| ||

|

Tip: Use site restrict in your query to search within a site (site:nytimes.com or site:.edu). Learn more.

Remove this alert.

Create another alert.

Manage your alerts.

Gold, Mining, silver, index, prices, today, oil, crude, dow jones, nasdaq, s&p 500, TSX, barrick gold, toromocho, CUP, goog, msft, aapl, finance, yahoo, bing, google,currency converter, currency, rates, currency tool, currency trading, currency transfers, foreign exchange, conversion, , live currency rates, mid-market, obsolete, precious metals, rate calculations, save money, save time, special units, tips, trade currency, up to the minute, world currency, xe trade, currency symbols

| ||

|

| ||

| Business Briefs Charleston Post Courier --The Dow Jones industrial average fell 24.97 points, 0.22 percent, to 11178.58. --The broader-based Standard & Poor's 500 index fell 1.89, or 0.16 percent, ... See all stories on this topic » |

| ||

| TSX approves disposition of Jubilee zinc and lead project - Frontline Gold SteelGuru Mr Walter Henry president and CEO of Frontline Gold Corporation announced that the TSX Venture Exchange has approved the sale of Frontline's 50% interest in ... See all stories on this topic » |

dow2664

The book Trading Realities: The Truth, the Lies, and the Hype In-Between by Jeff Augen is a very easy-to-read guide to avoiding fallacies, such as buying for the long term and holding onto stocks that have paper losses, and utilizing new strategies to viewing trends, analyzing and reducing risk, and making money trading. Several interesting narratives are included, such as the incident where Goldman Sachs (GS) admitted to trading against its clients. The smoking gun email from a Goldman senior executive appears at the end of the chapter. Augen explains in simple terms how volatility works and how stock options can be utilized to increase profits and reduce risk. One of the interesting techniques that he provides is buying the iPath S&P 500 VIX Short Term Futures ETN (VXX) and writing one month at-the-money calls against it. The downside is limited because the volatility will never go away. Plenty of other strategies such as this appear throughout the book. Option collars are explained very clearly and is what he considers the most conservative of trades. One technique he shows on pages 203 and 204 demonstrates how an investor can own Apple (AAPL) for free in 72 weeks. Synthetic stock is another technique that he covers, in order to reduce the cost of a trade. For traders who have never or rarely delved into option trading strategies, I recommend that you read Trading Realities .

dow2664

U.S. Stock Futures' Losses Widen as Commodities Join the Sell-Off Schaeffers Research – 1 hour ago Good morning! The Dow Jones Industrial Average (DJIA) is headed for an opening drop of about 31 points, while the S&P 500 Index (SPX) is trading roughly 3.6 points below fair value. Losses have … Opening View: DJIA Futures Fall as Irish Bailout Fails to Ease Concerns – NASDAQ

U.S. Stock Futures' Losses Widen as Commodities Join the Sell-Off

The Gap Inc. (NYSE:GPS) publicized its Earnings Press Release on November 18, 2010 affected its price percentage to surge 1.06% closing the day at $20.91. The equities were traded with the volume of 10.46 million shares and retained growth in price since the start of week trading. The stock got RSI (14) of 66.13 suggested its position with less probability for growth and its theoretical beta of 1.18 clears its more movement with market conditions. The performance with respect to rate of return of the stock in this week remained positive with 1.85% while the performance for a month remained at 8.23% and 21.43 for a Quarter. Likewise same performance computation for Half year was negative at 4.61%, -4.43% for a year but Year to Date performance remained 1.70%. The Company's long term position looks stronger with no burden of debt in capital structure as had debt to equity ratio of 0.00 in the most recent quarter results. On the other hand short term liquidity position with 2.00 Current Ratio in most recent quarter witnessed of having more current assets than current liabilities. In past twelve months the Gross Margin of the Company attained 40.85% while Profit Margin remained at 8.26%. The growth of Quarterly EPS year over year reached to 10.36% however growth of Quarter to Quarter Sales was 2.22%.

tdp2664Penny Stock Live

Below is today's Daily News and Research on U.S.-Listed Chinese Stocks:

AUTC: AutoChina International Announces the Establishment of a Wholly Owned Financial Leasing Company – Business Wire (Mon 8:02AM EST)

AUTC: AutoChina International Enters into Lease Securitization Program with CITIC Trust Co. Ltd. – Business Wire (Mon 8:01AM EST)

AUTC: AutoChina International Reports 2010 Third Quarter and Nine Month Financial Results – Business Wire (Mon 8:00AM EST)

AUTC: Q3 2010 AUTOCHINA INTERNATIONAL LIMITE Earnings Release – Before Market Open – CCBN (Mon 7:07AM EST)

BIDU: Trading the Stealth Momentum Shift – at Seeking Alpha (Mon 7:57AM EST)

CAAS: China Automotive Systems Achieves Production Milestone with 10 Millionth Steering Unit – PR Newswire (Mon 7:09AM EST)

CBEH: China Integrated Energy Recognized as One of the Top High-Tech Research and Development Enterprises by Shaanxi Provincial Government – PR Newswire (Mon 8:00AM EST)

CFSG CVVT FSIN HRBN ONP RINO: Prepare for the RINO Fallout – at Seeking Alpha (Mon 9:14AM EST)

CISG: Q3 2010 CNINSURE INC Earnings Release – After Market Close – CCBN (Mon 7:07AM EST)

CISG: CNinsure to Host Analyst and Investor Day on December 10, 2010 – GlobeNewswire (Mon 6:56AM EST)

CMM: China Mass Media Corp Earnings Call scheduled for 8:00 am ET today – CCBN (Mon 8:00AM EST)

CMM: Q3 2010 China Mass Media Corp Earnings Release – Before Market Open – CCBN (Mon 7:07AM EST)

CPHI: China Pharma Holdings, Inc. Obtains High-Tech Enterprise Status – PR Newswire (Mon 8:00AM EST)

