09% for the last 12 months. Its net profit margin was 53.38% for the same period. EXCO Resources, Inc. (NYSE:XCO) has the 5th highest Return on Equity in this segment of the market. Its ROE was 89.19% for the last 12 months. Its net profit margin was 202.56% for the same period.

Pioneer Southwest Energy Partners L.P. (NYSE:PSE) has the 6th highest Return on Equity in this segment of the market. Its ROE was 64.05% for the last 12 months. Its net profit margin was 44.23% for the same period. Ultra Petroleum Corp. (NYSE:UPL) has the 7th highest Return on Equity in this segment of the market. Its ROE was 47.36% for the last 12 months. Its net profit margin was 40.34% for the same period. Teton Energy Corporation (NASDAQ:TECJQ) has the 8th highest Return on Equity in this segment of the market. Its ROE was 43.00% for the last 12 months. Its net profit margin was 47.93% for the same period. W&T Offshore, Inc. (NYSE:WTI) has the 9th highest Return on Equity in this segment of the market. Its ROE was 41.29% for the last 12 months. Its net profit margin was 23.21% for the same period. AmeriGas Partners, L.P. (NYSE:APU) has the 10th highest Return on Equity in this segment of the market. Its ROE was 38.69% for the last 12 months. Its net profit margin was 7.68% for the same period.

tdp2664

China Analyst

Top 10 Oil/Gas Production Stocks with Highest Return on Equity: GSX, MILL, GST, NEP, XCO, PSE, UPL, TECJQ, WTI, APU (Nov 04, 2010)

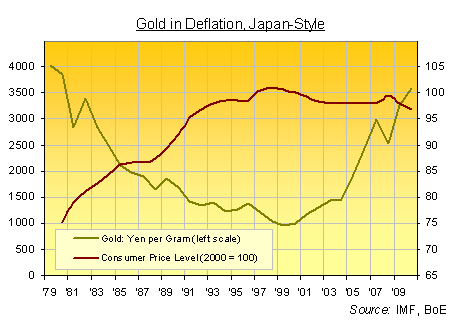

Gold and (Only) 11 Zeroes, Part Two

How gold’s one-trick “inflation hedge” more than trebled amid the modern world’s template deflation…

LET’S IMAGINE the central bankers are right, says Adrian Ash at BullionVault.

Let’s say that – rather than actually ending a two-decade deflation – the price of clothing to Western consumers is only now set to turn lower.

Let’s agree that the doubling of central-bank foreign reserves since 2005…plus the worst sub-zero real rates of interest since the mid-70s…will count for nothing in global energy or food prices.

Let’s also say, despite all experience since the credit crunch bit in 2007, that the “output gap” theory – those “low rates of resource utilization” as the Fed put it on Wednesday – finally comes good, and so excess capacity conspires with slack demand to pull costs lower.

Let’s imagine, in short, that money actually starts to gain value. What then?

Back in 2002, three years after Japanese consumer prices began falling and one year after the Bank of Japan first embarked on quantitative easing to try and reverse that trend, Tokyo’s Economic & Industrial Policy Bureau organized a survey of consumer experiences. (A big thank-you to Atsuko Whitehouse of Bullion-Vault-Japan for this research, by the way…)

All told, 80% of respondents in 2002 said they felt some level of deflation in prices. A little over 25% felt deflation “very strongly”, in fact. And only 1% said there had there been no deflation in their experience.

Yet Gold Prices in both the Tocom futures market and in Tokyo’s Ginza shopping district had risen 37% regardless. That gave early buyers of the ultimate (and apparently one-trick) “inflation hedge” a better than 40% gain in real terms.

Sure, the price of gold globally had also been rising. And Japan’s gold-friendly deflation came as the Yen fell on the forex market, extending the Dollar-price rise by 16% for Japanese buyers. But throughout its long, soft depression – and until 2009 – Japan was the world’s second-largest economy, with the world’s second-largest stock market. Thanks to Tokyo’s swollen government spending since consumer prices peaked in 1998, it’s since gone from the second-largest to No.1 bond market, too.

So we shouldn’t dismiss Japan’s experience as a mere footnote or outlier. It certainly suffered deflation in domestic risk-asset prices and credit supplies too, if not in the actual volume of money supplied to the economy. (As in the US and UK, base money grew fat and squatted on bank balance-sheets thanks to quantitative easing; it failed to pile new debt on top of the then-record total.) While government bonds rose in price, yielding just-about real returns thanks to those gently slipping consumer prices, the Nikkei index of stocks fell by more than a quarter. Real estate, having already lost one fifth over the previous decade nationally – and after more than halving in the 6 biggest cities – lost another fifth again.

The only major economy to hit deflation since before the Second World War, Japan thus offers our only template for what a modern deflation might look and smell like. Hence its obsessive hold on central-bank chiefs and would-be policy-makers (Ben Bernanke at the Fed, Adam Posen at the Bank of England, Paul Krugman everywhere). Hence BullionVault‘s quick survey of Japan’s investment landscape since 1998. Because it looks remarkably like the ground opening up before US and UK investors tonight.

- Cash pays zip – ZIRP, in fact, thanks to the zero interest-rate policy pioneered (to no effect) by the Bank of Japan a decade ago;

- No bargain in stocks – the S&P might be very much cheaper from its price/earnings peak of 45 back in 2000, but it’s still above 20, while Japan’s stock market only now trades at 15 times earnings – an historical discount to be sure, but hardly a single-digit bargain;

- Flight into bonds – where Tokyo led, Washington and even Westminster now follow, issuing record volumes of debt at record-low yields to pension and insurance funds hungry for a “risk-free” zero return;

- Caution thwarted – forced to seek risk by miserable dividends and interest rates, otherwise cautious savers turned to high-yield bonds, emerging markets, currency trading, and precious metals investment.

