After a week of modest gains with volatile swings in both directions, Friday closed with stocks mixed, light volume, and questions over the future profits of two blue-chip heavyweights — American Express Company (NYSE: AXP ) and Verizon Communications Inc. (NYSE: VZ ). Over 100 of the S&P 500 companies reported earnings, including 12 of the Dow 30. American Express fell 3.1% on weak demand for new loans, while Verizon fell 1.3% on disappointment over slow growth in the wireless area. But both exceeded earnings estimates, which illustrates investors’ focus on future expectations. Amazon.com, Inc. (NASDAQ: AMZN ) beat earnings estimates and rose 2.5%, and Schlumberger Limited (NYSE: SLB ) jumped 5.4% as it too beat estimates. But Exelon Corporation (NYSE: EXC ) fell 3.5% after an increase in Q3 earnings of 12% and falling operating margins due to higher costs. Overhanging the market is the G-20 meeting in South Korea. The finance ministers and central bankers of key nations are meeting to reach agreement on “managing exchange rates and cool what has been called a ‘currency war’” (Wall Street Journal). Treasury prices fell Friday, as investors sold bonds in preparation of a $109 billion new debt supply this week. The 10-year Treasury note fell 8/32 to push the yield to 2.563%. The bond market fell on Thursday following a comment by Federal Reserve Bank of St. Louis President James Bullard who he sees “small increments” of Treasury-bond purchases when the Fed meets in early November. The U.S. dollar rose, which offset some of the losses earlier in the week. The greenback closed on Friday at $1.3929 versus $1.3925 on Thursday. At Friday’s close, the Dow Jones Industrial Average was off 14 points to 11,133, the S&P 500 rose 3 points to 1,183, and the Nasdaq gained 20 points at 2,479. The NYSE traded only 772 million shares with advancers ahead of decliners by 1.5-to-1. On the Nasdaq, advancers were ahead by 1.75-to-1 on volume of 445 million shares. For the week, the Dow gained 0.6%, the S&P 500 rose 0.6%, and the Nasdaq was up 0.4%. On Friday, crude oil for December delivery rose $1.13 to $81.69 a barrel, and the Energy Select Sector SPDR (NYSE: XLE ) gained 39 cents, closing at $59.30. December gold fell 50 cents to $1,325.10 an ounce with traders “saying that most of the currency-related jitters surrounding the potential for further U.S. monetary easing have been priced into the market” (Wall Street Journal). The PHLX Gold/Silver Sector Index (NASDAQ: XAU ) closed at 196.82, up 0.34 points. What the Markets Are Saying There is really very little to be said of the market’s action last week other than the fact that the volatility or “sound and fury” of early in the week was apparently “signifying nothing,” to borrow a line from Shakespeare. But Friday may have provided a clue as to the future direction of the market with volume at one of the lowest days of the entire year. Last week, the Dow added 70 points, the S&P 500 was up 7 points, and the Nasdaq gained 11 points — not a spectacular week for the bulls, but enough to keep them plodding ahead. To summarize the last couple of weeks: The S&P 500 spiked through its 200-day moving average and the double-top at 1,130, and in a little over a month ran to the major resistance at the bottom of April’s trading diamond at 1,185. It also popped over the January trading peak at 1,150 and the flash crash rebound at 1,173. This is an impressive performance, so what is there not to like? Well, first there were very modest stock gains despite 88% of companies that reported last week topping EPS estimates and 62% had better-than-expected revenues. And, to put it in the words of MarketWatch’s Michael Ashbaugh, there could be some looming trouble ahead from a “second 9-to-1 downdraft within the next several sessions (piling on Tuesday’s 9-to-1 sell-off). I would add that Friday’s puny volume numbers and stalling prices in the midst of some glowing earnings reports makes me more than just a little uncomfortable. We would not want to see more solid earnings reports or better economic numbers with accompanying declines in stock prices — that scenario could turn into a ‘good news/bad market reaction’ that often precedes a pullback.” Until the April high is resolved, I’ll remain a very cautious bull. For one of the stocks you should be bullish on, see my Trade of the Day . Today’s Trading Landscape Earnings to be reported before the opening include: Bank of Hawaii, Boardwalk Pipeline, Boyd Gaming, Ceragon, Changyou.com, DSP Group, Kaiser Aluminum, KVH Industries, Lorillard, M/I Homes, NuStar Energy, NV Energy, RadioShack, Roper Industries, Sohu.com and Tuesday Morning. Earnings to be reported after the close include: Aaron’s, Advent Software, Amgen, Arch Capital, Atheros Communications, BancorpSouth, Basic Energy Services, BE Aerospace, Cabot Oil & Gas, Chemed, Covenant Transport, Crane, Developers Diversified Realty, Digital River, East West Bancorp, Edwards Lifesciences, Energy XXI, Ferro, Harris, Heartland Financial, Hexcel, Insituform Technologies, Integrated Device, Kilroy Realty, Masco, Matrixx Initiatives, MIPS Technologies, Nara Bancorp, National Instruments, Olin, Owens & Minor, Plum Creek, PLX Technology, Reinsurance Group of America, Rent-A-Center, SL Green Realty, Synovus, Texas Instruments, Ultra Clean Holdings, Veeco Instruments, Vertex Pharmaceuticals, Volterra Semiconductor, W.R. Berkley, Zix Corp. and Zoran. Economic report due: existing home sales (the consensus expects 4.3 million). If you have questions or comments for Sam Collins, please e-mail him at samailc@cox.net .

tdp2664

gol2664

InvestorPlace

Gold, Mining, silver, index, prices, today, oil, crude, dow jones, nasdaq, s&p 500, TSX, barrick gold, toromocho, CUP, goog, msft, aapl, finance, yahoo, bing, google,currency converter, currency, rates, currency tool, currency trading, currency transfers, foreign exchange, conversion, , live currency rates, mid-market, obsolete, precious metals, rate calculations, save money, save time, special units, tips, trade currency, up to the minute, world currency, xe trade, currency symbols

Monday, October 25, 2010

The Good News/Bad News About This Market

Top NYSE Pre-Market Stock Gainers (BYD, ODP, General Electric)

Boyd Gaming Corporation (NYSE:BYD) added 0.13% to $8 in pre market trading hours. The company said Monday its third-quarter earnings slipped to $5.6 million, or 6 cents a share, from $6.3 million, or 7 cents a share, in the year-ago period. Analysts polled by FactSet Research were looking for earnings of 5 cents a share, on average. Revenue fell 4.1% to $595.4 million from $620.8 million. The Wall Street consensus was for sales of $575.9 million. The company has a market capitalization of $688.95 million. Office Depot, Inc. (NYSE:ODP) added 6.91% to $4.95 during the pre market. The company on Monday said Chairman and CEO Steve Odland will resign on Nov. 1. Board member Neil Austrian will serve as interim chief executive officer and chairman while the board searches for a replacement. The company said it expects third-quarter earnings of 3 cents a share, excluding a one-time gain of 15 cents a share, and revenue of $2.9 billion, compared to the Wall Street estimate for a loss of 2 cents a share and revenue of $2.9 billion, in a survey of analysts by FactSet Research. The stock has a 52-week range of $3.36-$9.19 and is down more than 29% year-to-date. General Electric Company (NYSE:GE) advanced 0.72% to $16.17 in pre market hours. The company said Monday it won a $750 million contract to expand an electric power station in Andhra Pradesh, India, with gas turbines. The company said the deal includes the sale of six Frame 9FA gas turbines, three D-11 steam turbines, training, and long-term services. As of now, the market capitalization of the company stood at $171.65 billion.

tdp2664

Newsworthy Stocks

Double Bravo for Goldmans!

Pay on Wall Street is on pace to break a record for a second consecutive year…

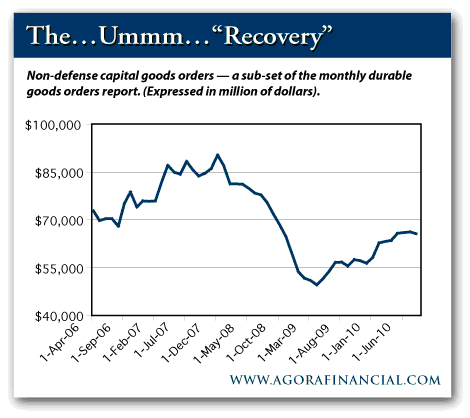

NO MATTER how many times the Conference Board reports dismal consumer confidence, or the Institute for Supply Management reports anemic manufacturing activity, or the National Association of Realtors reports abysmal home sales, some economist somewhere will track down a hopeful data point and force-feed it into his “improving economy” scenario, writes Eric Fry, reporting from Laguna Beach, California, for The Daily Reckoning.

When, for example, the Census Bureau reported a steep 1.3% drop in durable goods orders last month, the chief US economist at Barclays Capital, Dean Maki, crowed, “This is reassuring news. Capital goods spending still seems to be on a very solid underlying trend.”

Ah yes, capital goods spending – the sub-sector of the durable goods report that is believed to correlate closely with private-sector business activity.

It’s true that capital goods orders rebounded 4.1% in August…after plunging 5.3% in July. Nevertheless, according to Maki’s perspective, investors should ignore July’s drop in capital goods orders (and also ignore the drop in overall durable goods orders in August). It is the August increase in capital goods orders that matters most, says he, and it is this data point that establishes a “very solid underlying trend.”

But as the chart below shows quite clearly, this “solid trend” is looking a bit shaky.

Capital goods orders may have bounced off the bottom of very depressed levels, but they are stalling well below optimal levels. The same could be said for the overall American economy. It is bouncing off of depressed levels. But this bounce seems to contain a strange and unhealthy mix of losers and winners.

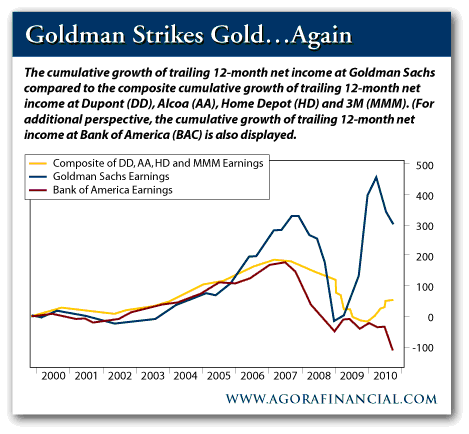

Fifteen months after the official end of the 2008-9 recession, America’s big metal-bending corporations still aren’t bending very much metal. Meanwhile, America’s big regulation-bending corporations like Goldman Sachs have returned from the brink of extinction to convert leveraged trading into record profits…or at least record bonuses.

Despite a financial crisis that nearly doomed Goldman Sachs for all- time, the reviled financial firm recently reported all-time record profits. Goldman’s third quarter result pulled the company’s trailing 12-month profit down from record territory. But that “disappointing” $1.9 billion quarterly profit owed much of its disappointment to the hefty $3.8 billion bonus expense that Goldman set aside during the quarter. For the first nine months of the year, Goldman has booked a net profit of $6 billion, while setting aside $13.1 billion in bonus expense.