CSIQ JKS: Top Solar Stock Play for 2011: Think Inputs – at TheStreet.com (Mon 8:28AM EST)

DL: CDEL to Offer Self-Taught Higher Education Study Process Monitoring Program in Guangxi Province – PR Newswire (Mon 9:00AM EST)

FMCN: Focus Media Holding Ltd. Earnings Call scheduled for 8:00 pm ET today – CCBN (Mon 7:35AM EST)

FTLK: Funtalk China Holdings Limited Announces Earnings Date for Second Quarter Fiscal 2011 Financial Results – PR Newswire (Mon 8:00AM EST)

HOLI: Hollysys Automation Technologies Announces Its Nuclear JV Granted a Two Reactor Automation and Control Contract for Fangchenggang Nuclear Power Station – PR Newswire (Mon 8:00AM EST)

HRBN: InPlay: Harbin Electric enters loan agreement with China Development Bank – Briefing.com (Mon 7:01AM EST)

HRBN: Harbin Electric Enters Loan Agreement with China Development Bank – PR Newswire (Mon 7:00AM EST)

HSFT: InPlay: HiSoft Tech intends to file registration statement – Briefing.com (Mon 6:39AM EST)

KONG: KONGZHONG CORP Earnings Call scheduled for 7:30 pm ET today – CCBN (Mon 7:36AM EST)

STV: [$$] The Irish 'Surprise' – at TheStreet.com (Mon 9:01AM EST)

TSL: Trina Solar's ADRs Quoted on the Singapore Exchange GlobalQuote Board – PR Newswire (Mon 8:00AM EST)

YGE: Yingli Green Energy Grants Applied Materials Award for Outstanding Technology and Service – Business Wire (Mon 7:30AM EST)

tdp2664

China Analyst

Daily News and Research on Chinese Stocks (Nov 22, 2010)

It’s at the periphery that the debt-bubble is exploding hardest…

ONE SIMPLE WAY of thinking about the world’s problems is that over indebtedness is overwhelming institutions at the periphery of the global system, says Dan Denning in Melbourne for The Daily Reckoning Australia.

A few years ago, that meant margin-lenders and non-bank lenders in America’s housing market being swallowed by bigger more traditional banks that were not financed by securitization (think Rams Home Loan here in Australia).

But the banks weren’t well capitalized enough to withstand credit write downs so the risk had to be swallowed by an even larger party with deeper pockets (or access to your pockets). Gradually, risk of debt default has been centralized in a smaller number of institutions and governments, migrating from the private balance sheet to the public. Instead of being disaggregated, it’s being repatriated.

Yes, it’s kind of a boring thought to begin the week with. But it may explain a lot of what’s going on in the moment. No one wants to take losses on bad debt and have a thorough reckoning of profits and losses. So the problem is passed on like a virus to the next biggest remaining party.

An obvious example is Ireland (and Portugal, and Greece, and Spain). Ireland’s government agreed in principal over the weekend to a bailout fund from the European Union and the International Monetary Fund. The liabilities of Irish banks have become too big a problem for Ireland’s national government to manage without destroying its own balance sheet and credit rating in the process.

At one level this represents a victory for multi-national financial companies over the traditional nation state. Ireland ceded power and sovereignty to the EU and IMF because its banks have held a gun to its head. The banks win and Ireland’s people suffer the consequences, with terms of surrender dictated by the EU and the IMF.

Whether or not this model of submission finance (where the banks threaten to kill the country unless their ransom demands are met) is the actual design of the banks and/or the trans national organizations is a good question. It could be that some people want weaker nation states and stronger Supra States like the EU.

In fact, that could be the case in Ireland. In June of 2008, Irish voters rejected the EU’s Lisbon Treaty. That treaty was itself a sneaky way of forcing a European constitution on Europe after major nations like France and the Netherlands had rejected said constitution by popular vote. For unelected bureaucrats, “No” never really means “No.”

European parliaments ratified the Lisbon Treaty and thumbed their nose at popular opposition from the little people. Like medieval landed elites and clergy, today’s governing class is not interested in the consent of the governed. It correctly realizes that it doesn’t derive its power from that consent, but from the power to throw people in jail for not paying taxes or for breaking any one of myriad laws which the State has erected in private and public life.

The Irish constitution required another vote by the people on adopting a European constitution and the Irish, being rebellious at heart, rejected it. Naturally, European power brokers in Brussels moved ahead with the project of greater economic and political integration in Europe anyway. The democratic process wasn’t meant to be an actual referendum on whether Europe should become more “one.” The vote was just window dressing to give the European project the patina of respect from having been voted on by “the people”.

But in the age of growing government power, the people don’t really matter, except as votes to be bought and tax serfs to be fattened and farmed. And now Ireland, whose banks are stuffed with bad debt, finds itself having to do what its told by the EU and IMF whether it likes it or not.

By the way, this slow motion tyranny of the ruling elite bureaucratic class is just as true here in Australia as it is everywhere else. Here, it takes the form of a government refusing to cost a $43 billion national broadband plan of dubious worth. It takes many other bi-partisan forms too, of course. Here in Victoria, it’s the enormous number of spin doctors employed by the government (at taxpayer expense) to consult on public policy and cram all sorts of propaganda down your eyeballs.

Don’t expect an end to Europe’s crisis, though. It will just migrate to the next nation with large public sector deficits and widening bond spreads (where investors openly doubt the ability of governments to cut spending and address structural economic weakness). Portugal is already the red hot favorite for the next crisis. But the real issue is the same everywhere: too much debt at the local level and an institutional arrangement that guarantees each local crisis will imperil the viability of the whole European project.

That’s what you get for trying to have one monetary policy of twelve different economies. Meanwhile, in America, the peripheral crisis is in with State and City governments. The Federal government can always monetize the debt through the Federal Reserve, printing money to buy bonds issued by the Treasury. City and State governments enjoy no such privilege. Thus, you’ve seen falling muni’ bond prices and cancelled offerings as borrowers fret about investor appetite for more debt.