“Domestic uncertainties spur Japanese investment,” the World Gold Council’s quarterly Gold Demand Trends reported at the close of 2001. Physical gold demand from private Japanese citizens then rose another 24% in 2002, swelling again in 2003 only to rise by 26% by physical volume in 2004.

That year, and for the second time since 2002, the Bank of Japan announced a cut in its ceiling for bank-deposit cover (equivalent to the FDIC), capping insurance at ¥10 million ($90,000). That really meant something, as the WGC noted, in a nation of “occasional bank failures” where “56% of household investments are held in bank accounts.” And spooked by the fear of a truly deflationary uninsured bank failure, retail Gold Investment demand surged by 42% in tonnage terms in 2004, rising by nearly 50% by Yen value from 2003 to ¥103 billion ($1bn at the time). And right alongside, four years of ZIRP had forced a far greater quantity of Japan’s famous cash-savings to seek better-than-zip elsewhere as well.

The initial period of Japanese deflation – marked by sinking interest rates and gently falling consumer prices – brought a series of mis-selling scandals in high-yield foreign bonds. Well, they were only scandals after Russia and then Argentina defaulted, of course. No-one much minded when they were paying (and the lesson went unlearned too, of course). Average daily volumes in the Tokyo foreign exchange market meantime rose 18% between 2003 and 2006 according to Bank of Japan data, but the Watanabes didn’t really get hooked until the finance industry spotted the trend, and created retail-friendly products for leveraged currency speculation.

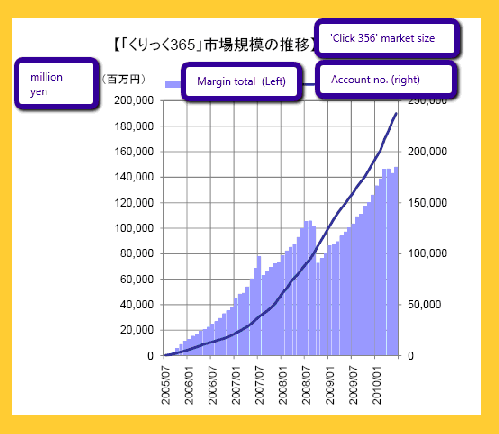

The Tokyo Financial Exchange, for instance, launched its Click365 forex platform in 2005…

Sound at all familiar? It isn’t just Gold Bullion that catches a bid when the returns paid to cash fall to zero. And absent a sharp decline in consumer prices – rather than the low single-digit declines seen year-on-year in Japan over the last decade – it isn’t just US consumers who might doubt the official cost-of-living data either.

A consumer survey run by the Bank of Japan found people felt inflation was running above 3.0% per year in Sept. 2009. After reporting a slight dip this spring, the 4,000 adults responding to Oct. 2010′s survey pegged the true rate of consumer-price inflation at 1.3% per year…eating almost all of the 15-year Japanese government bond’s current yield (5-year debt yields 0.3%) and delivering negative real-returns-to-cash almost as bad as those now suffered by US and UK savers.

To repeat – two things happen to Gold Investment when the returns paid to cash fall to zero:

- First, the missed interest that you’d otherwise earn holding cash-on-deposit vanishes. Gold still pays you nothing, of course, but neither does cash. So the opportunity cost of owning gold is removed;

- Second, and only slowly…over time…more and more people come to feel (if not realize) that putting cash in the bank guarantees a loss of real value. Because if inflation is 8.3% but interest rates are only 6.7% (United States, official CPI, winter 1973) – or if inflation is 1.5% but interest rates are zero (official US inflation, summer 2010; Bank of Japan consumer survey, last twelve months’ average) – you can be sure your money will buy you less stuff one year from now. So you start seeking an alternative store. And gold’s rarity, indestructibility and deep, liquid market make it the obvious choice, even though it still pays you nothing. Because at least it’s not cash, which in a world of zero or sub-zero real rates must also be multiplying faster than gold miners can dig new ore out of the ground.

Anyway, thought experiment over. Because that brings us full circle…back to positive inflation and negative real rates…but with 600 billion extra dollars about to pumped into global asset and commodity prices by today’s deflation-fearing Federal Reserve.

Buying Gold today…?

gol2664

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES November 4th, 2010 Mid Day

dow2664

Stocks close with gains on Wednesday and that trend continues at open and into mid day on Thursday. Investors report the rally in the market comes as a result of the highly anticipated annonuncement made Wednesday by the Fed to roll out another round of bond purchases, as well as in response to the results from the midterm elections. On Wednesday the Fed released it’s plan to buy $600 billion of treasuries to help stimulate the economy. This measure, known as quantitative easing, assists in pressuring long term interest rates and decreasing inflation to support the lagging economy. Overseas markets also report gains as a result of the Feds economic recovery plan. Economists report mixed feelings over the Feds stimulus plan and how the move may help or hinder the economy in the long term. The Republican’s anticipated victory in the midterm elections has also boosted stocks. Investors report that a Republican majority may result in more business friendly legislation. The Labor Dept is scheduled to release its monthly jobs report Friday. The initial jobless claims report indicates an increase from 445,000 to 457,000 claims for the week ending Oct. 30 and an overall high unemployment rate. Economists report that the slow economic growth continues to affect weakness in the job market. At mid day the market indices continue to soar. NASDAQ is up 33.11 points to 2,573.38 . DJIA is up 189.74 points to 11,404.87. S&P 500 is up 17.73 points to 1,215.53. The Treasurys 10-year yield is down 0.15 to 2.47%. The dollar is down 0.0061 to the Euro at $1.43. Author: Pamela Frost