Bravo for Goldman shareholders! Double bravo for Goldman insiders!

Elsewhere on Wall Street, a similar story has been unfolding. “Pay on Wall Street is on pace to break a record for a second consecutive year,” the Wall Street Journal reported recently. Even though net profits at the top financial firms remain about 20% below the peak levels of 2006, the Journal relates, compensation has increased more than 20% over the same timeframe. And just like that, you’ve got record compensation. “Financial overhaul has affected the structure [of Wall Street compensation],” says the Journal, “but not the level.”

But while prosperity has been quick to return to Wall Street, it has been slow to return to the American manufacturing sector. In the chart below, the yellow line tracks the combined earnings growth of four big “dirty fingernails” American companies: Dupont, Alcoa, Home Depot and 3M. The blue line tracks the same trend for Goldman Sachs. The two lines do not look very similar, do they? The yellow line is downward- sloping and remains well below the high-water mark of 2007. The blue line is upward-sloping and has exceeded the high-water mark of 2007.

And the red line? That’s Bank of America’s dismal profit trend. The big bank doesn’t bend metal, of course, but it does operate in almost every corner of American commerce, both industrial and consumer. Res ipsa loquitur.

And yet, despite the fact that Bank of America is still struggling and most of the manufactures of America are merely kicking the can down the road, quirky signs of apparent economic resurgence appear from time to time.

During a brief jaunt up to San Francisco last weekend, your editor encountered a sold-out city. On Saturday night, every single 4-star and a 5-star hotel in San Francisco was sold out. Not a single luxury hotel room available – which meant that the few available 3-star hotels were asking 4-star prices. Two-star hotels, for their part, were trying to extract three-star prices. But your editor declined the price-gouging and took his lodging Dollars up across the Golden Gate Bridge to Marin County.

For less than the price of an overpriced three-star hotel in San Francisco, your editor took a room at the delightful San Anselmo Inn. And with the money he saved, he purchased a fantastic meal at Insalata, a restaurant across the street from the Inn. The restaurant was full, though not jam-packed.

Elsewhere in Barbara Boxer-land, the story was the same. From Carmel to Los Gatos to San Francisco, your editor and his entourage strolled into restaurants that were full, without being jam-packed. They waited 15 to 20 minutes for a table in almost every venue.

But these random, narrowly focused anecdotes do not square with most of the evidence from the front lines of capital formation. A lifelong friend of your editor’s – whose family has been operating a very successful specialty steel business in Southern California for the last several decades – is enjoying much less success today than in years past. This steel business that once threw off hundreds of thousands of Dollars per month in profit, now throws off red ink every once in a while. On an annual basis the business is still profitable, but topline sales remain about 40% below the peak levels of three years ago.

“Can you see any signs of a pickup in activity?” we asked our friend last week.

“Nope. Nuthin’…We’ve got the same customers we’ve always had – at least the ones who haven’t gone out of business – but they’re all placing much smaller orders than they used to. So the guys who used to place $100,000 orders are placing $10,000 or $20,000 orders. Everyone is cautious. No one wants to hold any inventory. And everybody I know is telling the exact same story.”

Busy trading desks in Manhattan and busy restaurants in San Francisco are not signs of recession. But neither are barely profitable manufacturing businesses the signs of recovery.

The current economic rebound still feels more like hope than substance, more like a Wall Street fairy tale than a Main Street reality. On the other hand, the stories of economic vitality that are flowing out of the world’s emerging markets seem to be very real indeed.

Gold Investment – simple, secure and cost-effective at BullionVault…

gol2664

Top Percentage Gainers (CommScope, Inc., Sohu.com Inc.)

CommScope, Inc. (NYSE:CTV) soared 29.50% to $29.95 on hefty volume after the company confirmed that it is in discussions with The Carlyle Group regarding a take-over deal. The deal will allow The Carlyle Group, a private equity firm to acquire all of the outstanding shares of CommScope for $31.50 a share in cash. CommScope, Inc. (CommScope), along with its subsidiaries, is a provider of infrastructure solutions for communication networks. The Company, through its Andrew Solutions brand, offers radio frequency subsystem solutions for wireless networks. Sohu.com Inc. (NASDAQ:SOHU) climbed 11.33% to $73.21 and made a new 52-week high of $74.99 after the company said its net profit rose to $41 million or $1.01 a share from $37.4 million or 88 cents a share, a year earlier. Revenue surged 20% to $164.1 million from $136.6 million. Analysts were expecting the company to report 90 cents a share, on revenue of $156.7 million. Sohu said operating expenses excluding share-based compensation rose 7% from a year earlier to $50.1 million. For the current quarter, the company sees non-GAAP earnings of $1.10 – $1.15 a share, on revenue of $163 million to $168 million. Compared to analysts estimates of earnings of 95 cents a share, on revenue of $162.6 million. Sohu.com Inc. (Sohu) is an Internet company in China, providing Chinese with news, information, entertainment and communication. The Company's business consists of advertising, online game and wireless business. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Fastest-Growing U.S.-Listed International Stocks (Oct 25, 2010)

This ranking was UPDATED TODAY before 4:30 AM ET. Below are the fastest-growing U.S.-listed international stocks based on Wall Street analysts' consensus estimate of annual EPS growth over the long term (3-5 years). CLICK HERE for Fastest-Growing Chinese Stocks Listed in U.S.