What does it mean? It probably means that California or Illinois is going to go bankrupt before Washington does. And when one or two states or ten or twenty cities go bankrupt, it will put more pressure on the bankrupt Federal government in America to “do something.” Like what?

All of this roughly fits in with the idea we laid out in Friday’s subscriber-only update for Australian Wealth Gameplan: global growth is not going to come from debt-laded OECD countries. If it’s going to come, it’s going to come from the BRIICS. But those countries (Brazil, Russia, Indonesia, India, China, and South Africa) are sorting out whether they want to continue devalue their currencies (as they must in an export-driven growth model) or begin relying more on domestic demand and allowing for currency appreciation to stem inflation concerns.

Speaking of which, Ben Bernanke had a go at China in a speech he gave in Germany on Friday. He said that, “For large, systemically important countries with persistent current account surpluses, the pursuit of export-led growth cannot ultimately succeed if the implications of that strategy for global growth and stability are not taken into account.”

He went on to claim that the running up of large current account surpluses destabilized global growth. And more importantly, he claimed that artificially suppressed currencies didn’t’ allow for the needed rebalancing in the global economy. It was Fed speak for, “You’re doing it all wrong, China.”

That’s a pretty audacious claim for a man who’s taken US monetary policy into completely unchartered waters and kicked off a migration into higher risk assets and commodities.

Where does that leave Australia as we begin the week? Good question. The risk of China over-tightening its bank lending to contain inflation would definitely be bearish for Aussie resources. But for now, no one seems overly concerned that un-sound monetary policy is going to affect Aussie asset prices. Maybe they should be.

Or maybe we worry too much. But we can’t help it. And what we’re worrying/wondering about now is if China, too, is at the periphery of the global credit boom, inasmuch as it created tremendous productive capacity to fuel credit-driven consumption in the West. What if a lot of China’s boom vanishes with the inevitable deleveraging and debt-deflation in the West?

Get the safest gold at the lowest prices by using world No.1 BullionVault…

gol2664

JA Solar Holdings Co., Ltd. (ADR) (NASDAQ:JASO) soared 5.30% to $7.57 on over 6.20 million shares, compared to its average volume of 10.57 million shares. So far this year, the stock ha soared over 33% so far this year. The stock has a 52-week range of $3.70-$10.24. JA Solar Holdings Co., Ltd. (JA Solar) is a manufacturer of high-performance solar cells based in People’s Republic of China. The Company produces and sells both monocrystalline and multicrystalline solar cells. Dean Foods Company (NYSE:DF) jumped 2.70% to $7.63 on over 7.39 million shares after the stock made a new 52-week low of $7.37. Over the past one week, the stock has slumped over 58%. Dean Foods Company is a food and beverage company. The Company operates through two segments: Fresh Dairy Direct and WhiteWave-Morningstar. Fresh Dairy Direct, formerly DSD Dairy, is a processor and distributor of milk and other dairy products in the United States. Yingli Green Energy Hold. Co. Ltd. (ADR) (NYSE:YGE) rose 3.50% to $11.10 after the Company discussed its third quarter 2010 results. Net revenues increased 21.7% to RMB 3,284.2 million. Net income was RMB 456.1 million in the third quarter of 2010 compared to RMB 120.8 million in the third quarter of 2009. Yingli Green Energy Holding Company Limited is a vertically integrated photovoltaic (PV) product manufacturer. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