Percentage Movers Of The Day (URRE, GIVN, TRLG)

Uranium Resources, Inc. (NASDAQ:URRE) surged 5.84% to $1.81. The company will form a joint venture with a unit of Cameco to produce uranium on land in south Texas. The stock opened at $1.85 and is trading within the range of $1.76-$1.90. The stock made its fresh 52-week high of $1.90. The stock went up more than 137% year-to-date. Given Imaging Ltd. (NASDAQ:GIVN) plunged 12.92% to $15.41. The company reported third-quarter net income fell to 3 cents a share from 13 cents in the year-earlier period. Adjusted earnings were 11 cents against 20 cents. The company also cut its forecast for the year. At current market price, the market capitalization of the company stands at $458.47 million. True Religion Apparel, Inc. (NASDAQ:TRLG) slumped 7.80% to $18.56. The company posted third-quarter net income of $11.8 million, or 48 cents a share, compared with $14.1 million, or 58 cents a share, a year ago. Net sales increased 12.5 percent to $92.8 million. Analysts, on average, were expecting earnings of 58 cents a share, before special items, on revenue of $94.08 million, Gross margins fell to 62.1 percent from 64.7 percent partly on lower initial markup on women’s jeans due to competitive pricing.

tdp2664

Newsworthy Stocks

Market News: Barnes & Noble Inc. (NYSE:BKS), IBM (NYSE:IBM), General Dynamics (NYSE:GD)

Here are several more breaking news stories which could affect market stocks in trading later today. The following companies should see some movement: Barnes & Noble Inc. (NYSE:BKS), IBM (NYSE:IBM), General Dynamics (NYSE:GD). Here is a more detailed look at the news that will affect each company when trading continues. Barnes & Noble Inc. (NYSE:BKS) The NOOK will receive a number of free eBooks from Barnes & Noble Inc. (NYSE:BKS) this November. Barnes & Noble Inc. (NYSE:BKS) November line-up for the “More in Store(TM)” program only to the NOOK(TM) family of eBook Readers. It exclusively involves special offers and savings, and it is expected that it will influence the sales of the NOOK(TM) family of eBook Readers. The November line up includes all the recent best sellers, and customers can download data to NOOK which can be accessed at any time. IBM (NYSE:IBM) Researchers at IBM (NYSE:IBM) have launched a new, smart, smaller version of the internet. This smarter Internet will make your life easier, such as ordering taxis, managing social engagements or even paying bills. Academic and government research organizations also collaborated with IBM (NYSE:IBM) for this piece of research. Joanna Ng, master inventor and head of research at IBM (NYSE:IBM)'s Center for Advanced Studies, said “The project illustrated how the Internet will move beyond the present paradigm where people are responsible for the initiating and managing their own manual navigation of the Web, to a ‘personalized Web,’ functioning as a platform of services and resources that are dynamically and automatically configured to suit each person’s individual goals, tasks and concerns, in a way that person wants”. General Dynamics (NYSE:GD) General Dynamics (NYSE:GD) has been awarded a new contract in Spain. It is a four-year contract for the Spanish Army, Air Force and Navy through its Spanish subsidiary Santa Barbara Sistemas. The maximum potential value of the contract is approximately 20 million Euros. The standard ammunition for the armed forces of all NATO members is”5.56 NATO,” and this ammunition will be manufactured in Palencia, in the center of Spain. General Dynamics (NYSE:GD) conducts its business through four European operating sites located in Spain, Germany, Austria, and Switzerland. Including wheeled (PIRANHA, PANDUR, DURO, EAGLE), tracked (ASCOD), and amphibious vehicles and bridging systems (M3, IRB, REBS), and other military goods. Expect more movement when trading continues for Barnes & Noble Inc. (NYSE:BKS), IBM (NYSE:IBM) and General Dynamics (NYSE:GD).

tdp2664

E money daily

Nasdaq 3 Most Active Stocks (BRCM, ORCL, CMCSA)

Broadcom Corporation (NASDAQ: BRCM) shares traded higher on above average volume today. The stock ended the day 2.34% higher at $42.46, on above average volume of 12.78 million. The stock touched a 52-week high of $42.55 today. It has a 52-week range of $26.12-$42.55. Recently, the company announced the introduction of Broadcom BCM88600 series. It is the industry’s first ethernet switching silicon to enable scalable modular switching platforms with capacity ranging from 100 gigabits per second to 100 terabits per second. Oracle Corporation (NASDAQ: ORCL) shares touched a 52-week high in today's trading. The stock ended the day 0.92% higher at $29.47, on volume of 35.70 million. The stock touched a 52-week high of $29.82. It has a 52-week range of $20.65-$29.82. Recently, the company announced that it will acquire Art Technology Group Inc. in an all cash deal for $1 billion. Comcast Corporation (NASDAQ: CMCSA) shares climbed in today's trading, touching a 52-week high. The stock ended the day 1.89% higher at $21.06, on volume of 21.36 million. The stock touched a 52-week high of $21.19. It has a 52-week range of $13.95-$21.19. Recently, the company announced the third quarter 2010 results, with revenues at $9.5 billion, a 7.3% increase as compared to $8.8 billion in previous year. This growth was due to solid operating results in the cable and programming segments. The earnings per share stood at $0.31, a 6.1% decrease from the $0.33 reported in the previous year. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES November 4th, 2010 End of Day Notes