Ranking | Company (Ticker) | Long-Term Growth | Country/Region

1 Endeavour Silver Corp. (CAN) (AMEX:EXK) 1619.0% Canada

2 Silver Standard Resources Inc. (USA) (NASDAQ:SSRI) 539.0% Canada

3 MakeMyTrip Limited (NASDAQ:MMYT) 150.0% India

4 Golar LNG Limited (USA) (NASDAQ:GLNG) 134.0% Bermuda

5 AngloGold Ashanti Limited (ADR) (NYSE:AU) 113.2% South Africa

6 Radware Ltd. (NASDAQ:RDWR) 103.0% Israel

7 ING Groep N.V. (ADR) (NYSE:ING) 97.8% Netherlands

8 Aurizon Mines Ltd.(USA) (AMEX:AZK) 87.0% Canada

9 Randgold Resources Ltd. (ADR) (NASDAQ:GOLD) 70.5% Jersey

10 AEGON N.V. (ADR) (NYSE:AEG) 70.3% Netherlands

11 CTC Media, Inc. (NASDAQ:CTCM) 69.9% Russia

12 Silvercorp Metals Inc. (USA) (NYSE:SVM) 68.0% Canada

13 Aixtron AG (ADR) (NASDAQ:AIXG) 64.2% Germany

14 Baidu.com, Inc. (ADR) (NASDAQ:BIDU) 60.7% China

15 Kyocera Corporation (ADR) (NYSE:KYO) 56.9% Japan

16 Cemex SAB de CV (ADR) (NYSE:CX) 56.3% Mexico

17 Cosan Limited (NYSE:CZZ) 53.9% Brazil

18 Yongye International, Inc. (NASDAQ:YONG) 53.7% China

19 Toyota Motor Corporation (ADR) (NYSE:TM) 53.1% Japan

20 TIM Participacoes SA (ADR) (NYSE:TSU) 47.7% Brazil

21 Methanex Corporation (USA) (NASDAQ:MEOH) 46.0% Canada

22 Autoliv Inc. (NYSE:ALV) 43.7% Sweden

23 Mitsui & Co., Ltd. (ADR) (NASDAQ:MITSY) 40.0% Japan

24 Lloyds TSB Group plc (ADR) (NYSE:LYG) 40.0% United Kingdom

25 MercadoLibre, Inc. (NASDAQ:MELI) 39.8% Argentina

26 Gerdau SA (ADR) (NYSE:GGB) 38.2% Brazil

27 China Petroleum & Chemical Corp. (ADR) (NYSE:SNP) 38.2% China

28 SMART Technologies Inc (NASDAQ:SMT) 38.0% Canada

29 Nomura Holdings, Inc. (ADR) (NYSE:NMR) 36.9% Japan

30 China Marine Food Group Ltd (AMEX:CMFO) 36.0% China

31 China-Biotics Inc. (NASDAQ:CHBT) 35.5% China

32 AutoNavi Holdings Ltd (NASDAQ:AMAP) 35.0% China

33 LJ International, Inc. (NASDAQ:JADE) 35.0% Hong Kong

34 Tata Motors Limited (ADR) (NYSE:TTM) 35.0% India

35 Allot Communications Ltd. (NASDAQ:ALLT) 35.0% Israel

36 ORIX Corporation (ADR) (NYSE:IX) 34.2% Japan

37 Cameco Corporation (USA) (NYSE:CCJ) 34.0% Canada

38 Yingli Green Energy Hold. Co. Ltd. (ADR) (NYSE:YGE) 33.4% China

39 CNinsure Inc. (NASDAQ:CISG) 32.5% China

40 China GengSheng Minerals, Inc. (AMEX:CHGS) 32.0% China

41 Fomento Economico Mexicano SAB (ADR) (NYSE:FMX) 31.4% Mexico

42 Aegean Marine Petroleum Network Inc. (NYSE:ANW) 31.2% Greece

43 E-House (China) Holdings Limited (NYSE:EJ) 31.0% China

44 Weatherford International Ltd. (NYSE:WFT) 31.0% Switzerland

45 HSBC Holdings plc (ADR) (NYSE:HBC) 30.7% United Kingdom

46 Duoyuan Global Water Inc (NYSE:DGW) 30.1% China

47 SunOpta, Inc. (USA) (NASDAQ:STKL) 30.0% Canada

48 Shiner International, Inc. (NASDAQ:BEST) 30.0% China

49 Chinacast Education Corporation (NASDAQ:CAST) 30.0% China

50 Charm Communications Inc (NASDAQ:CHRM) 30.0% China

51 China Jo Jo Drugstores Inc (NASDAQ:CJJD) 30.0% China

52 China Ritar Power Corp. (NASDAQ:CRTP) 30.0% China

53 Deer Consumer Products, Inc. (NASDAQ:DEER) 30.0% China

54 Home Inns & Hotels Management Inc. (ADR) (NASDAQ:HMIN) 30.0% China

55 Telestone Technologies Corporation (NASDAQ:TSTC) 30.0% China

56 HDFC Bank Limited (ADR) (NYSE:HDB) 30.0% India

57 Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP) 29.6% China

58 Sinovac Biotech Ltd. (NASDAQ:SVA) 29.0% China

59 Harmony Gold Mining Co. (ADR) (NYSE:HMY) 28.6% South Africa

60 Winner Medical Group, Inc (NASDAQ:WWIN) 28.0% China

61 Companhia Siderurgica Nacional (ADR) (NYSE:SID) 27.7% Brazil

62 VanceInfo Technologies Inc. (NYSE:VIT) 27.6% China

63 Eurand N.V. (NASDAQ:EURX) 27.5% Netherlands

64 BT Group plc (ADR) (NYSE:BT) 27.5% United Kingdom

65 Navios Maritime Holdings Inc. (NYSE:NM) 27.1% Greece

66 New Oriental Education & Tech. Group Inc (NYSE:EDU) 26.9% China

67 Lululemon Athletica inc. (NASDAQ:LULU) 26.9% Canada

68 Gold Fields Limited (ADR) (NYSE:GFI) 26.1% South Africa

69 Seaspan Corporation (NYSE:SSW) 25.3% Hong Kong

70 China Medical Technologies, Inc. (ADR) (NASDAQ:CMED) 25.1% China

71 Cresud Inc. (ADR) (NASDAQ:CRESY) 25.0% Argentina

72 China Advanced Con. Materials Gr. Inc (NASDAQ:CADC) 25.0% China

73 China Education Alliance, Inc. (NYSE:CEU) 25.0% China

74 China Fire & Security Group, Inc. (NASDAQ:CFSG) 25.0% China

75 IFM Investments Limited (NYSE:CTC) 25.0% China

76 SmartHeat Inc (NASDAQ:HEAT) 25.0% China

77 QKL Stores Inc (NASDAQ:QKLS) 25.0% China

78 Spreadtrum Communications, Inc. (NASDAQ:SPRD) 25.0% China

79 7 DAYS GROUP HOLDINGS LIMITED(ADR) (NYSE:SVN) 25.0% China

80 Tri-Tech Holding, Inc. (NASDAQ:TRIT) 25.0% China

81 Dr. Reddy's Laboratories Limited (ADR) (NYSE:RDY) 25.0% India

82 Goldcorp Inc. (USA) (NYSE:GG) 24.8% Canada

83 Vivo Participacoes SA (ADR) (NYSE:VIV) 24.5% Brazil

84 China New Borun Corp (NYSE:BORN) 24.5% China

85 Open Text Corporation (USA) (NASDAQ:OTEX) 24.4% Canada

86 Harbin Electric, Inc. (NASDAQ:HRBN) 24.3% China

87 ReneSola Ltd. (ADR) (NYSE:SOL) 24.3% China

88 China Nuokang Bio-Pharmaceutical Inc. (NASDAQ:NKBP) 24.0% China

89 ICICI Bank Limited (ADR) (NYSE:IBN) 24.0% India

90 Koninklijke Philips Electronics NV (ADR) (NYSE:PHG) 24.0% Netherlands

91 Companhia Brasileira de Distrib. (ADR) (NYSE:CBD) 23.9% Brazil

92 Credicorp Ltd. (USA) (NYSE:BAP) 23.8% Peru

93 Longtop Financial Technologies Limited (NYSE:LFT) 23.7% China

94 Trina Solar Limited (ADR) (NYSE:TSL) 23.6% China

95 China Real Estate Information Corp (NASDAQ:CRIC) 23.4% China

96 American Dairy, Inc. (NYSE:ADY) 23.3% China

97 Camelot Information Systems Inc (NYSE:CIS) 23.3% China

98 China Distance Education Holdings Ltd. (NYSE:DL) 23.3% China

99 China Information Security Tech, Inc. (NASDAQ:CNIT) 23.0% China

100 Yuhe International, Inc (NASDAQ:YUII) 22.6% China

101 IMAX Corporation (USA) (NASDAQ:IMAX) 22.5% Canada

102 AsiaInfo-Linkage, Inc. (NASDAQ:ASIA) 22.5% China

103 China Integrated Energy, Inc. (NASDAQ:CBEH) 22.5% China

104 Fundtech Ltd. (NASDAQ:FNDT) 22.5% Israel

105 Tyco Electronics Ltd. (NYSE:TEL) 22.5% Switzerland

106 China TransInfo Technology Corp. (NASDAQ:CTFO) 22.0% China

107 51job, Inc. (ADR) (NASDAQ:JOBS) 22.0% China

108 China Kanghui Holdings (NYSE:KH) 22.0% China

109 HONDA MOTOR CO., LTD. (ADR) (NYSE:HMC) 21.9% Japan

110 Concord Medical Services Holding Ltd. (NYSE:CCM) 21.7% China

111 China Life Insurance Company Ltd. (ADR) (NYSE:LFC) 21.6% China

112 China Green Agriculture, Inc (NYSE:CGA) 21.3% China

113 UTi Worldwide Inc. (NASDAQ:UTIW) 21.1% Virgin Islands, British

114 Wimm-Bill-Dann Foods OJSC (ADR) (NYSE:WBD) 21.1% Russia

115 Ecopetrol S.A. (ADR) (NYSE:EC) 21.0% Colombia

116 AirMedia Group Inc. (ADR) (NASDAQ:AMCN) 20.7% China

117 Siemens AG (ADR) (NYSE:SI) 20.5% Germany

118 RRSat Global Communications Network Ltd. (NASDAQ:RRST) 20.5% Israel

119 Validus Holdings, Ltd. (NYSE:VR) 20.4% Bermuda

120 Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL) 20.0% Bermuda

121 PolyMet Mining Corp. (USA) (AMEX:PLM) 20.0% Canada

122 A-Power Energy Generation Systems, Ltd. (NASDAQ:APWR) 20.0% China

123 ATA Inc.(ADR) (NASDAQ:ATAI) 20.0% China

124 China Housing & Land Development, Inc. (NASDAQ:CHLN) 20.0% China

125 China Cord Blood Corp (NYSE:CO) 20.0% China

126 China Valves Technology, Inc. (NASDAQ:CVVT) 20.0% China

127 HiSoft Technology International Limited (NASDAQ:HSFT) 20.0% China

128 SinoHub Inc (AMEX:SIHI) 20.0% China

129 VisionChina Media Inc (NASDAQ:VISN) 20.0% China

130 Xinyuan Real Estate Co., Ltd. (ADR) (NYSE:XIN) 20.0% China

131 ClickSoftware Technologies Ltd. (NASDAQ:CKSW) 20.0% Israel

132 Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) 20.0% Luxembourg

133 Advanced Semiconductor Engineering (ADR) (NYSE:ASX) 20.0% Taiwan

134 Siliconware Precision Industries (ADR) (NASDAQ:SPIL) 20.0% Taiwan

135 Gafisa SA (ADR) (NYSE:GFA) 19.8% Brazil

136 Given Imaging Ltd. (NASDAQ:GIVN) 19.7% Israel

137 Imperial Oil Limited (USA) (AMEX:IMO) 19.5% Canada

138 Wonder Auto Technology, Inc. (NASDAQ:WATG) 19.5% China

139 Sensata Technologies Holding N.V. (NYSE:ST) 19.5% Netherlands

140 NetEase.com, Inc. (ADR) (NASDAQ:NTES) 19.4% China

