How come gold and Silver Bullion prices pulled back as the Fed's QE2 hit...?

BOTH THE Shanghai and Hong Kong stock markets tumbled to multi-week lows on

reports that Beijing is willing to hike interest rates again, in order to tackle

the country's accelerating inflation rate, writes Gary Dorsch of Global Money

Trends . The tumble that started on November 12th shaved some 11% off the

Shanghai red-chip index. The Chinese Politburo is utilizing almost all of its

weapons for combating inflation, except for the one that Washington advocates

– lifting the Yuan against the US Dollar at a quicker pace. However, on Nov.

17th, Zhou Qiren – a key advisor to the PBoC – said Chinese rate hikes are

no panacea for curbing inflation: "Loose monetary policy in 2009 has created

excessive liquidity and helped fuel prices of various products. Too much

liquidity and fewer goods is the reason behind inflation. Raising interest rates

cannot change such a situation," he told the China Securities Journal. Thus, if

Chinese and Chicago commodity markets manage to rebound strongly from their

latest shake-out, it would signal that inflationary pressures are deeply

entrenched. The PBoC would be faced with the biggest inflation threat to its

economy in decades. Meanwhile, the Fed was scheduled to buy $105 billion of

Treasury securities from Nov. 12th through Dec 9th, which in turn, might fuel

another tidal wave of liquidity into the global commodities and metals markets.

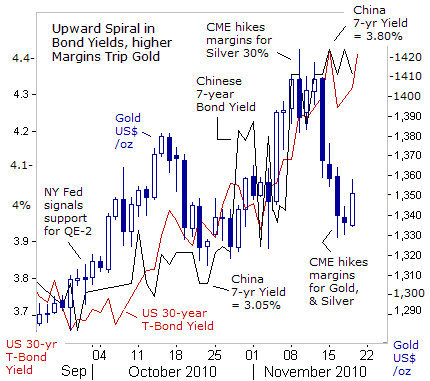

Gold Bullion and Silver Prices have still tumbled from their recent highs,

however, spooked by hefty increases in margin requirements set by the

US-exchange operators for agricultural and metal futures. Given the

extraordinary efforts of the bond market vigilantes in jacking-up US Treasury

yields, and the upward drift in Chinese yields, the mountain that the precious

metals' bulls must climb has gotten steeper. However, one should also keep in

mind that Chinese bond yields are still far below the inflation rate, and

therefore, offering a negative rate of return. In regards to the US T-bond

market, if there's a growing realization that the US-government is bankrupt, and

can only pay back its debts by printing paper, then precious metals are a safe

haven. So far, the actual results of the Fed's QE-2 scheme are horrifying.

Monetizing the Treasury's debt on such a massive scale has only reawakened the

bond vigilantes from their slumber. If the Fed cannot stop the slide in T-bond

prices, and bond yields ratchet sharply higher, the euphoria in the stock

markets over QE-2 is misguided. A similar example is the events leading up to

Back Monday, October 1987. At best, the results of QE-2 would simply guide the

US-economy into the "Stagflation" trap. Buying Gold or physical Silver Bullion

today...?