dow2664

Stock futures were higher ahead of the opening bell this morning. Big news posted yesterday afternoon as the Federal Reserve’s policy report was a bit better than expected. Stock trending has been high ever since. Another positive for the market was the mid-term election results in that Republicans now control the house and added seats in the Senate. An influx of Republican control and legislative power is viewed as a positive for the market as Republicans are viewed as having an acute business focus. Economic earnings report posted strong through mid-day today and the stock action surge continued. The Labor department did post today that people seeking jobless benefits increased significantly last week. According to the Labor department, claims for unemployment aid rose by 20,000 to a seasonally adjusted 457,000 level for the week ending October 30th. The related statistic of the four week average of unemployment claims rose by 2,000 to 456,000. This information is receiving some spotlight attention right now as the unemployment insurance benefit program is set to expire come the end of this month. Earlier today, reports circulated that the Obama administration is open to considering the possibility of extending tax cuts to all income tax brackets. The end of day Dow Jones Industrials settled in the green at 11,430.76. The Nasdaq settled up as well at 2,577.34. The S&P 500 settled up at 1,221.06. The dollar devalued and lost to the euro by .0031 today. Overall, it was a big day for stock action. All three major index values end the day at 2-year highs. Author: Frank Matto

Top 10 Rebounding U.S.-Listed Chinese Stocks: CNR, JKS, RHGP, SCLX, SHZ, SPRD, SOL, JOBS, HSFT, BIDU (Nov 04, 2010)

Below are the top 10 rebounding U.S.-listed Chinese stocks, UPDATED TODAY before 4:30 AM ET. These companies are interesting turnaround stories.

China Metro Rural Holdings Ltd (AMEX:CNR) is the 1st best rebounding stock in this segment of the market. It has risen 379% from its 52-week low. It is now trading at 94% of its 52-week high. JinkoSolar Holding Co., Ltd. (NYSE:JKS) is the 2nd best rebounding stock in this segment of the market. It has risen 373% from its 52-week low. It is now trading at 99% of its 52-week high. Renhuang Pharmaceuticals, Inc. (AMEX:RHGP) is the 3rd best rebounding stock in this segment of the market. It has risen 350% from its 52-week low. It is now trading at 78% of its 52-week high. Sino Clean Energy Inc. (NASDAQ:SCLX) is the 4th best rebounding stock in this segment of the market. It has risen 263% from its 52-week low. It is now trading at 72% of its 52-week high. China Shen Zhou Mining & Resources Inc. (AMEX:SHZ) is the 5th best rebounding stock in this segment of the market. It has risen 262% from its 52-week low. It is now trading at 47% of its 52-week high.

Spreadtrum Communications, Inc. (NASDAQ:SPRD) is the 6th best rebounding stock in this segment of the market. It has risen 250% from its 52-week low. It is now trading at 100% of its 52-week high. ReneSola Ltd. (ADR) (NYSE:SOL) is the 7th best rebounding stock in this segment of the market. It has risen 245% from its 52-week low. It is now trading at 82% of its 52-week high. 51job, Inc. (ADR) (NASDAQ:JOBS) is the 8th best rebounding stock in this segment of the market. It has risen 204% from its 52-week low. It is now trading at 98% of its 52-week high. HiSoft Technology International Limited (NASDAQ:HSFT) is the 9th best rebounding stock in this segment of the market. It has risen 189% from its 52-week low. It is now trading at 98% of its 52-week high. Baidu.com, Inc. (ADR) (NASDAQ:BIDU) is the 10th best rebounding stock in this segment of the market. It has risen 188% from its 52-week low. It is now trading at 97% of its 52-week high.

tdp2664

China Analyst

Top 10 Rebounding U.S.-Listed Chinese Stocks: CNR, JKS, RHGP, SCLX, SHZ, SPRD, SOL, JOBS, HSFT, BIDU (Nov 04, 2010)

Magic Software Enterprises Ltd. Financial Press Release Influenced its Trading to Achieve More- MGIC, ALXA, DPTR, BIOS, PCBC

Dear PSL members Magic Software Enterprises Ltd. (NASDAQ:MGIC) according to its financial results announced on 3 November, 2010 earned 66% growth in Revenues with respect to its previous 3rd Quarter $13.5 million. The Operating Income remained $2.5 million which was three times higher than Q3 Operating Income of 2009. Therefore, MGIC in last session gained high percentage change of 14.14% and its trading closed at $3.31 which was not achieved for a long time. The total volume of the shares traded during the last session was also influenced as was unusual with 1.84 million shares. Company's EPS growth this remained 36.69% while annual EPS growth in past 5 years was 8.81%. Its quarterly sales growth noted year over year provided 57.91% while quarterly EPS growth of 72.47% for the same period. Company holds un-levered capital structure with debt to equity and long term to equity ratio of 0.00%. Alexza Pharmaceuticals, Inc. (NASDAQ:ALXA) will announce its Financial Results in next week. ALXA advanced 7.37% with the closing price of $1.02. The overall volume in last trading session was 1.58 million shares as compared to its average volume of 2.10 million shares. The price range of stock in 52 weeks remained $0.87 – $3.92. Delta Petroleum Corp. (NASDAQ:DPTR) is going to announce its Earnings press release on Nov 9th, 2010. DPTR surged 6.20% with the closing price of $0.79. The overall volume in last trading session was 1.44 million shares as compared to its average volume of 1.81 million shares. The price range of stock in 52 weeks remained $0.67 – $1.95. BioScrip Inc. (NASDAQ:BIOS) after losing some points upon its Earning Results made recovery. BIOS jumped 6.20% with the closing price of $5.24. The overall volume in last trading session was 1.29 million shares as compared to its average volume of 491, 377 shares. The price range of stock in 52 weeks remained $4.01 – $9.84. Pacific Capital Bancorp (NASDAQ:PCBC) plan to publicize its Earnings today on Nov 4th, 2010. After hitting new low of $0.38 it gained 4.65% with the closing price of $0.45. The overall volume in last trading session was 5.27 million shares as compared to its average volume of 1.67 million shares. The price range of stock in 52 weeks remained $0.38– $5.49.