141 Orthofix International NV (NASDAQ:OFIX) 19.3% Netherland Antilles

142 Veolia Environnement (ADR) (NYSE:VE) 19.3% France

143 Compania de Minas Buenaventura SA (ADR) (NYSE:BVN) 19.2% Peru

144 Canadian Solar Inc. (NASDAQ:CSIQ) 19.0% China

145 Gulf Resources, Inc. (NASDAQ:GFRE) 19.0% China

146 City Telecom (H.K.) Limited (ADR) (NASDAQ:CTEL) 19.0% Hong Kong

147 VistaPrint NV (NASDAQ:VPRT) 18.9% Bermuda

148 Ryanair Holdings plc (ADR) (NASDAQ:RYAAY) 18.9% Ireland

149 LDK Solar Co., Ltd. (NYSE:LDK) 18.9% China

150 Banco Santander-Chile (ADR) (NYSE:SAN) 18.7% Chile

151 Suntech Power Holdings Co., Ltd. (ADR) (NYSE:STP) 18.6% China

152 Tenaris S.A. (ADR) (NYSE:TS) 18.5% Luxembourg

153 Mindray Medical International Limited (NYSE:MR) 18.4% China

154 ZHONGPIN INC. (NASDAQ:HOGS) 18.3% China

155 Solarfun Power Holdings Co., Ltd. (ADR) (NASDAQ:SOLF) 18.3% China

156 3SBio Inc. (ADR) (NASDAQ:SSRX) 18.0% China

157 Nidec Corporation (ADR) (NYSE:NJ) 17.8% Japan

158 Genpact Limited (NYSE:G) 17.6% Bermuda

159 Novo Nordisk A/S (ADR) (NYSE:NVO) 17.5% Denmark

160 Duoyuan Printing, Inc. (NYSE:DYP) 17.5% China

161 JinkoSolar Holding Co., Ltd. (NYSE:JKS) 17.5% China

162 WuXi PharmaTech (Cayman) Inc. (ADR) (NYSE:WX) 17.5% China

163 Endurance Specialty Holdings Ltd. (NYSE:ENH) 17.4% Bermuda

164 Ceragon Networks Ltd. (NASDAQ:CRNT) 17.3% Israel

165 Sorl Auto Parts, Inc. (NASDAQ:SORL) 17.3% China

166 Tele Norte Leste Participacoes SA (ADR) (NYSE:TNE) 17.2% Brazil

167 Ritchie Bros. Auctioneers (USA) (NYSE:RBA) 17.1% Canada

168 Global Sources Ltd. (Bermuda) (NASDAQ:GSOL) 17.0% Bermuda

169 CDC Software Corp (NASDAQ:CDCS) 17.0% Hong Kong

170 Nice Systems Ltd. (ADR) (NASDAQ:NICE) 17.0% Israel

171 Wipro Limited (ADR) (NYSE:WIT) 16.8% India

172 WNS (Holdings) Limited (ADR) (NYSE:WNS) 16.7% India

173 China Automotive Systems, Inc. (NASDAQ:CAAS) 16.7% China

174 Marvell Technology Group Ltd. (NASDAQ:MRVL) 16.6% Bermuda

175 China Security & Surveillance Tech. Inc. (NYSE:CSR) 16.6% China

176 Infosys Technologies Limited (ADR) (NASDAQ:INFY) 16.5% India

177 Hollysys Automation Technologies Ltd (NASDAQ:HOLI) 16.5% China

178 Transocean LTD (NYSE:RIG) 16.5% Switzerland

179 Perfect World Co., Ltd. (ADR) (NASDAQ:PWRD) 16.3% China

180 SINA Corporation (USA) (NASDAQ:SINA) 16.2% China

181 Simcere Pharmaceutical Group (NYSE:SCR) 16.0% China

182 China Precision Steel, Inc. (NASDAQ:CPSL) 16.0% Hong Kong

183 Core Laboratories N.V. (NYSE:CLB) 16.0% Netherlands

184 Anheuser-Busch InBev NV (ADR) (NYSE:BUD) 15.7% Belgium

185 Warner Chilcott Plc (NASDAQ:WCRX) 15.5% Ireland

186 Schlumberger Limited. (NYSE:SLB) 15.1% Netherland Antilles

187 American Safety Insurance Holdings, Ltd. (NYSE:ASI) 15.0% Bermuda

188 Alpha Pro Tech, Ltd. (AMEX:APT) 15.0% Canada

189 DragonWave, Inc.(USA) (NASDAQ:DRWI) 15.0% Canada

190 Tim Hortons Inc. (USA) (NYSE:THI) 15.0% Canada

191 Vitran Corporation, Inc. (USA) (NASDAQ:VTNC) 15.0% Canada

192 Herbalife Ltd. (NYSE:HLF) 15.0% Cayman Islands

193 O2Micro International Limited (ADR) (NASDAQ:OIIM) 15.0% Cayman Islands

194 American Lorain Corporation (AMEX:ALN) 15.0% China

195 Fushi Copperweld, Inc. (NASDAQ:FSIN) 15.0% China

196 Jinpan International Limited (NASDAQ:JST) 15.0% China

197 KongZhong Corporation (ADR) (NASDAQ:KONG) 15.0% China

198 Semiconductor Manufacturing Int'l (ADR) (NYSE:SMI) 15.0% China

199 BluePhoenix Solutions, Ltd.(USA) (NASDAQ:BPHX) 15.0% Israel

200 Natuzzi, S.p.A (ADR) (NYSE:NTZ) 15.0% Italy

201 KONAMI CORPORATION (ADR) (NYSE:KNM) 15.0% Japan

202 AerCap Holdings N.V. (NYSE:AER) 15.0% Netherlands

203 Avago Technologies Limited (NASDAQ:AVGO) 15.0% Singapore

204 POSCO (ADR) (NYSE:PKX) 15.0% South Korea

205 AU Optronics Corp. (ADR) (NYSE:AUO) 15.0% Taiwan

206 Himax Technologies, Inc. (ADR) (NASDAQ:HIMX) 15.0% Taiwan

207 Teva Pharmaceutical Industries Ltd (ADR) (NASDAQ:TEVA) 14.9% Israel

208 Coca-Cola FEMSA, S.A.B. de C.V. (ADR) (NYSE:KOF) 14.8% Mexico

209 JA Solar Holdings Co., Ltd. (ADR) (NASDAQ:JASO) 14.6% China

210 ChinaEdu Corporation (ADR) (NASDAQ:CEDU) 14.5% China

211 Chemspec International Ltd (NYSE:CPC) 14.5% China

212 CNH Global N.V. (ADR) (NYSE:CNH) 14.5% Netherlands

213 Changyou.com Limited(ADR) (NASDAQ:CYOU) 14.4% China

214 Banco Itau Holding Financeira S.A. (ADR) (NYSE:ITUB) 14.4% Brazil

215 Telvent Git, S.A (NASDAQ:TLVT) 14.4% Spain

216 Textainer Group Holdings Limited (NYSE:TGH) 14.3% Bermuda

217 Millicom International Cellular SA (USA) (NASDAQ:MICC) 14.2% Luxembourg

218 Gol Linhas Aereas Inteligentes SA (ADR) (NYSE:GOL) 14.0% Brazil

219 Mitel Networks Corporation (NASDAQ:MITL) 14.0% Canada

220 Patni Computer Systems Limited (ADR) (NYSE:PTI) 14.0% India

221 Logitech International SA (USA) (NASDAQ:LOGI) 14.0% Switzerland

222 ARM Holdings plc (ADR) (NASDAQ:ARMH) 14.0% United Kingdom

223 Mobile TeleSystems OJSC (ADR) (NYSE:MBT) 13.9% Russia

224 Shinhan Financial Group Co., Ltd. (ADR) (NYSE:SHG) 13.8% South Korea

225 Foster Wheeler Ltd. (NASDAQ:FWLT) 13.7% Switzerland

226 ENSCO PLC (NYSE:ESV) 13.7% United Kingdom

227 Lazard Ltd (NYSE:LAZ) 13.5% Bermuda

228 ShengdaTech, Inc. (NASDAQ:SDTH) 13.5% China

229 Verigy Ltd. (NASDAQ:VRGY) 13.5% Singapore

230 Research In Motion Limited (USA) (NASDAQ:RIMM) 13.4% Canada

231 Carnival plc (ADR) (NYSE:CUK) 13.4% United Kingdom

232 FirstService Corporation (USA) (NASDAQ:FSRV) 13.3% Canada

233 Shire Plc. (ADR) (NASDAQ:SHPGY) 13.3% United Kingdom

234 IRSA Inversiones Representaciones (ADR) (NYSE:IRS) 13.0% Argentina

235 Helen of Troy Limited (NASDAQ:HELE) 13.0% Bermuda

236 Brookfield Asset Management Inc. (USA) (NYSE:BAM) 13.0% Canada

237 Sasol Limited (ADR) (NYSE:SSL) 13.0% South Africa

238 Canadian Imperial Bank of Commerce (USA) (NYSE:CM) 13.0% Canada

239 Companhia de Bebidas das Americas (ADR) (NYSE:ABV) 12.9% Brazil

240 Taiwan Semiconductor Mfg. Co. Ltd. (ADR) (NYSE:TSM) 12.9% Taiwan

241 Qiagen NV (NASDAQ:QGEN) 12.8% Netherlands

242 Signet Jewelers Ltd. (NYSE:SIG) 12.7% Bermuda

243 Axis Capital Holdings Limited (NYSE:AXS) 12.7% Bermuda

244 ICON plc (ADR) (NASDAQ:ICLR) 12.5% Ireland

245 EnCana Corporation (USA) (NYSE:ECA) 12.5% Canada

246 Flextronics International Ltd. (NASDAQ:FLEX) 12.5% Singapore

247 Crucell N.V. (ADR) (NASDAQ:CRXL) 12.3% Netherlands

248 SAP AG (ADR) (NYSE:SAP) 12.2% Germany

249 China Digital TV Holding Co., Ltd. (NYSE:STV) 12.2% China

250 Tyco International Ltd. (NYSE:TYC) 12.1% Switzerland

251 Ingersoll-Rand PLC (NYSE:IR) 12.0% Ireland

252 Global Crossing Ltd. (NASDAQ:GLBC) 12.0% Bermuda

253 The Bank of Nova Scotia (USA) (NYSE:BNS) 12.0% Canada

254 Celestica Inc. (USA) (NYSE:CLS) 12.0% Canada

255 Ness Technologies, Inc. (NASDAQ:NSTC) 12.0% Israel

256 China Yuchai International Limited (NYSE:CYD) 12.0% Singapore

257 Alcon, Inc. (NYSE:ACL) 12.0% Switzerland

258 UBS AG (USA) (NYSE:UBS) 12.0% Switzerland

259 Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS) 11.9% Germany

260 Smith & Nephew plc (ADR) (NYSE:SNN) 11.9% United Kingdom

261 Diageo plc (ADR) (NYSE:DEO) 11.8% United Kingdom

262 Amdocs Limited (NYSE:DOX) 11.8% United Kingdom

263 Covidien plc (NYSE:COV) 11.7% Ireland

264 Compania Cervecerias Unidas S.A. (ADR) (NYSE:CCU) 11.6% Chile

265 CAE, Inc. (USA) (NYSE:CAE) 11.5% Canada

266 Noble Corporation (NYSE:NE) 11.5% Cayman Islands

267 Chicago Bridge & Iron Company N.V. (NYSE:CBI) 11.5% Netherlands

268 Portugal Telecom, SGPS (ADR) (NYSE:PT) 11.5% Portugal

269 Nokia Corporation (ADR) (NYSE:NOK) 11.4% Finland

270 Stantec Inc. (USA) (NYSE:STN) 11.3% Canada

271 China Gerui Adv Mtals Grp Ltd (NASDAQ:CHOP) 11.2% China

272 Mettler-Toledo International Inc. (NYSE:MTD) 11.2% Switzerland

273 Grupo Televisa, S.A. (ADR) (NYSE:TV) 11.1% Mexico

274 Accenture Plc (NYSE:ACN) 11.1% Ireland

275 Maiden Holdings, Ltd. (NASDAQ:MHLD) 11.0% Bermuda

276 Platinum Underwriters Holdings, Ltd. (NYSE:PTP) 11.0% Bermuda

277 Pan American Silver Corp. (USA) (NASDAQ:PAAS) 11.0% Canada

278 TELUS Corporation (USA) (NYSE:TU) 11.0% Canada

279 Check Point Software Technologies Ltd. (NASDAQ:CHKP) 10.8% Israel