A headline grabbing week, in which the stock market was drubbed on Monday and Tuesday, ended on Friday with a whimper. However, despite the flat close, the U.S. markets still must confront worries over China’s response to its growth rate, Europe’s shaky economies, and the long-term impact of the Fed’s second round of quantitative easing (QE2). On Friday, China raised its bank reserve requirements, but that had little impact on trading since the increase had been anticipated. Tuesday’s sharp fall was in part due to China’s tighter money policy and the resulting impact on U.S. exports to that massive market. Ireland’s fragile economy was in the news for the entire week, but late news on Friday seemed to indicate that talks with the European Union (EU) and the European Central bank are going well. And on Sunday, it was announced that Ireland had applied to the EU for a bailout worth tens of billions of euros. Of the Dow Industrials, The Boeing Company (NYSE: BA ) was the worst performer, down 1.6%, and The Walt Disney Company (NYSE: DIS ) was a close second, off 1.5%. The top gainers were Hewlett-Packard Company (NYSE: HPQ ), up 2.18%, and American Express Company (NYSE: AXP ), up 1.25%. In corporate news, AnnTaylor Stores Corp. (NYSE: ANN ) jumped 8.5% on better-than-expected Q3 earnings and same-store sales. Caterpillar Inc. (NYSE: CAT ) said that it is buying Bucyrus International, Inc. (NASDAQ: BUCY ) for a 32% premium of $7.6 billion, and EMC Corporation (NYSE: EMC ) said that it will pay Isilon Systems, Inc. (NASDAQ: ISLN ) $2.25 billion, which is a 29% premium. General Motors Co. (NYSE: GM ) closed on Friday at $34.26, one day following its successful return to the NYSE following its restructuring and IPO. The benchmark 10-year Treasury note rose on Friday bringing its yield to 2.87%. Thirty-year Treasury bonds fell to a yield of 4.24%. The euro gained versus the dollar, and late Friday was quoted at $1.3691 versus $1.3628 on Thursday. At Friday’s close, the Dow Jones Industrial Average rose 22 points to 11,204, the S&P 500 was up 3 points to 1,200, and the Nasdaq rose 4 points to 2,518. The NYSE traded 1.1 billion shares with advancers over decliners by 1.4-to-1. The Nasdaq crossed 581 million shares and advancers were ahead by 1.2-to-1. For the week, the Dow rose 0.1%, the S&P 500 was unchanged, and the Nasdaq was unchanged. Crude oil for December delivery fell 34 cents to $81.51 a barrel, and the Energy Select Sector SPDR (NYSE: XLE ) rose 53 cents to $63.59. December gold fell 70 cents to $1,352.30 an ounce, and the PHLX Gold/Silver Sector Index (NASDAQ: XAU ) rose 1.58 points to 212.37. What the Markets Are Saying This has been a “headlines related market” for months, but last week almost every twist and turn could be related to a headline-grabbing event in some part of the world. This makes for some interesting days for traders, but does little for the average investor. Prices see-saw from support to resistance and back again, sometimes traversing price bands in a matter of hours rather than the days or even months that was typical several years ago. The general result of this type of volatility is that the “big money” and long-term investors tend to stay away. Thus, the markets are left to short-term traders, some of whom are often in and out in a matter of minutes, and this leads technicians to label the market as having little commitment or conviction. Last week, we saw the S&P 500 traverse the entire support zone of 1,210 to 1,174 in three days, and then jump to an intraday high of 1,200 on Thursday, and close at the round number on Friday. Technically that’s an upside reversal after falling from its new high for the year to the important support at just above its 50-day moving average, and then jumping to a big round number like 1,200. But the bears would say that the rally was preceded by “9-to-1″ volume down days with the highest volume since June. The bulls say that the reversal up to 1,200, which is just above the 20-day moving average of the S&P 500, coupled with the big volume down day on Tuesday was a “selling climax,” which will result in a new high. So who is correct? When faced with a stand-off between bulls and bears, it is sometimes helpful to go to our indicators, both internal and sentiment, for a clue. Here is what they show: Internal indicators, chiefly Moving Average Convergence/Divergence (MACD) , momentum, stochastics and Relative Strength Index (RSI) , have moved from extreme “overbought” numbers to modestly “oversold,” and the stochastics have even flashed a near-term “buy” signal. Sentiment indicators are mixed with Investors Intelligence telling us that the advisers are now bullish, surging from 48.4% to 56.2% in just one week, while the bears fell to 20.2% from 23.1%. In the words of II, this “shows that there is less and less cash on the sidelines,” and is thus a bearish sign. However, the AAII Sentiment Survey shows that the bulls have fallen to 40% from 57.56% in just one week with bears increasing from 28.49% to 32.50%, and that is modestly bullish. On balance, despite the mixed signals, I believe that the technical situation is mildly bullish only because the last strong technical signal was Thursday’s impressive reversal. But the bulls must back this up with a solid breakout on strong breadth and high volume or prices will collapse back to support at 1,174 or lower. If you are a long-term buyer of stocks with a buy-and-hold strategy, then there are many good values to be had as long as you recognize the volatile nature of the market. But if you are a trader or short-term holder, then you must memorize the support and resistance numbers for the major stock market indices, as well as for the stocks in which you have an interest. Buy on support (low numbers) and sell on resistance (high numbers). This is easy to say and difficult for most traders to execute because it is almost always contrary to the current run of headline news. See market’s support zones here. Today’s Trading Landscape To see a list of the companies reporting earnings today, click here . For a list of this week’s economic reports due out, click here . If you have questions or comments for Sam Collins, please e-mail him at samailc@cox.net .

tdp2664

gol2664

InvestorPlace

dow2664

Gold price per ounce was down at last trade but Silver and copper were up. Prior to opening bell of the U.S. trading session for November 223nd, 2010, the dollar is struggling. Precious metal commodities dipped a bit last week but are expected to bounce back. Confusion persists right now as commodities dipped based on oversees concerns with Ireland’s long term debt problems and China’s interest rate hikes aimed at cooling off the fast pace of their growing economy. Experts are predicting that the dollar will remain lower into the next year as the Fed pumps money into the economy through QE2. The traditional relationship between the dollar and precious metal commodities is an inverse one and thus the lower dollar value is expected to boost commodity prices. Recent precious metal data reveals that spot gold price is at $1,356.89. Spot silver is at $27.45. Overall in 2010, Gold has jumped 23%. Analysts believe that the price jump overall stems from oversees demand, but the message out of China right now is indirectly negative. The move to slow down their economy will be interpreted as an inflation reducing event and increase apprehensions about investing in precious metals right now. Last trading price for Gold December delivery contract was in the red by .05% at $1,352.30. Silver was in the green by 1.29% at $27.18. Copper was up as well by.07% at $3.83. Author: Camillo Zucari

Merck & Co., Inc. announced on Saturday, 19th November, that its new study showed positive results about the usage of its cholesterol drug Vytorin. The usage of this drug helps in reducing the risk of heart attack. It also helps in reducing the need of heart surgeries in chronic kidney patients by 16%. The study was conducted by Oxford University in which more than 9000 patients were examined who had advanced or end-stage chronic kidney disease. Merck declared that with these strong results in the improvement of patients the drug will be presented for approval to use it for kidney diseases. Merck also declared that the result is considerable because kidney patients have high risk of vascular disease. With the approval of this medicine it will help company to compete in the market above its competitors. Merck & Co., Inc. (Merck) is a global health care company that delivers health solutions through its medicines, vaccines, biologic therapies, and consumer and animal products, which it markets directly and through its joint ventures. The Company's operations are principally managed on a products basis. The Pharmaceutical segment includes human health pharmaceutical and vaccine products marketed either directly by the Company or through joint ventures.

tdp2664Penny Stock Live

Below are the top 10 U.S.-listed Chinese stocks with most analyst downgrades in the past four weeks, UPDATED TODAY before 4:30 AM ET. Sentiment on these stocks is turning more negative.

Sohu.com Inc. (NASDAQ:SOHU) has the 1st most analyst downgrades in the past four weeks. It was downgraded by 4 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 15 of the 23 analysts covering it. Perfect World Co., Ltd. (ADR) (NASDAQ:PWRD) has the 2nd most analyst downgrades in the past four weeks. It was downgraded by 4 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 9 of the 21 analysts covering it. Seaspan Corporation (NYSE:SSW) has the 3rd most analyst downgrades in the past four weeks. It was downgraded by 3 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 6 of the 10 analysts covering it. JA Solar Holdings Co., Ltd. (ADR) (NASDAQ:JASO) has the 4th most analyst downgrades in the past four weeks. It was downgraded by 2 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 9 of the 23 analysts covering it. SINA Corporation (USA) (NASDAQ:SINA) has the 5th most analyst downgrades in the past four weeks. It was downgraded by 2 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 6 of the 24 analysts covering it.