tdp2664Penny Stock Live

Market News: Morgan Stanley (NYSE:MS), Coca-Cola Co. (NYSE:KO), Humana (NYSE:HUM)

Here are some more breaking stock news briefs which could see some changes on the markets later. The following companies should see some movement: Morgan Stanley (NYSE:MS), Coca-Cola Co. (NYSE:KO), Humana (NYSE:HUM). Here is a more detailed look at the news that will affect each company when trading continues. Morgan Stanley (NYSE:MS) Emission credits are on Morgan Stanley (NYSE:MS)'s shopping list. Morgan Stanley (NYSE:MS) and MGM's founders said today in an e-mailed statement that Geneva-based Mercuria bought the stake in MGM International Group LLC, a Miami, Florida-based developer of carbon credits. As per the company's declaration on 2007, company had bought 38 percent of MGM in the previous year. Andrei Marcu, head of policy and regulatory affairs at Mercuria said that "MGM represents a strategic move for Mercuria and signals our belief in the long-term opportunities in this market, including post 2012, This acquisition will provide additional supply." Coca-Cola Co. (NYSE:KO) China was the location for Coca-Cola (NYSE:KO) executives this week, as they opened several new bottling plants in the country. As per the announcement made by the company last year, the new bottling plants in China are being opened as part of a 3-year $2bn investment in the country. A total of 1.6 Billion RMB ($240m) has gone into the building of three plants. All three will locally produce international beverages such as Coca-Cola, Sprite, Fanta, and Minute Maid. Luohe is the biggest one in three plants and the bottling plant will be the largest Coca-Cola production facility in China. Humana (NYSE:HUM) Illness and injury are a cause of restrictions for older adults, Humana (NYSE:HUM) has reported. Thomas M. Gill, a Humana Foundation Professor of internal medicine (geriatrics), investigative medicine and epidemiology and public health at Yale conducted the research at Yale School of Medicine. Gill said that "We now have a much better understanding of the complex and highly dynamic disabling process.” Over 10 years starting in 1998 Gill and his co-authors followed 754 adults age 70 and older with monthly phone interviews. Fall-related injury led to the highest likelihood of developing new or worsening disability. We may see more movement when trading continues for Morgan Stanley (NYSE:MS), Coca-Cola Co. (NYSE:KO) and Humana (NYSE:HUM).

tdp2664

E money daily

Closing Update: Stocks Up 1.5% -2%, Trading In 2008 Territory

dow2664

Closing Update: Stocks Up 1.5% -2%, Trading In 2008 Territory istockAnalyst.com – 2 hours ago -NYSE up 174 (+2%) to 7,782.40 -DJIA up 220 (+1.96%) to 11,435 -S&P 500 up 23.10 (+1.9%) to 1,221 -Nasdaq up 37.07 (+1.5%) to 2,577 GLOBAL SENTIMENT Hang Seng up 1.62% Nikkei up 2.17% FTSE up 1.8 …

Closing Update: Stocks Up 1.5% -2%, Trading In 2008 Territory

Newmont (NYSE:NEM), Gammon (NYSE:GRS), Randgold (Nasdaq:GOLD) Move Up on Rising Gold Prices

gol2664

Newmont (NYSE:NEM), Gammon (NYSE:GRS), Randgold (Nasdaq:GOLD) Move Up on Rising Gold Prices Everything Gold – 5 hours ago Newmont Mining Corporation (NYSE:NEM), Gammon Gold Inc. (NYSE:GRS), and Randgold Resources (Nasdaq:GOLD) are all trading up today as they move higher in unison with the broader gold market. Almost …

When Is It Time to Sell a Dividend Stock?