280 Net Servicos de Comunicacao SA (ADR) (NASDAQ:NETC) 10.8% Brazil

281 PartnerRe Ltd. (NYSE:PRE) 10.7% Bermuda

282 Kubota Corporation (ADR) (NYSE:KUB) 10.6% Japan

283 America Movil SAB de CV (ADR) (NYSE:AMX) 10.5% Mexico

284 CRH PLC (ADR) (NYSE:CRH) 10.4% Ireland

285 Canadian Natural Resource Ltd (USA) (NYSE:CNQ) 10.3% Canada

286 Ternium S.A. (ADR) (NYSE:TX) 10.3% Luxembourg

287 Telecom Corp of New Zealand (ADR) (NYSE:NZT) 10.3% New Zealand

288 Triple-S Management Corp. (NYSE:GTS) 10.3% Puerto Rico

289 Rogers Communications Inc. (USA) (NYSE:RCI) 10.3% Canada

290 Canadian Pacific Railway Limited (USA) (NYSE:CP) 10.2% Canada

291 Arch Capital Group Ltd. (NASDAQ:ACGL) 10.2% Bermuda

292 Canadian National Railway (USA) (NYSE:CNI) 10.2% Canada

293 Willis Group Holdings PLC (NYSE:WSH) 10.2% United Kingdom

294 Steiner Leisure Limited (NASDAQ:STNR) 10.0% Bahamas

295 Argo Group International Holdings, Ltd. (NASDAQ:AGII) 10.0% Bermuda

296 Aspen Insurance Holdings Limited (NYSE:AHL) 10.0% Bermuda

297 Allied World Assurance Holdings, Ltd. (NYSE:AWH) 10.0% Bermuda

298 Enstar Group Ltd. (NASDAQ:ESGR) 10.0% Bermuda

299 Flagstone Reinsurance Holdings SA (NYSE:FSR) 10.0% Bermuda

300 Montpelier Re Holdings Ltd. (NYSE:MRH) 10.0% Bermuda

301 Everest Re Group, Ltd. (NYSE:RE) 10.0% Bermuda

302 Agnico-Eagle Mines Limited (USA) (NYSE:AEM) 10.0% Canada

303 Bank of Montreal (USA) (NYSE:BMO) 10.0% Canada

304 Descartes Systems Group (USA) (NASDAQ:DSGX) 10.0% Canada

305 Kingsway Financial Services Inc. (USA) (NYSE:KFS) 10.0% Canada

306 Manulife Financial Corporation (USA) (NYSE:MFC) 10.0% Canada

307 TransGlobe Energy Corporation (USA) (NASDAQ:TGA) 10.0% Canada

308 Global Indemnity plc (NASDAQ:GBLI) 10.0% Cayman Islands

309 Greenlight Capital Re, Ltd. (NASDAQ:GLRE) 10.0% Cayman Islands

310 Lan Airlines S.A. (ADR) (NYSE:LFL) 10.0% Chile

311 China Pharma Holdings, Inc. (AMEX:CPHI) 10.0% China

312 China Sunergy Co., Ltd. (ADR) (NASDAQ:CSUN) 10.0% China

313 China Nepstar Chain Drugstore Ltd. (NYSE:NPD) 10.0% China

314 Sutor Technology Group Ltd. (NASDAQ:SUTR) 10.0% China

315 DryShips Inc. (NASDAQ:DRYS) 10.0% Greece

316 CDC Corporation (NASDAQ:CHINA) 10.0% Hong Kong

317 Focus Media Holding Limited (ADR) (NASDAQ:FMCN) 10.0% Hong Kong

318 Tata Communications Limited (ADR) (NYSE:TCL) 10.0% India

319 Gilat Satellite Networks Ltd. (NASDAQ:GILT) 10.0% Israel

320 Ituran Location and Control Ltd. (US) (NASDAQ:ITRN) 10.0% Israel

321 Voltaire Ltd. (NASDAQ:VOLT) 10.0% Israel

322 Copa Holdings, S.A. (NYSE:CPA) 10.0% Panama

323 Telefonaktiebolaget LM Ericsson (ADR) (NASDAQ:ERIC) 10.0% Sweden

324 Credit Suisse Group AG (ADR) (NYSE:CS) 10.0% Switzerland

325 GigaMedia Limited (NASDAQ:GIGM) 10.0% Taiwan

326 Giant Interactive Group Inc (NYSE:GA) 10.0% China

327 ABB Ltd (ADR) (NYSE:ABB) 9.9% Switzerland

328 CGI Group Inc. (USA) (NYSE:GIB) 9.8% Canada

329 Mizuho Financial Group, Inc. (ADR) (NYSE:MFG) 9.7% Japan

330 ACE Limited (NYSE:ACE) 9.7% Switzerland

331 Alterra Capital Holdings Ltd. (NASDAQ:ALTE) 9.7% Bermuda

332 Mechel OAO (ADR) (NYSE:MTL) 9.7% Russia

333 Magna International Inc. (USA) (NYSE:MGA) 9.6% Canada

334 China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU) 9.6% Hong Kong

335 Seagate Technology PLC (NASDAQ:STX) 9.6% Ireland

336 Toronto-Dominion Bank (USA) (NYSE:TD) 9.5% Canada

337 Banco Bradesco SA (ADR) (NYSE:BBD) 9.5% Brazil

338 CNOOC Limited (ADR) (NYSE:CEO) 9.4% Hong Kong

339 Shanda Interactive Entertainment Ltd ADR (NASDAQ:SNDA) 9.4% China

340 Sun Life Financial Inc. (USA) (NYSE:SLF) 9.3% Canada

341 Cellcom Israel Ltd. (NYSE:CEL) 9.1% Israel

342 Barrick Gold Corporation (USA) (NYSE:ABX) 9.0% Canada

343 Teck Resources Limited (NYSE:TCK) 9.0% Canada

344 Empresa Nacional de Electricidad (ADR) (NYSE:EOC) 9.0% Chile

345 Luxottica Group S.p.A. (ADR) (NYSE:LUX) 9.0% Italy

346 Grupo Aeroportuario del Sureste (ADR) (NYSE:ASR) 8.9% Mexico

347 RenaissanceRe Holdings Ltd. (NYSE:RNR) 8.8% Bermuda

348 Enersis S.A. (ADR) (NYSE:ENI) 8.7% Chile

349 Enbridge Inc. (USA) (NYSE:ENB) 8.7% Canada

350 Gildan Activewear Inc. (USA) (NYSE:GIL) 8.5% Canada

351 Crude Carriers Corp. (NYSE:CRU) 8.5% Greece

352 Navios Maritime Partners L.P. (NYSE:NMM) 8.5% Greece

353 Telecom Argentina S.A. (ADR) (NYSE:TEO) 8.4% Argentina

354 Unilever plc (ADR) (NYSE:UL) 8.4% United Kingdom

355 WPP PLC (ADR) (NASDAQ:WPPGY) 8.4% Ireland

356 Rio Tinto plc (ADR) (NYSE:RIO) 8.3% United Kingdom

357 France Telecom SA (ADR) (NYSE:FTE) 8.1% France

358 Coca-Cola HBC S.A. (ADR) (NYSE:CCH) 8.1% Greece

359 Unilever N.V. (ADR) (NYSE:UN) 8.1% Netherlands

360 Cott Corporation (USA) (NYSE:COT) 8.0% Canada

361 Fuqi International, Inc. (NASDAQ:FUQI) 8.0% China

362 Oriental Financial Group Inc. (NYSE:OFG) 8.0% Puerto Rico

363 KB Financial Group, Inc. (ADR) (NYSE:KB) 8.0% South Korea

364 British American Tobacco (ADR) (AMEX:BTI) 8.0% United Kingdom

365 Assured Guaranty Ltd. (NYSE:AGO) 7.8% Bermuda

366 Delhaize Group (ADR) (NYSE:DEG) 7.7% Belgium

367 National Grid plc (ADR) (NYSE:NGG) 7.7% United Kingdom

368 BCE Inc. (USA) (NYSE:BCE) 7.7% Canada

369 Nabors Industries Ltd. (NYSE:NBR) 7.5% Bermuda

370 Companhia Energetica Minas Gerais (ADR) (NYSE:CIG) 7.5% Brazil

371 China Mass Media Intl Adv Corp. (ADR) (NYSE:CMM) 7.5% China

372 ASM International N.V. (USA) (NASDAQ:ASMI) 7.5% Netherlands

373 Syngenta AG (ADR) (NYSE:SYT) 7.5% Switzerland

374 ASML Holding N.V. (ADR) (NASDAQ:ASML) 7.3% Netherlands

375 Fresh Del Monte Produce Inc. (NYSE:FDP) 7.0% Cayman Islands

376 Alcatel-Lucent (ADR) (NYSE:ALU) 7.0% France

377 Trinity Biotech plc (ADR) (NASDAQ:TRIB) 7.0% Ireland

378 Partner Communications Company Ltd (ADR) (NASDAQ:PTNR) 7.0% Israel

379 Popular, Inc. (NASDAQ:BPOP) 7.0% Puerto Rico

380 Banco Bilbao Vizcaya Argentaria SA (ADR) (NYSE:BBVA) 7.0% Spain

381 InterContinental Hotels Group PLC (ADR) (NYSE:IHG) 7.0% United Kingdom

382 Kinross Gold Corporation (USA) (NYSE:KGC) 7.0% Canada

383 Shanda Games Limited(ADR) (NASDAQ:GAME) 6.8% China

384 TransCanada Corporation (USA) (NYSE:TRP) 6.7% Canada

385 Royal Bank of Canada (USA) (NYSE:RY) 6.7% Canada

386 Diana Shipping Inc. (NYSE:DSX) 6.6% Greece

387 Vodafone Group Plc (ADR) (NASDAQ:VOD) 6.5% United Kingdom

388 Andatee China Marine Fuel Ser Corp (NASDAQ:AMCF) 6.4% China

389 Telecom Italia S.p.A. (ADR) (NYSE:TI) 6.2% Italy

390 Brookfield Infrastructure Partners L.P. (NYSE:BIP) 6.0% Bermuda

391 Cenovus Energy Inc (ADR) (NYSE:CVE) 6.0% Canada

392 Suncor Energy Inc. (USA) (NYSE:SU) 6.0% Canada

393 Banco Latinoamericano de Comercio Exr SA (NYSE:BLX) 6.0% Panama

394 Woori Finance Holdings Co., Ltd. (ADR) (NYSE:WF) 6.0% South Korea

395 Sohu.com Inc. (NASDAQ:SOHU) 5.8% China

396 Companhia Paranaense de Energia (ADR) (NYSE:ELP) 5.5% Brazil

397 Embotelladora Andina SA (ADR) (NYSE:AKO.A) 5.5% Chile

398 Telefonica S.A. (ADR) (NYSE:TEF) 5.4% Spain

399 Brasil Telecom SA (ADR) (NYSE:BTM) 5.3% Brazil

400 Shaw Communications Inc. (USA) (NYSE:SJR) 5.3% Canada

401 Reed Elsevier NV (ADR) (NYSE:ENL) 5.3% Netherlands

402 China Telecom Corporation Limited (ADR) (NYSE:CHA) 5.2% China

403 Teekay LNG Partners L.P. (NYSE:TGP) 5.0% Bermuda

404 Knightsbridge Tankers Limited (NASDAQ:VLCCF) 5.0% Bermuda

405 Embraer – Empr Bras Aeronautica (ADR) (NYSE:ERJ) 5.0% Brazil

406 TAM S.A. (ADR) (NYSE:TAM) 5.0% Brazil

407 Agrium Inc. (USA) (NYSE:AGU) 5.0% Canada

408 Yamana Gold Inc. (USA) (NYSE:AUY) 5.0% Canada

409 CryptoLogic Limited (USA) (NASDAQ:CRYP) 5.0% Canada

410 Eldorado Gold Corporation (USA) (NYSE:EGO) 5.0% Canada

411 Gammon Gold, Inc. (NYSE:GRS) 5.0% Canada

412 Nexen Inc. (USA) (NYSE:NXY) 5.0% Canada

413 Talisman Energy Inc. (USA) (NYSE:TLM) 5.0% Canada

414 Noah Education Holdings Ltd. (ADR) (NYSE:NED) 5.0% China

415 Deutsche Bank AG (USA) (NYSE:DB) 5.0% Germany

416 Capital Product Partners L.P. (NASDAQ:CPLP) 5.0% Greece

417 Euroseas Ltd. (NASDAQ:ESEA) 5.0% Greece

418 Safe Bulkers, Inc. (NYSE:SB) 5.0% Greece

419 DHT Holdings Inc (NYSE:DHT) 5.0% Jersey

420 First BanCorp. (NYSE:FBP) 5.0% Puerto Rico

421 Garmin Ltd. (NASDAQ:GRMN) 5.0% Switzerland