Suntech Power Holdings Co., Ltd. (ADR) (NYSE:STP) has the 6th most analyst downgrades in the past four weeks. It was downgraded by 1 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 34 of the 44 analysts covering it. LDK Solar Co., Ltd. (NYSE:LDK) has the 7th most analyst downgrades in the past four weeks. It was downgraded by 1 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 12 of the 18 analysts covering it. NetEase.com, Inc. (ADR) (NASDAQ:NTES) has the 8th most analyst downgrades in the past four weeks. It was downgraded by 1 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 9 of the 25 analysts covering it. Melco Crown Entertainment Ltd (NASDAQ:MPEL) has the 9th most analyst downgrades in the past four weeks. It was downgraded by 1 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 8 of the 15 analysts covering it. Baidu.com, Inc. (ADR) (NASDAQ:BIDU) has the 10th most analyst downgrades in the past four weeks. It was downgraded by 1 brokerage analyst(s) in this period. The stock is rated negatively or neutrally by 7 of the 26 analysts covering it.

tdp2664

China Analyst

Top 10 U.S.-Listed Chinese Stocks with Most Analyst Downgrades: SOHU, PWRD, SSW, JASO, SINA, STP, LDK, NTES, MPEL, BIDU (Nov 22, 2010)

Several news stories could affect individual companies today. The following listed companies should see some movement: Tesco PLC (LON:TSCO), British Airways plc (LON:BAY), Vodafone Group plc (LON:VOD). Here is a more detailed look at stories affecting the firms’ stock prices. Tesco PLC (LON:TSCO) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full TSCO chart at Wikinvest Tesco PLC (LON:TSCO) has reported increased sales in Asia. Tesco PLC (LON:TSCO), the largest retailer in the UK, has revealed that its sales in India, China, Korea, Malaysia and Thailand have been increased in the 9 months till 31 October. According to the presentation published in the official website of Tesco PLC (LON:TSCO), the sales in India rose by 18 percent while the gains reported in China were 8.3 percent. Malaysia, Korea and Thailand were having an increase of 0.5 percent, 6.7 percent and 3.4 percent respectively. British Airways plc (LON:BAY) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full BAY chart at Wikinvest British Airways plc (LON:BAY) has planned to launch new flight routes to Sweden. By end of this month, British Airways plc (LON:BAY) is starting twice daily flights to Gothenburg, Sweden’s second largest city from Heathrow Airport, London. This move will give their customers even more choice to do their Christmas shopping in Europe. Richard Tams, British Airways’ head of UK and international sales, said: “We are really excited about flying to this fabulous city on the south west coast of Sweden. The schedule is perfect for UK originating day round trips, and for connections onto the worldwide network.” Vodafone Group plc (LON:VOD) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full VOD chart at Wikinvest Vodafone Group plc (LON:VOD) has introduced a new BlackBerry smart phone to their customers. The BlackBerry Torch 9800, first ever to have a sliding form factor from BlackBerry has been officially introduced by Vodafone Group plc (LON:VOD) in Malta. The highly-awaited BlackBerry 6 operating system also makes its debut on this new BlackBerry Torch 9800, which steers in the next-generation of messaging and multimedia. Alexandre Froment Curtil, Head of Marketing at Vodafone Group plc (LON:VOD) Malta said, "Our two companies that brought the first BlackBerry smart phones to the local market have teamed up again with the new BlackBerry Torch to provide our users an enormously popular service with the latest technological advances." We may see more movement as the exchanges continue for Tesco PLC (LON:TSCO), British Airways plc (LON:BAY) and Vodafone Group plc (LON:VOD).

tdp2664

E money daily

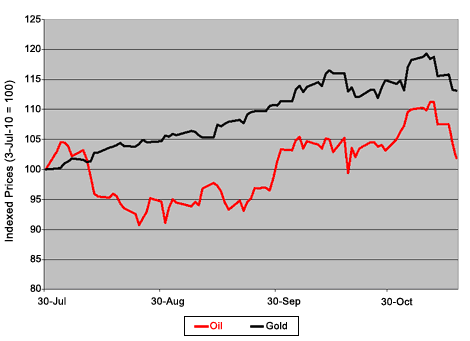

Gold Price movements have led oil dramatically this year to date…

HARD ASSET prices sold off hard last week as concerns over credit tightening in the Chinese market prompted traders and investors to rethink their inflation notions, says Brad Zigler at Hard Assets Investor.

Unexpectedly, in October, year-over-year inflation on the Chinese mainland rose to 4.4%, prompting authorities to jawbone a jack-up of interest rates and price controls.

Thus Gold Prices tumbled from that $1400-per-ounce level reached after a nearly unabated three-month rise. Industrial commodities also took it on the chin, as fears of slowing growth in China percolated.

But the most industrial of commodities is, of course, oil. Oil had rallied in autumn along with gold, albeit with greater volatility, and with punier returns as well. Gold Prices chugged uphill from July’s end to a 14.8% gain ahead of the November election. Simultaneously, oil pitched and rolled 3.2% higher.

The wheels on the commodity undercarriage started wobbling after the votes were tallied and, more importantly, once the Fed laid out the parameters of its second tranche of quantitative easing. Then oil and gold both tumbled.

Gold Prices led the way down, just as they had led the way up. Since the top of November, bullion’s slumped 1.7%, while front-month WTI crude prices have slid 1.3%.

Recently, oil prices have gyrated nearly twice as much as gold. This autumn, the annualized standard deviation in oil’s daily close has been 27.8%, while gold’s wobbled at a 14.7% rate.