Dividend stocks have lots of appealing factors, and it's easy to find reasons to buy. Some stocks have a great dividend yield. Others have a decades-long history of raising dividends once a year. Then there are picks with a modest dividend but great upside potential for shares. If you're looking for a reason to buy dividend stocks, there are plenty. But a trickier scenario is knowing when to get out. So when do you sell a dividend stock? Some dividend investors have a holding period of forever, thinking that all stocks suffer slides or even dividend cuts so it all works out in the wash when your priority is on the quarterly payout. If that describes you, then the answer to the question of when to sell is simply "never." Other dividend investors find quarterly payouts nice but really secondary to share values. Investors with this mindset typically set stop losses or set sell targets because it's the stock price that matters most. If that describes you, then obviously you're not asking when to sell a dividend stock — you're wondering when is the best time to buy and sell based on the best share price. For those who fall in between, pulling the trigger on a dividend stock is a balancing act. They grant some leeway to stocks with a hefty and reliable payout when shares slip, or they'll stick with a stock that has slashed its dividend because it has upside potential for shares in the long term. But where do you draw the line? There are five conditions that are helpful in sounding the sell signal for any dividend stock investor. The company cuts or altogether eliminates its dividend. This one is fairly obvious. You can sometimes stomach a company that keeps dividends flat for a few years. But if a company is slashing dividends, it means that the balance sheet has gotten so bad that it needs to literally take money out of shareholders' pockets. The most likely scenario in this situation is that investors will be stung twice — once with the cancellation of dividends and again as share prices suffer. Take General Electric (NYSE: GE ), which cut its dividend in February of 2009 and saw shares drop -10% the next day. The dividend stock sees its annual dividend yield drop below 1%. There are plenty of stocks out there that offer a nominal dividend — even small cap companies with lower volume and a comparatively small pool of profits to share. But if a company's dividend is below 1%, chances are that it's not a dividend stock. It's just a stock that happens to offer a dividend. If a stock is truly in your portfolio because of its quarterly payout, you must demand more than a payout of just a few pennies per share. Besides, if dividends are an afterthought for companies then there's no guarantee that they will make an effort to maintain or boost their payouts. Your "yield on cost" for the specific stock is below 2%. Let's say you bought shares of Home Depot (NYSE: HD ) in 2000 at their peak of around $60 a share. The current annualized dividend for HD is about 95 cents a share — meaning your yield based on the cost you paid is just 1.6%. Yes, Home Depot might be offering investors a dividend yield of 3% or so based on current valuations… but if you bought in at twice that, then your personal "yield on cost" is dramatically different. Just as profits are relative depending when you bought in to a stock, so are dividend yields. The dividend stock is bought out. Frequently such deals are made with a lot of cash — meaning there's less to pay out in dividends. So don’t wait around three months anticipating a payday that won’t be all that impressive in most cases. Other times you may find that a company with a great yield and good potential for shares has been bought by a less favorable competitor, so it's better to move out of the position instead of accepting the resulting shares from the buyout. And lastly, obviously if the company goes private, there will no longer be shareholders to share in the profits. Your position in the dividend stock is down 50%. Though small fluctuations in share price are not necessarily a problem for dividend investors, watching a position get hacked in half should set off warning bells. A dividend stock with a yield of about 2% will take 50 years to "double your money" via dividends — or pay for itself, depending on how you view your investment. Waiting five decades (if not reinvested) just to get back to square one doesn't make any sense no matter how healthy the dividend payout is. You'll be better served by simply taking the haircut and finding a stronger dividend stock that will deliver reliable returns. Though it’s tempting to believe a dividend stock will fight back, it's often quicker to make up for a loss in a good stock that's on the rise than a bad stock that's getting a dead-cat bounce. Think of it this way: If you find a stock with a similar yield that provides the exact same performance, all you’re out is your broker fee. When you're down over 50%, even the most conservative buy-and-hold investor should consider rolling the dice. Jeff Reeves is editor of InvestorPlace.com. As of this writing, he did not own a position in any of the stocks named here. Follow him on Twitter at http://twitter.com/JeffReevesIP .

tdp2664

gol2664

InvestorPlace

Cablevision Systems Corporation (CVC) Touches 52-week High after Q3 Results

Cablevision Systems Corporation (NYSE: CVC) shares climbed after the company announced its third-quarter financial results. The stock ended the day 2.60% higher at $28.36, on above average volume of 5.35 million. The stock touched a 52-week high of $28.78. It has a 52-week range of $21.53-$28.78. Today, the company announced its third quarter results, with revenues at $1.808 billion, a 5.6% increase as compared to previous year. This improvement is reflected from its solid revenue growth in Telecommunications services and Rainbow, offset slightly by a decline at Newsday. This quarter reported average monthly revenue per basic video customer of $149.04. The cable advertising revenue grew 30.2% in the third quarter of 2010, compared to the prior year period. Cablevision operates through its subsidiary including CSC Holdings, a cable operators in the United States based on the number of basic video subscribers. It also operates cable programming networks, entertainment businesses, telecommunications companies and a newspaper publishing business. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

What Two Dow Stocks Increased Dividends for Over 50 Years?

dow2664

Even if you haven’t owned a stock for fifty years and even if you haven’t lived for fifty years, it is nice to know that there are companies that have rewarded their shareholders with annual dividend increases for over fifty. According to WallStreetNewsNetwork.com, which has posted a list of over 20 stocks that have increased dividends for over 30 years in a row, roughly a half dozen of them are in the Dow Jones Industrial Average, such as Coca Cola (KO) which has increased dividends 48 years in a row, and yields 2.9%. However, there are two companies that have raised dividends more than 50 years in a row, and both are components of the Dow Jones Industrial Average. Procter & Gamble (PG), which pays a yield of 3%, has boosted its dividend every year for 54 years. The stock trades at about 15 times forward earnings, and although the company did report a 6.8% drop in quarterly earnings, revenues were up 1.6%. Back in August, Argus upgraded the stock from a Hold to a Buy. The other member of the 50 year club is 3M Co. (MMM) which bumped up its dividend 52 years in a row. It pays a yield of 2.5% and has a forward PE of 14. The company just reported that quarterly earnings rose 13% on a revenue increase of 11%. EArlier this year, Barclays Capital upgraded the stock from Equal Weight to Overweight. To see the entire list of dividend increasers , which can be downloaded, sorted, and updated, go to WallStreetNewsNetwork.com. The list includes a couple stocks yielding in excess of 4%. Disclosure: Author did not own any of the above stocks at the time the article was written. By Stockerblog.com

What Two Dow Stocks Increased Dividends for Over 50 Years?