422 BP plc (ADR) (NYSE:BP) 5.0% United Kingdom

423 Teekay Offshore Partners L.P. (NYSE:TOO) 4.8% Bermuda

424 Pearson PLC (ADR) (NYSE:PSO) 4.8% United Kingdom

425 Novartis AG (ADR) (NYSE:NVS) 4.6% Switzerland

426 PetroChina Company Limited (ADR) (NYSE:PTR) 4.6% China

427 China Mobile Ltd. (ADR) (NYSE:CHL) 4.5% Hong Kong

428 Royal Dutch Shell plc (ADR) (NYSE:RDS.A) 4.3% Netherlands

429 GlaxoSmithKline plc (ADR) (NYSE:GSK) 4.2% United Kingdom

430 Reed Elsevier plc (ADR) (NYSE:RUK) 4.2% United Kingdom

431 IESI BFC Ltd (NYSE:BIN) 4.0% Canada

432 Consolidated Water Co. Ltd. (NASDAQ:CWCO) 4.0% Cayman Islands

433 Danaos Corporation (NYSE:DAC) 4.0% Greece

434 Statoil ASA(ADR) (NYSE:STO) 4.0% Norway

435 Companhia de Saneamento Basico (ADR) (NYSE:SBS) 4.0% Brazil

436 Philippine Long Distance Telephone (ADR) (NYSE:PHI) 3.9% Philippines

437 Telecomunicacoes de Sao Paulo SA (ADR) (NYSE:TSP) 3.2% Brazil

438 Energy XXI (Bermuda) Limited (NASDAQ:EXXI) 3.0% Bermuda

439 IAMGOLD Corporation (USA) (NYSE:IAG) 3.0% Canada

440 TOTAL S.A. (ADR) (NYSE:TOT) 3.0% France

441 Eni S.p.A. (ADR) (NYSE:E) 3.0% Italy

442 Grupo Aeroportuario del Centro Nort(ADR) (NASDAQ:OMAB) 3.0% Mexico

443 KT Corporation (ADR) (NYSE:KT) 3.0% South Korea

444 SK Telecom Co., Ltd. (ADR) (NYSE:SKM) 3.0% South Korea

445 Silver Wheaton Corp. (USA) (NYSE:SLW) 2.0% Canada

446 Turkcell Iletisim Hizmetleri A.S. (ADR) (NYSE:TKC) 2.0% Turkey

447 Petroleo Brasileiro SA (ADR) (NYSE:PBR) 1.8% Brazil

448 XL Group plc (NYSE:XL) 1.8% Ireland

449 Domtar Corp. (USA) (NYSE:UFS) 1.5% Canada

450 Huaneng Power International, Inc. (ADR) (NYSE:HNP) 1.5% China

451 Westpac Banking Corporation (ADR) (NYSE:WBK) 1.4% Australia

452 BRF Brasil Foods SA(ADR) (NYSE:BRFS) 1.3% Brazil

453 Barclays PLC (ADR) (NYSE:BCS) 1.2% United Kingdom

454 Ivanhoe Energy Inc. (USA) (NASDAQ:IVAN) 1.0% Canada

455 CPFL Energia S.A. (ADR) (NYSE:CPL) 0.3% Brazil

456 Sociedad Quimica y Minera (ADR) (NYSE:SQM) 0.2% Chile

457 Central European Media Enterprises Ltd. (NASDAQ:CETV) 0.0% Bermuda

458 Teekay Tankers Ltd. (NYSE:TNK) 0.0% Bermuda

459 Sanofi-Aventis SA (ADR) (NYSE:SNY) 0.0% France

460 Mahanagar Telephone Nigam Limited (ADR) (NYSE:MTE) 0.0% India

461 Panasonic Corporation (ADR) (NYSE:PC) 0.0% Japan

462 United Microelectronics Corp (ADR) (NYSE:UMC) 0.0% Taiwan

463 AstraZeneca plc (ADR) (NYSE:AZN) -1.2% United Kingdom

464 Homex Development Corp. (ADR) (NYSE:HXM) -1.2% Mexico

465 Ship Finance International Limited (NYSE:SFL) -1.8% Bermuda

466 Valeant Pharmaceuticals Int (USA) (NYSE:VRX) -2.2% Canada

467 Grupo Aeroportuario del Pacifico (ADR) (NYSE:PAC) -2.9% Mexico

468 Telefonos de Mexico, S.A. (ADR) (NYSE:TMX) -3.2% Mexico

469 Petrobras Energia Participaciones SA ADR (NYSE:PZE) -4.3% Argentina

470 Magyar Telekom Plc. (ADR) (NYSE:MTA) -4.8% Hungary

471 Northgate Minerals Corporation (USA) (AMEX:NXG) -5.9% Canada

472 Sterlite Industries India Limited (ADR) (NYSE:SLT) -6.5% India

473 LG Display Co Ltd. (ADR) (NYSE:LPL) -7.9% South Korea

474 James Hardie Industries SE (NYSE:JHX) -11.2% Netherlands

475 National Bank of Greece (ADR) (NYSE:NBG) -22.2% Greece

476 Nordic American Tanker Shipping Limited (NYSE:NAT) -23.0% Bermuda

477 InterOil Corporation (USA) (NYSE:IOC) -27.9% Australia

478 Excel Maritime Carriers Ltd (NYSE:EXM) -29.2% Greece

479 CGG Veritas (ADR) (NYSE:CGV) -29.9% France

480 Frontline Ltd. (USA) (NYSE:FRO) -30.0% Bermuda

481 Teekay Corporation (NYSE:TK) -30.0% Bermuda

482 ArcelorMittal (ADR) (NYSE:MT) -34.2% Luxembourg

483 Orient-Express Hotels Ltd. (NYSE:OEH) -36.6% Bermuda

484 Braskem SA (ADR) (NYSE:BAK) -38.9% Brazil

tdp2664

China Analyst

Fastest-Growing U.S.-Listed International Stocks (Oct 25, 2010)

Market News: Pfizer Inc. (NYSE:PFE), Marathon Oil (NYSE:MRO), United Technologies Corp. (NYSE:UTX)

Here is another batch of stock briefings which may affect trading on world markets later today. The following listed companies should see some movement: Pfizer Inc. (NYSE:PFE), Marathon Oil (NYSE:MRO), United Technologies Corp. (NYSE:UTX). Here is a more detailed look at the news that will affect each company when trading continues. Pfizer Inc. (NYSE:PFE) Pfizer (NYSE:PFE) has bought a 40% stake in Brazilian generic drug maker Teuto. The stake worth $240 will help Pfizer (NYSE:PFE) to increase its participation in Brazils pharmaceutical market. Pfizer (NYSE:PFE) has also an option to buy the remaining stake of Teuto by 2014.The company said in an official statement that .” The deal shows the company’s commitment to pursue focused investments in key emerging markets to accelerate our growth and increase patient access to high-quality medicines.” Marathon Oil (NYSE:MRO) Marathon Oil (NYSE:MRO) has signed a contract for acquiring oil exploration blocks in Kurdistan region of Iraq. The new contract signed by Marathon Oil (NYSE:MRO) recently helps the company operate and take 80% share in two blocks and 20% working interest in other two. This will also boosts company's crude production. This contract marks the entry of Marathon Oil (NYSE:MRO) into Iraq, which has now operations in Canada, Angola and Libya. "The company will open and staff an office in the region," a spokeswoman said. United Technologies Corp. (NYSE:UTX) United Technologies (NYSE:UTX) has raised its third quarter profit up to 13%. Following gains in its Pratt&Whitney jet engines business, and the purchase of GE Security helped United Technologies (NYSE:UTX) to grow more than estimated. Chairman and Chief Executive Louis Chenevert said that “additional restructuring is in store as commercial aerospace aftermarket orders have rebounded nicely but the commercial construction markets remain weak." United Technologies (NYSE:UTX) has raised its full year guidance to $4.70 per share on an annual basis. Expect more movement when trading continues for Pfizer Inc. (NYSE:PFE), Marathon Oil (NYSE:MRO) and United Technologies Corp. (NYSE:UTX).

tdp2664

E money daily

Stocks in Review at NASDAQ (MIPS, ALKS, LINTA, CCME, ATPG)

Dear PSL members MIPS Technologies, Inc. confirmed about 4G chipmaker Sequans Communications selection of its MIPS32® M14Kc™ processor core to provide mobile solutions for next generation. The American Electronic Association Conference is going to be help from Nov 7-9, 2010 in which CEO and CFO of MIPS will present while the next day the executives would present in multiple sessions. MIPS Technologies, Inc. (NASDAQ:MIPS) plunged 1.56%, closing the day at $10.40 with the overall trading volume of 1.37 million shares for the day. Its market capitalization is $490.44 million and in 52 weeks the price range remained $3.44 – $10.50. Alkermes, Inc. (NASDAQ:ALKS) reported a fall of 0.27%, closing the day at $11.07 with the overall trading volume of 1.57 million shares for the day. Its market capitalization is $1.06 billion and in 52 weeks the price range remained $7.54 – $16.10. Liberty Media Corp (Interactive) (NASDAQ:LINTA) advanced 0.76%, closing the day at $14.63 with the overall trading volume of 1.48 million shares for the day. Its market capitalization is $8.75 billion and in 52 weeks the price range remained $9.82 – $16.80. China MediaExpress Holdings Inc (NASDAQ:CCME) dropped 6.27%, closing the day at $14.20 with the overall trading volume of 1.40 million shares for the day. Its market capitalization is $472.73 million and 52 week price range remained $7.58 – $16.60. ATP Oil & Gas Corporation (NASDAQ:ATPG) declined 0.94%, closing the day at $14.73 with the overall trading volume of 1.40 million shares for the day. Its market capitalization is $755.22 million and 52 week price range remained $8.16 – $23.97.

tdp2664Penny Stock Live

Most active stocks, Antofagasta, Kazakhmys, Xstrata, Randgold Resources

gol2664

Most active stocks, Antofagasta, Kazakhmys, Xstrata, Randgold Resources ukcitymedia – 4 hours ago The Footsie is being driven upwards this morning largely by the mining sector which is producing some large gains right across the board. The G20 meeting of finance ministers essentially agreed to …