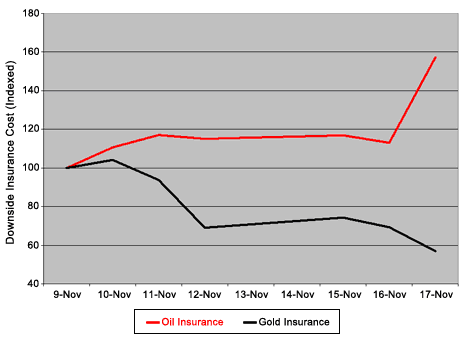

But most arresting is the expectations of future volatility reflected in option prices. As gold topped the $1400 mark, the CBOE Gold Volatility Index (CBOE: GVZ) jumped to 24.65. This index represents the near-term variance in the price of the SPDR Gold Shares Trust (NYSE Arca: GLD) – here, an annualized 24.65% – as imputed to option premiums. A week before, when gold was $50 lower, the volatility index registered 21.87.

Metrics like the CBOE Gold Volatility Index are often called “fear indexes”, because their gyrations measure the cost of insuring their underlying assets. Options are, after all, insurance contracts. Owners of assets like gold or gold proxies, for example, can purchase put options to protect their investments in anticipation of stormy market activity. The put sets a worst-case sales price for the asset in the event of a plunge. If the storm passes or never materializes, the insurance can be peeled off or allowed to expire while the underlying asset is retained.

A fear index exists for oil prices, too. The CBOE Oil Volatility Index (CBOE: OVX) tracks the risk in United States Oil Fund (NYSE Arca: USO) contracts. At gold’s recent peak, oil traded for $86.72, pegging the fear index at 30.93. The volatility trajectory for oil, though, was opposite gold’s. A week before, the CBOE Oil Volatility Index was 31.56.

And now? What’s the options market telling us of future volatility? At last Wednesday’s close, GVZ had drifted down to 22.09, while OVX ballooned to 33.69. The message here is that option traders were growing more comfortable with the trend in gold’s price than oil’s.

Does that mean that traders think gold is likely to bounce while oil continues downward? Perhaps, but not necessarily.

These volatility indexes take the measure of puts together with calls – contracts that afford their owners protection against higher prices. To be sure of professional expectations, we have to isolate the puts from the calls. That allows us to monitor the market for downside protection.

In fact, the cost indexes for puts on gold and oil proxies have moved in opposite directions recently. The chart below plots values since the gold top on Nov. 9.

Gold puts (or here, downside protection on the GLD proxy) have cheapened relatively. Oil puts (again, puts on the USO exchange-traded fund) got more expensive. Thursday last week, oil insurance costs spiked B-I-G time. So, is that a harbinger of lower oil prices in the immediate future? Well, it says that traders believe the odds of another down leg have certainly increased.

Is that a guarantee of lower oil prices? Of course not. Option traders, remember, deal in probabilities and cost/benefit trade-offs. After the recent sell-off, the prospect of a relief rally shouldn’t be discounted. Given the oil market’s volatility, though, having a floor price locked in just seems like good business.

Traders’ fears were heightened by the increase in oil’s downside momentum despite Wednesday’s bullish inventory report. Earlier, commercial traders signaled their concern about lower prices by amassing a record-high net short position in WTI futures.

With Wednesday’s support taken out, crude is now poised, after the relief reaction, to aim for the $78 level I reckon – the halfway point of its May-November ascent.

Not that there won’t be some volatility along the way, mind you.

Want to buy physical Gold Bullion, not a proxy or leveraged risk, and own it outright in the safest locations on earth? Start with a free gram of Swiss gold at BullionVault now…

gol2664

Sirius XM Radio Inc. (NASDAQ:SIRI) surged 0.63% to $1.43. The 52-week range of the stock is $0.56-$1.61. The stock went up more than 138% year-to-date. The stock has average daily volume of 71.36 million shares. At current market price, the market capitalization of the company stands at $5.56 billion. MGM Resorts International. (NYSE:MGM) went up 0.70% to $13.01. The 52-week range of the stock is $8.92-$16.66. The stock opened at $13.17 and is trading within the range of $12.97-$13.22. The stock is up more than 45% from its 52-week low of $8.92 and is down more than 21% from its one-year high of $16.66. Las Vegas Sands Corp. (NYSE:LVS) gained 2.71% to $49.73. The 52-week range of the stock is $14.87-$55.47. The stock went up more than 233% year-to-date. The stock has average daily volume of 38.36 million shares. DryShips Inc. (NASDAQ:DRYS) jumped 2.04% to $5.50. The 52-week range of the stock is $3.28-$7.30. The stock went down more than 5% year-to-date. The average daily volume of the stock is 14.39 million shares. At current market price, the market capitalization of the company stands at $1.62 billion.