Today’s Gold Price Per Ounce Spot Gold, December Delivery Rates day’s End Notes November 4th, 2010; Dollar Lowers Gold On Rise

dow2664

The market has gained some footing and momentum off of the policy report from yesterday. Gold has regained some positive momentum as well. Gold price per ounce is on the rise again. Yesterday’s move by the Federal Reserve to initiate increased economic support to push the recovery forward is still being processed and analyzed by many, but investors are thinking positively right now. Stocks surged through mid-day and the surge continued through end of day close. Today was a huge day for stock action and the index values closed the day out at 2-year highs. The expectation is that, due to the Federal Reserve’s move to initiate further quantitative easing, interest rates will remain low for the long term and spending will increase. Also, the republican take over is viewed as more business friendly. Through mid-day trading today, the dollar had fallen against the euro, the British pound and the Japanese yen. As expected, gold swung in a positive direction as gold for December delivery surged to $1,378.70 an ounce. This trending continued through end of day close. The dollar showed this same pattern at end of day close for November 4th, 2010 and Gold moved ahead further. Gold for december delivery price per ounce settled up $45.50 or 3.4% to a record of $1,383.10. Author: Camillo Zucari

Will AutoZone Run Out of Gas?

In a previous article about small-cap stocks turned large cap , I discussed ARM Holdings (NASDAQ: ARMH ) and the pitfalls this tech stock faces now that it has grown substantially in recent years. The pitfalls of ARMH are not unique — small caps as measured by the Russell 2000 index have significantly outperformed the broader market. Specifically, small-cap equities that make up the Russell 2000 index have gained about 20% in the last year — about twice the S&P 500, which focuses on large-cap stocks. The appeal of smaller companies is obvious. My favorite example of blue-chip bloat is McDonald's (NYSE: MCD ) — a good stock that has outperformed the market recently but a company so ubiquitous that one MCD report says the farthest distance you can be from a McDonald's in the U.S. is 115 miles, or a less than 2-hour drive! MCD has grown thanks to innovative product developments and marketing. But small-cap companies do need to worry about new products — they can simply grow by doing what they do well already on a larger scale. What's more, these picks are more nimble and able to tackle the market trends of the day. But every small cap runs into a wall eventually, when it becomes too big to be considered a minor player any more. That means the explosive growth potential is probably over, and that the company will start behaving more like a lazy blue chip. To help you figure out the tipping point for the surging small-caps in your portfolio, here is a look at auto-parts store AutoZone (NYSE: AZO ) and why its recent growth may be slowing down. AutoZone (AZO) Market cap at the end of fiscal 2007: $8.2 billion Current market cap: $10.8 billion AutoZone (NYSE: AZO ) has been on a tear in the last two years. Unlike the rest of the market, AZO shares weathered the March 2009 low remarkably well — actually gaining 15% from the first of the year through March 10, 2009 while the broader market shed 21%. And the run hasn't really slowed down lately, with AutoZone tacking on 50% since Jan. 1, 2010, compared with about a 7% gain for the S&P 500 index. So what's behind AutoZone's success? Store expansion is a big part of the equation — from 3,300 stores in 2003 to 4,000 stores in 2007 to almost 5,000 stores worldwide at present day. Also, the relatively recent addition of a commercial sales program that provides delivery of parts and other products to repair shops ensures AZO serves businesses as well as consumers. On top of that, consumer are putting off new-car purchases and driving and maintaining older cars. All those contribute to the success for this auto parts retailer. However, AutoZone hasn't been the only parts store surging. Competitor O’Reilly Automotive, Inc. (NASDAQ: ORLY ) has a market cap of over $8 billion, 3,500 stores in its network and annual sales projected to top $5.3 billion this fiscal year – up almost 10% from the previous year. The 2008 acquisition of CSK Auto has made this stock a firm competitor in the auto-parts retail space. And then there's Advanced Auto Parts (NYSE: AAP ) with a similar tale — $5.8 billion in projected revenue this fiscal year, 3,400 stores and 8% sales growth projected for the year. AutoZone's projected sales growth for the year, however, is just north of 5%. So it appears that while macroeconomic trends are favorable to the auto-parts business, the competition is heating up and smaller competitors holding their own or even narrowing the gap between themselves and AZO. Once that trend dissipates, will AutoZone be able to continue its growth or is the auto parts marketplace nearing a saturation point? AZO could opt to turn to an acquisition to continue its momentum. The most realistic option may be online retailer U.S. Auto Parts Network (NASDAQ: PARTS ) to capitalize on Internet sales, but such a move would be costly and could backfire if new car sales rebound and parts sales roll back. The bottom line is that though AutoZone has been seeing great growth in recent years thanks to consumer trends, it could be approaching a tipping point in the market. Unless one of its major competitors cedes ground or unless it can come up with a new revenue stream, AZO is going to run out of gas. You can't rely on favorable economic trends to last forever, and with a market cap of nearly $11 billion, AZO is getting a bit too big for small-scale acquisitions to have much of an impact on the bottom line. Jeff Reeves is editor of InvestorPlace.com. As of this writing, he did not own a position in any of the stocks named here. Follow him on Twitter at http://twitter.com/JeffReevesIP .

tdp2664

gol2664

InvestorPlace

Analyst Actions on Chinese Stocks: AMCN, BIDU, CAST, CBEH, CFSG, CHA, CHL, CHU ... (Nov 4, 2010)

Below are today's Analyst Actions on U.S.-Listed Chinese Stocks.