This Week’s Top ETF Buys

Exchange traded funds in my buy list last week were successful, and I'm looking for the upward trend to continue this week. We did a nice job last week rotating out of the gold and mining exchange traded funds (ETF). The precious metals market took a breather last week after enjoying a nice run over the last several weeks. The same cannot be said for the rest of the market. Personally I was expecting a pause in stocks and made recommendations for both long and short exchange traded funds as the place to be. Instead the S&P 500 posted a robust gain of +.5%. In my market neutral position, investors following my Top ETF's to buy last week posted a more modest gain of +.15%. For the 4 weeks of making Top ETF picks we are up +3.6% versus up +3% for the S&P 500. So what happened last week? Investors can trace the gains to earnings and strong indications that the Federal Reserve will be executing quantitative easing in support of the economy in the near future. Such a move is very supportive for stocks. The dollar gained as the Treasury voiced support of the greenback. Of course currency traders know full well that central banks are notoriously poor at manipulating money prices. For the dollar to increase in value investors will start to worry when rates go up. Given that the Federal Reserve is in a mode of easing policy, it is unlikely for the dollar to gain traction. In fact, I would bet against it. Although gold prices retreated last week, I expect the trend to continue until we hit a price of $2,000 per ounce. On the economic calendar next week, investors will be treated to a whole host of numbers. At the top of the list will be home sales, existing and new. Look at those numbers to confirm a deflationary environment. For the overall health of the economy investors can digest the durable goods number. I suspect that number will show weakness. All in all I'm not comfortable being long only in this environment. We are overdue for a pause. I do not expect a serious correction, but simply a pause. As such the only change to the list of five exchange traded funds to buy this week would to exchange the regional banking ETF for a gold ETF. Here are the five ETF's to buy this week: SPDR Gold Shares (NYSE: GLD ) – Gold took a break last week. I want back in. The bias for gold is incredibly weighted to the upside. Demand combined with economic conditions in the United States bode well for those holding gold. My target for gold is $2,000. The move higher continues next week. SPDR S&P Semiconductor (NYSE: XSD ) – Technology shares including semiconductor stocks were a bit weaker than expected last week. A positive sign for the group was the solid gain on the Nasdaq on Friday. I expect that move to continue this week with semiconductor stocks leading any sustained gains in the market. SPDR Dow Jones Industrial Average (NYSE: DIA ) – The Dow Jones will be boringly steady this week. It is almost like watching paint dry and that is perfect for absolute return investing. We get our beta or volatility with the technology side of the market and our stability with the industrials. Don't expect to the index to move strongly one way or the other next week. ProShares Short Russell 2000 (NYSE: RWM ) – If the market does drop significantly next week we will get a big gain in holding the RWM. Small cap stocks have been very strong over the last two months. I expect the market to take back some of those gains next week. ProShares Short S&P 500 (NYSE: SH ) – The S&P 500 is now up +6% for the year. That is not bad considering many expected the world to end and stocks to fall this year. Much of the gains have occurred over the last few months. It would be only natural to take a pause and this ETF will protect you should there be a correction to the downside next week. Thus the only change this week is to sell the regional bank ETF and use the proceeds to take a position in the GLD.

tdp2664

gol2664

InvestorPlace

Market News: British Airways plc (LON:BAY), Centrica plc (LON:CNA), Whitbread plc (LON:WTB)

Here are several more stock briefings which could affect stocks in trading later today. The following stocks should see some movement: British Airways plc (LON:BAY), Centrica plc (LON:CNA), Whitbread plc (LON:WTB). Here is a more detailed look at the news that will affect each company when trading continues. British Airways plc (LON:BAY) To end the dispute, British Airways plc (LON:BAY) has come up with a 'fair deal'. The new offer, expected to put an end to the 'fight' between the crew and the authorites, will reinstate the heavily discounted travel for the staff immediately. In addition to the incremental pay rises, another 5.9 percent increase of basic pay will also be awarded over the next two years. British Airways plc (LON:BAY) said in a statement that "The offer we have made, based on our previous proposals, is very fair and reasonable and represents a genuine solution to the remaining issues in this dispute. The changes we have already made to onboard crew numbers and recruitment terms for new Heathrow crew represent substantial permanent savings for the company. These savings have been achieved without any compulsory redundancies despite the exceptional economic difficulties of the last two years, faced by the company and the country at large." Centrica plc (LON:CNA) Centrica plc's (LON:CNA) flexible benefits package has been recognized. The company's investment in flexible benefits packages has been awarded with the presentation of a special award. Centrica plc (LON:CNA) was named the Best Place for Flexible Working in the Top Employers for Working Families Awards 2010. The energy giant won the award, relegating American Express to second place. The winners are chosen by charity working families and the award is given to the organizations that are helping the employees to achieve a work-life balance. Whitbread plc (LON:WTB) The UK Hotel and Restaurant company Whitbread plc (LON:WTB) has reported 58% profit gain. The growth of its Budget Hotel brand and the Premier Inn are the primary drivers behind the big gains. Profit rise to $152 Billion during the last six months is a result of increased bookings at the hotel. The shares of Whitbread plc (LON:WTB) have advanced by 2.1% and the recent figures show the three year high in London trading. We could possibly see more movement when trading continues for British Airways plc (LON:BAY), Centrica plc (LON:CNA) and Whitbread plc (LON:WTB).

tdp2664

E money daily

Today’s G-20 Exchange Rate Currency News October 25th, 2010; Dollar Futures Lower FOREX; Curreny trading War on Horizon?

dow2664

Currency wars are debated and actions that devalue competing currencies are creating instability and volatility in the market for the global economic recovery. Many believe that the exchange rate system needs to be stabilized via a market-determined system of calculating exchange rates. One report due out this week in America that will have a trickle down effect on everything else, including currency rates, is the weekly first time jobless claims. Over this weekend’s meeting of the Group of G-20, major economies voiced their concerns that currency rates and the overall global economy will be affected by the “wall of money emanating from the U.S.” Asia, specifically, feels that the increase in greenback is causing a devaluation of their currency. Last week, a U.S. treasury official stated that pressure would be placed on Beijing during the G-20′s to allow for greater rise in the yuans value. To start this session trading week for October 25th 2010, the U.S. dollar has taken a tumble. It has fallen almost 1% against a basket of other currencies as investors feel a bit anxious about the fallout from the summit conferences. Is the stage set for an impending currency war and if so, will this volatility derail the fragile global recovery taking place? After the G-20 meeting came to a close, it was reported that there will be a refrain from competitive devaluation and disorderly movements in exchange rates. We shall see. Author: Camillo Zucari

US Stocks Rise; G20 Pledge Weighs on Dollar, Boosts Equities

dow2664

US Stocks Rise; G20 Pledge Weighs on Dollar, Boosts Equities Wall Street Journal – 46 minutes ago By Kristina Peterson Of DOW JONES NEWSWIRES NEW YORK (Dow Jones)–US stocks opened higher on Monday as a weekend pledge by global finance officials provided some relief for investors eager to …

US Stocks Rise; G20 Pledge Weighs on Dollar, Boosts Equities

Top NASDAQ Pre-Market Losers (FWLT, BPOP, PSYS)

Foster Wheeler Ltd. (NASDAQ:FWLT) dropped 1.75% to $23.61 in pre market hours. The company announced that Umberto della Sala, has been named Interim Chief Executive Officer (CEO), effective October 22. Mr. della Sala fills the CEO position vacated by Robert C. Flexon, who left the Company on October 22 to pursue other interests. The 52-week range of the stock is $20.33-$35.01. The stock went down more than 20% year-to-date. Popular, Inc. (NASDAQ:BPOP) lost 1.05% to $2.82 in pre market trading hours. Last week, the company posted a loss of 4 cents a share, compared with analysts' expectations of 2 cents a share according to Thomson Reuters. The company turned a profit after eight straight quarterly losses, helped by a gain from the sale of its processing unit Evertec. The sale of the unit resulted in a gain of about $531 million and boosted the bank's capital ratios, Popular said in a statement. In the past six months of trading sessions, the stock went down more than 27%. Shares of Psychiatric Solutions, Inc. (NASDAQ:PSYS) fell 0.53% to $33.50 during the pre market. Last week, the company posted a much better-than-expected quarterly profit as the mental health facility operator held staff costs steady while revenue jumped. Net income from continuing operations in the quarter was $53.7 million, or 94 cents a share, compared with $28.3 million, or 50 cents a share, a year ago. The 52-week range for the stock is $17.63-$33.68. The stock went up more than 55% year-to-date.

tdp2664

Newsworthy Stocks

The Wilber Corporation (AMEX: GIW) Hit 52-week High

Shares of The Wilber Corporation (AMEX:GIW ) are going crazy this morning as the stock has soared $2.99 or 50% to $9.01 after climbing to its 52-week high of $9.34 earlier in the session. This morning, Community Bank System, Inc. (NYSE: CBU) has reached an agreement to acquire The Wilber Corporation, parent company of Wilber National Bank in Oneonta, NY, for $101.8 million in Community Bank System stock and cash, or $9.50 per share. The merger agreement has been unanimously approved by the board of directors of both companies. So far this year, shares of GIW have jumped over 29% and 18.36% over the past one year. The stock has a 52-week range of $5.52-$9.34. The Wilber Corporation is engaged in ownership, supervision, and control of Wilber National Bank (the Bank). The Company, through the Bank and the Bank's subsidiaries, offers a range of commercial and consumer financial products, including business, municipal, and consumer loans, deposits. Disclaimer: The assembled information distributed by epicstockpicks.com is for information purposes only, and is neither a solicitation to buy nor an offer to sell securities. Epicstockpicks.com does expect that investors will buy and sell securities based on information assembled and presented herein. EpicStockPicks.com will not be responsible in any way for or accept any liability for any losses arising from an investor's reliance on or use of information obtained from our website or emails. PLEASE always do your own due diligence, and consult your financial advisor.

tdp2664

Epic Stock Picks

Daily News and Research on Chinese Stocks (Oct 25, 2010)

Below is today's Daily News and Research on U.S.-Listed Chinese Stocks:

ACH: Chalco swings to $17.7 million quarterly loss – at MarketWatch (Mon 8:30AM EDT)

ATV: Acorn International Announces Shareholder Resolution Adopted at 2010 Annual General Meeting – PR Newswire (Mon 8:00AM EDT)

AUTC: AutoChina International to Present at Upcoming Goldman Sachs China Investment Frontier Conference and Bank of America Merrill Lynch China Investment Summit in Beijing – Business Wire (Mon 8:30AM EDT)

BIDU: [$$] Why Buy Baidu? – at TheStreet.com (Mon 8:57AM EDT)

BIDU NTES SINA SOHU: Sohu Jumps on Q3 Beat, Higher Q4 Forecast – at Barrons.com (Mon 9:55AM EDT)

BSPM: Biostar Pharmaceuticals, Inc. Expands Rural Network by Over 21% in Third Quarter 2010; Brings Total Number of Locations to 8,500 – PR Newswire (Mon 8:00AM EDT)

CAEI: China Architectural Engineering Announces Fourth Closed Beta Testing of 'Warring States' – PR Newswire (Mon 8:00AM EDT)

CHA CHL NIV: 4-Star Stocks Poised to Pop: NIVS IntelliMedia – at Motley Fool (Mon 10:21AM EDT)

CHRM: Charm Communications Inc. to Announce Third Quarter 2010 Results on October 28, 2010 – PR Newswire (Mon 9:00AM EDT)

CTC: Century 21 China Real Estate to Hold Annual General Meeting on November 12, 2010 – PR Newswire (Mon 9:29AM EDT)

CTFO: China TransInfo and its UNISITS Subsidiary Receive Deloitte Technology Fast 50 China 2010 Award – PR Newswire (Mon 8:00AM EDT)

CYOU: 10 Unusual Stocks Attracting Huge Interest In The Pre-Market Right Now – Silicon Alley Insider (Mon 8:35AM EDT)