tdp2664

Newsworthy Stocks

dow2664

A year ago when I wrote my book The Green Light on Green Stocks: A Quick Guide to Green Investing and Making Money in Alternative Energy Stocks , I started touting cloud computing as a green industry, not to mention a way of providing money saving services to many corporations. Cloud computing as a growing industry is finally being recognized. Look at Salesforce.com (CRM), which is up 633% since it started trading in 2004. Last week, Isilon (ISLN) shares jumped 28.5% in one day, after EMC announced it would take over the company at $33.85 a share. So what is cloud computing? It is having your programs and data stored remotely, ‘in the clouds,’ instead of on individual computers. As long as you have Internet connection, you can have a fairly dumb computer ans still utilize cloud computing. So where are these so-called clouds? They are basically, in very simple terms, the servers of companies that provide this service, and those servers can be located anywhere. Do you have Yahoo (YHOO) mail, Google (GOOG) gmail, or hotmail? Then you are using cloud computing in a small way. You don’t have the email servers in your office or home, you use the Yahoo or Google servers. As a matter of fact, many public universities are turning over their student email services to Google, giving students a type of gmail account. It saves them money on servers and saves on staffing for support. These same benefits apply to the private sector, especially when you extend it to data storage and computer software. You don’t need a technician to come out an install new software to each employees’ station. You don’t need a bunch of network administrators monitoring the company’s servers. You don’t need to periodically upgrade computers. You don’t need to own a bunch of servers. You cut down on the costs and issues relating to the disposal of old computers and servers. You don’t need to deal with data security, as that is the job of the cloud computing company. The benefits of clouds are extensive, and there are over 25 stocks in the cloud industry to choose from, according to the Cloud Computer Stock list at WallStreetNewsNetwork.com, including companies involved in server farms and outsourced storage systems. Salesforce.com is a provider of customer-relationship management services that has promoted ‘the end of software’. Salesforce has customers of all sizes, including Corporate Express division of Staples (SPLS), Daiwa Securities (DSECY.PK), Expedia (EXPE), Dow Jones Newswires subsidiary of News Corp. (NWS-A), SunTrust Banks (STI), and Kaiser Permanente. Salesforce trades at a lofty 76 times forward earnings, debt in the amount of $476 million, with over $742 million in cash. The company just reported a quarterly sales increase of 30% year over year, with a one cent drop in earnings per share. VMware (VMW) is another major cloud and virtualization player. Its product VMware vSphere is a cloud computing data center platform. It sports a forward PE ratio of 45. The company has $450 million in debt with $2.9 billion in cash. The company reported that latest earnings increased an incredible 121.4% in earnings on a 45.8% increase in revenues. Citrix Systems, Inc. (CTXS) provides on demand applications and online services, including GoToMeeting, GoToWebinar, GoToTraining, GoToAssist, and GoToMyPC. This debt free company has $902 million in cash and carries a forward PE of 29. The latest quarterly earnings were up 64.3% on a revenue increase of 17.8%. To access a free Excel spreadsheet database of numerous companies involved in cloud computing in some way, that can be downloaded, sorted, and updated, go to wsnn.com. Disclosure: Author owns YHOO. By Stockerblog.com

Do Investors Have Their Heads in the Clouds?

Below are a number of today’s news stories relating to individual companies. The following stocks should see some movement: Marks and Spencer Group Plc (LON:MKS), BAE Systems plc (LON:BA), British Airways plc (LON:BAY). Here is a more detailed look at stories affecting the firms’ stock prices. Marks and Spencer Group Plc (LON:MKS) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full MKS chart at Wikinvest Marks and Spencer Group Plc (LON:MKS) study has revealed the return of family meetings. The latest study by the Marks and Spencer Group Plc (LON:MKS) Money shows that family meetings are back for Brits who have been focusing on financial issues. Colin Kersley, chief executive of Marks and Spencer Group Plc (LON:MKS) Money, said that ”British families are embracing the old adage that ‘two heads are better than one. We have seen a revival of traditional family meetings to discuss what to spend the family cash on. Children and even grandparents are involved in a variety of decisions from fridges to credit cards. I think this is a really positive move for the nation’s families – the idea of getting together as a team and playing a part in crucial decision making together is a wonderful development. Being open and honest about family finances can only bode well, opening up the next generation’s eyes to running a household’s finances.” BAE Systems plc (LON:BA) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full BA(BAE) chart at Wikinvest BAE Systems plc (LON:BA) has organized 'Bike for Tykes' event in Hawaii. By organizing this event, the largest defense contractor has kick-started my heart…er…the Marine Corps’ 2010 Toys for Tots campaign. To raise donation for this campaign, BAE Systems plc (LON:BA) usually use to sought donation from their employees. Since 2006, they raised more than 400 bikes to donate for the Toys for Tots campaign. Besides BAE Systems plc (LON:BA) employees, Marine Corps and sailors also used to take part in this campaign to distribute toys for needy children in Hawaii. British Airways plc (LON:BAY) Flash Player 9 or higher is required to view the chart Click here to download Flash Player now View the full BAY chart at Wikinvest British Airways plc (LON:BAY) has planned to launch new flight routes to Sweden. By end of this month, British Airways plc (LON:BAY) is starting twice daily flights to Gothenburg, Sweden’s second largest city from Heathrow Airport, London. This move will give their customers even more choice to do their Christmas shopping in Europe. Richard Tams, British Airways’ head of UK and international sales, said: “We are really excited about flying to this fabulous city on the south west coast of Sweden. The schedule is perfect for UK originating day round trips, and for connections onto the worldwide network.” We could see more movement as the stock markets continue for Marks and Spencer Group Plc (LON:MKS), BAE Systems plc (LON:BA) and British Airways plc (LON:BAY).

tdp2664

E money daily

Halliburton Company (NYSE:HAL) surged 0.85% to $37.88 after it made its fresh one-year high of $37.95. So far this year, the stock has jumped over 25%. It has a 52-week range of $36.75-$37.95. The company has a market capitalization of $34.46 million. Halliburton Company provides a variety of services and products to customers in the energy industry related to the exploration, development, and production of oil and natural gas. Walter Energy, Inc. (NYSE:WLT) jumped 9.24% to $105.81 and made a new 52-week high of $105.93 earlier in the session. So far this year, the stock has jumped over 40%. It has a 52-week range of $57.62-$105.93. The company has a market capitalization of $5.60 billion. Walter Energy, Inc., formerly Walter Industries, Inc., is a producer and exporter of metallurgical coal for the global steel industry and also produces steam coal, coal bed methane gas (natural gas), metallurgical coke and other related products. Texas Instruments Incorporated (NYSE:TXN) went up 1.46% to $31.94 as it made its new one-year high of $31.95. The stock opened at $31.51 and is trading in the range of $22.28-$31.95. As of now, the market capitalization of the company stands at $37.50 billion. The stock went up more than 22% year-to-date. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Below are the top 10 best-rated Solar stocks, UPDATED TODAY before 4:30 AM ET, based on the number of positive ratings by brokerage analysts. Seven Chinese companies (TSL, SOL, JASO, JKS, SOLF, YGE, CSUN) are on the list.