Bank of America maintained Neutral rating and $8 price objective on AirMedia Group Inc. (NASDAQ:AMCN). Bank of America maintained Buy rating and $113 price objective on Baidu.com, Inc. (NASDAQ:BIDU). Roth Capital Partners reiterated Buy rating on Chinacast Education Corporation (NASDAQ:CAST), and maintained $12 price target. Cowen and Company reiterated Outperform rating on China Integrated Energy, Inc. (NASDAQ:CBEH). Roth Capital Partners maintained Neutral rating and $9.50 price target on China Fire & Security Group, Inc. (NASDAQ:CFSG). New Street Research maintained Buy rating and HK$4.9 price target on the Hong Kong-listed shares of China Telecom Corporation Limited (NYSE:CHA). New Street Research maintained Buy rating and HK$105 price target on the Hong Kong-listed shares of China Mobile Ltd. (NYSE:CHL). New Street Research maintained Buy rating and HK$13.2 price target on the Hong Kong-listed shares of China Unicom (Hong Kong) Limited (NYSE:CHU). Piper Jaffray downgraded CNinsure Inc. (NASDAQ:CISG) from Overweight to Underweight, and cut price target from $33 to $22. Ticonderoga Securities maintained Buy rating and $10.50 price target on Cogo Group, Inc. (NASDAQ:COGO). Roth Capital Partners maintained Buy rating and $6 price target on China Ritar Power Corp. (NASDAQ:CRTP). JPMorgan maintained Overweight rating and $9 price target on Shanda Games Limited (NASDAQ:GAME). Roth Capital Partners maintained Buy rating and $14 price target on Hollysys Automation Technologies Ltd (NASDAQ:HOLI). Roth Capital Partners maintained Buy rating and $26 price target on Harbin Electric, Inc. (NASDAQ:HRBN). Bank of America maintained Neutral rating and $5.20 price objective on VisionChina Media Inc (NASDAQ:VISN). Collins Stewart maintained Buy rating and $16 price target on Yingli Green Energy Hold. Co. Ltd. (NYSE:YGE).

tdp2664

China Analyst

Analyst Actions on Chinese Stocks: AMCN, BIDU, CAST, CBEH, CFSG, CHA, CHL, CHU … (Nov 4, 2010)

Earnings From Small Cap Stocks (HDSN, IMMU, ZIOP)

Hudson Technologies, Inc. (NASDAQ:HDSN) plunged 6.21% to $1.66. The company announced results for the third quarter and nine months ended September 30, 2010. Revenues for the three months ended September 30, 2010 increased 23% to $7,996,000 from $6,499,000 in the comparable 2009 period. Gross profit margins improved to 23% of sales for the third quarter compared to 10% of sales in the third quarter last year. The company reported net income of $200,000, or $0.01 per basic and diluted share, for the third quarter of 2010, compared to a net loss of $658,000, or a loss of $0.03 per basic and diluted share, for the third quarter of 2009. The stock opened at $1.72 and is trading within the range of $1.66-$1.72. The stock went up more than 16% year-to-date. Immunomedics, Inc. (NASDAQ:IMMU) added 0.26% to $3.89. The company reported financial results for the first quarter ended September 30, 2010. The Company reported total revenues of $1.5 million and a net loss of $6.5 million, or $0.09 per share, for the first quarter of fiscal year 2011, which ended September 30, 2010. This compares to total revenues of $39.0 million and net income of $32.0 million, or $0.42 per share, for the same period last year. At current market price, the market capitalization of the company stands at $292.96 million. ZIOPHARM Oncology Inc. (NASDAQ:ZIOP) soared 7.46% to $4.61. The company reported its financial results for the three months ended September 30, 2010. For the third quarter of 2010, the Company’s cash used in operations was $5.8 million, an increase of $3.7 million from $2.1 million for the same period for 2009. The Company reported net loss from operations for the third quarter of 2010 of $8.5 million, or $(0.18) per basic share, compared to a net loss from operations of $2.6 million, or $(0.12) per share in the third quarter of 2009.

tdp2664

Newsworthy Stocks

Randgold Resources (GOLD) Down 2.5% Along With Falling Gold Prices

gol2664

Randgold Resources (GOLD) Down 2.5% Along With Falling Gold Prices Market Intelligence Center – Nov 3, 2010 Randgold Resources (NASDAQ: GOLD) opened at $95.08. So far today, the stock has hit a low of $92.54 and a high of $95.14. GOLD is now trading at $92.72, down $2.32 (-2.44%). The stock hit its 52 …

Stocks rally around the world after Fed action

dow2664

Stocks rally around the world after Fed action istockAnalyst.com – 1 hour ago (Source: Associated Press/AP Online) By PAUL WISEMAN WASHINGTON – Global stock markets staged an explosive rally Thursday, embracing a move by the Federal Reserve to try to rejuvenate the US …

Stocks rally around the world after Fed action

Bullion Monarch Mining (OTC-BB: BULM) Offers a “Perfect Hedge” for Investors

gol2664

Bullion Monarch Mining (OTC-BB: BULM) Offers a "Perfect Hedge" for Investors TheOTCInvestor.com – 1 hour ago By Justin Kuepper · Thursday, November 4th, 2010 Bullion Monarch Mining, Inc. (OTC-BB: BULM), a natural resource company focused on mining properties and other assets, offers significant …

Vonage Holdings Corp. under Pressure After its Quarter 3 Results – VG, FBP, RZ, PKD, CIM