EDS: Exceed Company Ltd. to Attend the Goldman Sachs China Investment Frontier Conference – PR Newswire (Mon 9:01AM EDT)

JASO LDK SOL SOLF YGE: Solar Stocks a Core Holding Now, Poll Says – at TheStreet.com (Mon 8:27AM EDT)

JKS: FirstWind IPO — Gone With the Wind? – at TheStreet.com (Mon 8:34AM EDT)

NIV: NIVS Selected by GOME Electrical Appliances as Key Supplier – PR Newswire (Mon 8:00AM EDT)

OINK: Tianli Agritech: Oink if You Like Value – at Seeking Alpha (Mon 7:42AM EDT)

PUDA: Puda Coal Signs Agreements to Acquire Two Additional Coal Mines – PR Newswire (Mon 9:42AM EDT)

QXM XING: Qiao Xing Universal Files Schedule 13E-3 in Connection with the Proposal to Acquire All Outstanding Shares of Qiao Xing Mobile – PR Newswire (Mon 8:00AM EDT)

SPRD TSTC: [$$] Taking Some Profits – at TheStreet.com (Mon 10:06AM EDT)

SSW: Seaspan Eliminates New Equity Requirements: Our Outlook Remains Positive – at Seeking Alpha (Mon 7:54AM EDT)

STP TSL YGE: Perspectives on the Recent U.S. Investigation of China's Solar Industry – at Seeking Alpha (Mon 10:13AM EDT)

SVA: Sinovac Biotech shares fall on outlook cut – at Reuters (Mon 10:20AM EDT)

SVA: Sinovac tumbles as drug indexes gain – at MarketWatch (Mon 10:02AM EDT)

YGE: Bill Gates, Google's Brin Fund Fight for Carbon Law – at Bloomberg (Mon 10:14AM EDT)

tdp2664

China Analyst

Daily News and Research on Chinese Stocks (Oct 25, 2010)

Gold vs. the US Baht

So the United States government wants a “Strong Dollar”…? Buy Gold – again…!

“WE WILL NOT devalue the US Dollar,” US Treasury Secretary Tim Geithner said last week (or words to that effect), writes Steve Sjuggerud in his Daily Wealth email.

And by golly, the people believed him! The Dollar soared on his “reassurance”. Gold Prices fell.

Wow…I was stunned.

Do THAT many investors NOT know their economic history?

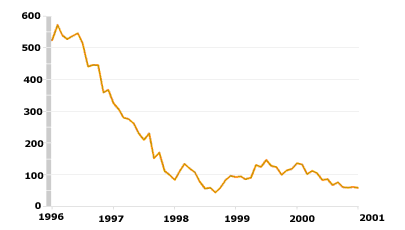

On June 30, 1997, Thailand’s leader said, “We will not devalue our currency.” Like Geithner this week, Thailand’s leader backed it up with all kinds of powerful, incontrovertible statements…like “if the currency is devalued, we will all become poor.”

But three days later, on July 3, 1997, Thailand devalued its currency.

The currency crashed. Check out a chart of Thailand stock market during the time of the crisis…down 90% in terms of US Dollars:

Can you imagine a 90% bust?

Thailand is just one well-known example of the “we will not devalue” speech, followed by a massive devaluation. We’ve seen it happen over and over again.

Porter Stansberry and I started out writing investment letters in the mid-1990s, focusing on emerging markets. The “we will not devalue” line got to be a joke around the office…As soon as we heard “we will not devalue” from an emerging-market finance minister, it was time to bet on a devaluation.

It’s like this. “We will not devalue” is the equivalent of your 7-year-old child hustling into the room and announcing, “There’s no need to count the number of cookies in the cookie jar!”

It makes you think, “Well, I wasn’t worried in the least about the cookies in the jar. And I wasn’t worried about my child lying, either. But now we’d better seriously check on both.”

Now, the US Treasury Secretary Tim Geithner just gave the “we will not devalue” speech. “No need to count those cookies in the cookie jar!” he’s hustling to tell us. Uh oh.

Our currency can’t have a crashing devaluation like we’ve seen time and again in emerging markets. We simply have a different type of currency system in the US than the emerging markets did when their currencies crashed overnight.

But Geithner just uttered the magic words of future currency collapse…So far, the market has believed him. The Dollar soared and gold crashed on his comments.

I thought investors were in on the joke…

My instinct – built on years of watching politicians say the same and end up doing the opposite – is to do the opposite of what investors did after Geithner’s speech. My instinct is to run from the Dollar, for the long run.

The fate of the Dollar was sealed last week. Looking ahead, the future is bright for Gold Investing and bleak for the Dollar.

Invest accordingly.

Start your Gold Investing with this free gram at the award-winning world No.1, BullionVault now…

gol2664

Upcoming Event of CENX about Earnings and Tentative Agreement of Century Aluminum Company Subsidiary- (CENX, AINV, STEC, OCLR, SPRD)

Dear PSL members A Century Aluminum Company wholly owned subsidiary Century Aluminum of Kentucky, attained a tentative agreement with steelworkers on a four year negotiable agreement which still need approval for which voting session will be held on October 28, 2010. It is also going to announce earnings of 3rd Quarter on 26th October 2010. Century Aluminum Company (NASDAQ:CENX) gained 0.77%, closing the day at $13.05 with the overall trading volume of 1.01 million shares for the day. Its market capitalization is $1.21 billion and in 52 weeks the price range remained $8.15 – $18.77. Apollo Investment Corp. (NASDAQ:AINV) reported a gain of 1.20%, closing the day at $10.95 with the overall trading volume of 1.13 million shares for the day. Its market capitalization is $2.13 billion and in 52 weeks the price range remained $8.69 – $13.69. STEC, Inc. (NASDAQ:STEC) advanced 3.24%, closing the day at $14.64 with the overall trading volume of 1.12 million shares for the day. Its market capitalization is $743.62 million and in 52 weeks the price range remained $9.47 – $25.65. Oclaro, Inc. (NASDAQ:OCLR) jumped 3.88%, closing the day at $14.73 with the overall trading volume of 1.06 million shares for the day. Its market capitalization is $729.10 million and 52 week price range remained $2.58 – $17.45. Spreadtrum Communications, Inc. (NASDAQ:SPRD) surged 1.10%, closing the day at $12.84 with the overall trading volume of 1.04 million shares for the day. Its market capitalization is $606.48 million and 52 week price range remained $4.52 – $14.20.

tdp2664Penny Stock Live

US Stocks Jump, Buoyed By Home Sales, Weaker Dollar

dow2664

US Stocks Jump, Buoyed By Home Sales, Weaker Dollar Wall Street Journal – 4 minutes ago By Kristina Peterson Of DOW JONES NEWSWIRES NEW YORK (Dow Jones)–US stocks climbed Monday, boosted by a jump in existing home sales and a weekend pledge by global finance officials that calmed …

US Stocks Jump, Buoyed By Home Sales, Weaker Dollar

TODAY’S STOCK MARKET DOW JONES INDUSTRIAL AVERAGE DJI, S&P 500, NASDAQ INDEX TRENDS, NOTES October 25th, 2010 Approaching Mid Day

dow2664

Stocks ended mixed on Friday as investors attempt to sort through a variety of reports and predict how the economy will respond. Currency tensions were reported at the G-20 summit in South Korea, a continued line up of corporate quarterly earnings and a decline in jobless claims. At opening bell on Monday stocks are set to rise. G-20 leaders report no specific plans in place at this time to keep trade in balance but agree to avoid using currency differences to gain advantage. Investors await more quarterly earnings reports as well as the results of midterm elections. Radio Shack reports a 23% increase in third quarter earnigs to $46 million. Texas instruments is scheduled to release it’s quarterly report today with analysts anticipating profits. So far corporate quarterly results have exceeded expectations and investors hope that this trend will continue. The National Association of Realtors is scheduled on the economic calendar today to release its report on existing homes sales for September. Economists anticipate an increase in sales from 4.13 million to 4.25 million. Approaching mid day the market indices are all in the green. NASDAQ is up 23.71 points or 0.96% to 2503.10. DJIA is up 102.78 points or 0.92% to 11235.34. S&P 500 is up 11.48 points or 0.97% to 1194.56. The dollar is down as well as the Treasurys 10-year yield currently at 2.50%. Crude oil is up 1.45 to $83.14 a barrel. Author: Pamela Frost

Stocks Going Ex Dividend the Second Week of November

dow2664

Here is our latest update on the stock trading technique called ‘Buying Dividends’. This is the process of buying stocks before the ex dividend date and selling the stock shortly after the ex date at about the same price, yet still being entitled to the dividend . This technique generally works only in bull markets. In flat or choppy markets, your have to be extremely careful. In order to be entitled to the dividend, you have to buy the stock before the ex-dividend date, and you can’t sell the stock until after the ex date. The actual dividend may not be paid for another few weeks. WallStreetNewsNetwork.com has compiled a downloadable and sortable Excel list of the stocks going ex dividend during the next week or two. The list contains many dividend paying companies, all with market caps over $500 million, and yields over 2%. Here are a few examples showing the stock symbol, the ex-dividend date and the yield. ITT Corporation (ITT) market cap: $8.8B ex div date: 11/9/2010 yield: 2.1% Linear Technology Corporation (LLTC) market cap: $6.8B ex div date: 11/9/2010 yield: 3.0% Walgreen Company (WAG) market cap: $33.6B ex div date: 11/10/2010 yield: 2.0% FORTIS INC (FRTSF) market cap: $5.6B ex div date: 11/10/2010 yield: 3.6% Southwest Gas Corporation (SWX) market cap: $1.6B ex div date: 11/10/2010 yield: 2.9% The additional ex-dividend stocks can be found at wsnn.com. (If you have been to the website before, and the latest link doesn’t show up, you may have to empty your cache.) If you like dividend stocks, you should check out the high yield utility stocks and the Monthly Dividend Stocks at WallStreetNewsNetwork.com or WSNN.com. Dividend definitions: Declaration date: the day that the company declares that there is going to be an upcoming dividend. Ex-dividend date: the day on which if you buy the stock, you would not be entitled to that particular dividend; or the first day on which a shareholder can sell the shares and still be entitled to the dividend. Record date : the day when you must be on the company’s books as a shareholder to receive the dividend. The ex-dividend date is normally set for stocks two business days before the record date. Payment date: the day on which the dividend payment is actually made, which can be as long at two months after the ex date. Don’t forget to reconfirm the ex-dividend date with the company before implementing this technique. Disclosure: Author does not own any of the above at the time article was written. By Stockerblog.com

Stocks Going Ex Dividend the Second Week of November

Medical equipment and supplies handed over to the Durba Referral Hospital, DRC

gol2664

Medical equipment and supplies handed over to the Durba Referral Hospital, DRC MBendi – 51 minutes ago A shipment of vital medical equipment and supplies was handed over to the Durba Referral Hospital and the Gambella Clinic in Watsa in the Haut-Uele district of the DRC close to the Kibali Gold …