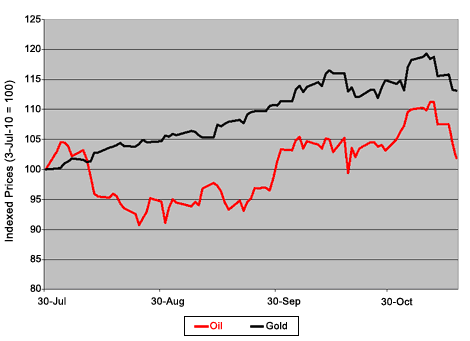

Gold Price movements have led oil dramatically this year to date…

HARD ASSET prices sold off hard last week as concerns over credit tightening in the Chinese market prompted traders and investors to rethink their inflation notions, says Brad Zigler at Hard Assets Investor.

Unexpectedly, in October, year-over-year inflation on the Chinese mainland rose to 4.4%, prompting authorities to jawbone a jack-up of interest rates and price controls.

Thus Gold Prices tumbled from that $1400-per-ounce level reached after a nearly unabated three-month rise. Industrial commodities also took it on the chin, as fears of slowing growth in China percolated.

But the most industrial of commodities is, of course, oil. Oil had rallied in autumn along with gold, albeit with greater volatility, and with punier returns as well. Gold Prices chugged uphill from July’s end to a 14.8% gain ahead of the November election. Simultaneously, oil pitched and rolled 3.2% higher.

The wheels on the commodity undercarriage started wobbling after the votes were tallied and, more importantly, once the Fed laid out the parameters of its second tranche of quantitative easing. Then oil and gold both tumbled.

Gold Prices led the way down, just as they had led the way up. Since the top of November, bullion’s slumped 1.7%, while front-month WTI crude prices have slid 1.3%.

Recently, oil prices have gyrated nearly twice as much as gold. This autumn, the annualized standard deviation in oil’s daily close has been 27.8%, while gold’s wobbled at a 14.7% rate.

But most arresting is the expectations of future volatility reflected in option prices. As gold topped the $1400 mark, the CBOE Gold Volatility Index (CBOE: GVZ) jumped to 24.65. This index represents the near-term variance in the price of the SPDR Gold Shares Trust (NYSE Arca: GLD) – here, an annualized 24.65% – as imputed to option premiums. A week before, when gold was $50 lower, the volatility index registered 21.87.

Metrics like the CBOE Gold Volatility Index are often called “fear indexes”, because their gyrations measure the cost of insuring their underlying assets. Options are, after all, insurance contracts. Owners of assets like gold or gold proxies, for example, can purchase put options to protect their investments in anticipation of stormy market activity. The put sets a worst-case sales price for the asset in the event of a plunge. If the storm passes or never materializes, the insurance can be peeled off or allowed to expire while the underlying asset is retained.

A fear index exists for oil prices, too. The CBOE Oil Volatility Index (CBOE: OVX) tracks the risk in United States Oil Fund (NYSE Arca: USO) contracts. At gold’s recent peak, oil traded for $86.72, pegging the fear index at 30.93. The volatility trajectory for oil, though, was opposite gold’s. A week before, the CBOE Oil Volatility Index was 31.56.

And now? What’s the options market telling us of future volatility? At last Wednesday’s close, GVZ had drifted down to 22.09, while OVX ballooned to 33.69. The message here is that option traders were growing more comfortable with the trend in gold’s price than oil’s.

Does that mean that traders think gold is likely to bounce while oil continues downward? Perhaps, but not necessarily.

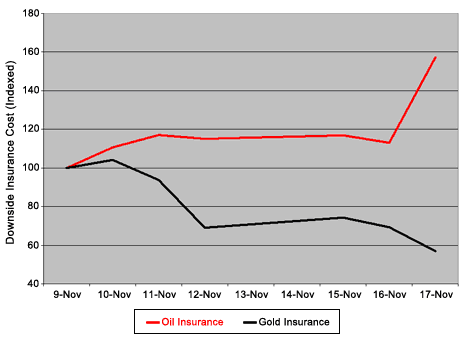

These volatility indexes take the measure of puts together with calls – contracts that afford their owners protection against higher prices. To be sure of professional expectations, we have to isolate the puts from the calls. That allows us to monitor the market for downside protection.

In fact, the cost indexes for puts on gold and oil proxies have moved in opposite directions recently. The chart below plots values since the gold top on Nov. 9.

Gold puts (or here, downside protection on the GLD proxy) have cheapened relatively. Oil puts (again, puts on the USO exchange-traded fund) got more expensive. Thursday last week, oil insurance costs spiked B-I-G time. So, is that a harbinger of lower oil prices in the immediate future? Well, it says that traders believe the odds of another down leg have certainly increased.

Is that a guarantee of lower oil prices? Of course not. Option traders, remember, deal in probabilities and cost/benefit trade-offs. After the recent sell-off, the prospect of a relief rally shouldn’t be discounted. Given the oil market’s volatility, though, having a floor price locked in just seems like good business.

Traders’ fears were heightened by the increase in oil’s downside momentum despite Wednesday’s bullish inventory report. Earlier, commercial traders signaled their concern about lower prices by amassing a record-high net short position in WTI futures.

With Wednesday’s support taken out, crude is now poised, after the relief reaction, to aim for the $78 level I reckon – the halfway point of its May-November ascent.

Not that there won’t be some volatility along the way, mind you.

Want to buy physical Gold Bullion, not a proxy or leveraged risk, and own it outright in the safest locations on earth? Start with a free gram of Swiss gold at BullionVault now…

gol2664

No comments:

Post a Comment