Real Goods Solar, Inc. (NASDAQ:RSOL) is the 1st best-rated stock in this segment of the market. It is rated positively by 100% of the 4 brokerage analysts covering it. GT Solar International, Inc. (NASDAQ:SOLR) is the 2nd best-rated stock in this segment of the market. It is rated positively by 85% of the 13 brokerage analysts covering it. Trina Solar Limited (ADR) (NYSE:TSL) is the 3rd best-rated stock in this segment of the market. It is rated positively by 83% of the 29 brokerage analysts covering it. ReneSola Ltd. (ADR) (NYSE:SOL) is the 4th best-rated stock in this segment of the market. It is rated positively by 78% of the 9 brokerage analysts covering it. JA Solar Holdings Co., Ltd. (ADR) (NASDAQ:JASO) is the 5th best-rated stock in this segment of the market. It is rated positively by 61% of the 23 brokerage analysts covering it.

JinkoSolar Holding Co., Ltd. (NYSE:JKS) is the 6th best-rated stock in this segment of the market. It is rated positively by 60% of the 5 brokerage analysts covering it. First Solar, Inc. (NASDAQ:FSLR) is the 7th best-rated stock in this segment of the market. It is rated positively by 57% of the 49 brokerage analysts covering it. Solarfun Power Holdings Co., Ltd. (ADR) (NASDAQ:SOLF) is the 8th best-rated stock in this segment of the market. It is rated positively by 57% of the 14 brokerage analysts covering it. Yingli Green Energy Hold. Co. Ltd. (ADR) (NYSE:YGE) is the 9th best-rated stock in this segment of the market. It is rated positively by 50% of the 28 brokerage analysts covering it. China Sunergy Co., Ltd. (ADR) (NASDAQ:CSUN) is the 10th best-rated stock in this segment of the market. It is rated positively by 40% of the 5 brokerage analysts covering it.

tdp2664

China Analyst

Top 10 Best-Rated Solar Stocks: RSOL, SOLR, TSL, SOL, JASO, JKS, FSLR, SOLF, YGE, CSUN (Nov 22, 2010)

Its being reported today November 22nd that Rolls Royce has succeeded in winning a contract worth of $1.8 billion form Air China to supply and service 20 air craft engines. Rolls Royce also won a $1.2 billion contract from China Eastern Airline in start of this month. After the engine explosion in mid air of one of Rolls Royce production the company was got stuck in various safety concerns. This new order is a sign of regaining the confidence of the company internationally. With the effect of this deal Rolls Royce will supply engines for Airbus A350s and A330s. These engines will be delivered with the service of Chinese carrier who would take the A330 planes from 2013 to 2015 and the rest A350 planes from 2018 to 2020. According to the various engine problems, which arose in the last month, company declared that the problems have been identified in the engines and the cause was exterminated. Rolls-Royce Group plc is an integrated power systems company, operating in civil and defense aerospace, marine and energy markets. The Company serves customers in over 120 countries. Its gas turbine products are shipped to customers worldwide, by land, sea and air. It is a global provider of defense aero-engine products and services, with 18,000 engines in service for 160 customers in 103 countries. Its marine business has more than 2,000 customers and equipment installed on over 30,000 vessels worldwide, including those of 70 navies.

tdp2664Penny Stock Live

dow2664

Stocks closed on Friday with gains , after a week of volatile movement. At open Monday the market remains flat with no new economic reports scheduled for release today. Economists predict increased uncertainty for market trending, as many investors plan to take time off for the Thanksgiving Holiday this week. All U.S. Markets will be closed Thursday in acknowledgment of the national holiday. On the economic calendar for Tuesday is the release of minutes from the Federal Reserve’s November policy meeting. Also expected out later this week are reports on housing, economic growth and figures on personal income and spending. Negotiations continue to determine the measures needed to stabilize the Irish banking system. Ireland’s struggling banking sector hiked fears amongst investors around the globe and increased pressure on the stock market as well as pushed down the value of the euro to the dollar. The guidelines for an aid package are expected to be finalized in the next few weeks and is estimated to be worth tens of billions of dollars. Although the plan for aid is unpopular in Ireland, investors report relief from the the uncertainty of the situation. Approaching mid day the market indexes are mixed with increase volatility. DJIA lost 37.08 points to 11,166.47. NASDAQ is up 2.20. points to 2,520.20. S&P 500 is down 3.24 points to 1,196.55. The Treasurys 10-year yield is down 0.05 to 2.83%. Oil is down 0.24 to $81.61 a barrel. Author: Pamela Frost

dow2664

Top 10 Best-Rated Dow 30 (DJIA) Stocks: JPM, KO, HPQ, WMT, PFE, AXP, MRK, UTX, MMM, BA (Nov 22, 2010) China Analyst – 5 minutes ago Below are the top 10 best-rated Dow Jones Industrial Average (DJIA, INDEXDJX:.DJI) stocks, UPDATED TODAY before 4:30 AM ET, based on the number of positive ratings by brokerage analysts. JPMorgan …

| ||

| Gold Prices Flat as Ireland Asks for Loan TheStreet.com The spot gold price Monday was down $1, according to Kitco's gold index. Gold prices were treading water as Ireland relented and asked for bailout money ... See all stories on this topic » |

| ||

| GLOBAL MARKETS: European Stocks Rise On Ireland Rescue Plan Wall Street Journal By Toby Anderson & Michele Maatouk Of DOW JONES NEWSWIRES LONDON (Dow Jones)--European stocks were higher Monday, along with the euro, gold and oil prices, ... See all stories on this topic » | ||

| Hong Kong stock market to extend trading hours Economic Times Afternoon trading runs for two hours, Dow Jones said. HK Exchanges hopes the increased trading hours will bolster the position of Hong Kong stock market in ... See all stories on this topic » | ||

| Brazil Stocks Open Lower On Continued European Debt Worries Wall Street Journal SAO PAULO (Dow Jones)--Brazilian stocks opened lower Monday on renewed worries about public sector debt in European countries. ... See all stories on this topic » |