You can’t quote Gold Prices in Zimbabwe Dollars, because it approaches infinity…

NOW FORECASTING ongoing waves of mortgage delinquency, illiquidity and bank insolvency, Bob Moriarty of 321gold says the safest strategy is having “a $20 US gold piece in your right hand and a 1-ounce Gold Bar in your left.”

Here Bob Moriarty explains to The Gold Report how the US government “is lying” about unemployment figures and recommends investors have “a triangle of investments” – the most important of which are physical precious metals.

The Gold Report: Bob, give us your perspective on what’s happened since we last talked with you in July. First off is the announcement last month that the US ‘officially’ emerged from the recession in August 2009.

Bob Moriarty: My one-word answer to that is “rubbish”. If the government had said we emerged from the recession in August 2009 and went into an official depression, I would have to agree. If you read John William’s Shadowstats.com, the real unemployment rate in the US today is 22.5%. You cannot have the end of a recession with 22% unemployment.

TGR: Do you think it’s because the government is using different definitions for what causes a recession?

Bob Moriarty: Exactly. Another term for it is “lying”.

TGR: But economists are the ones that made the announcement.

Bob Moriarty: So? They’re lying. The government changed the definition to make the numbers go down in the same way that it provided no cost of living adjustment (COLA) for Social Security. Anybody who’s been to a grocery store knows we have price inflation. Prices are going up – period. According to the government, they’re not.

TGR: But if the government is manipulating this, why did it come out with no COLA increase right before an election? Manipulation again?

Bob Moriarty: The government’s not manipulating; it is lying. It used to be the government lied on occasion; now, it’s lying about everything. We absolutely do have price inflation. Those who don’t realize it haven’t bought food or gasoline in the last year; anyone who has bought food and gas knows we have inflation. But the government has some vested interest in paying out as little as possible for Social Security, so it can say, ‘Oh, we’ve got no inflation.’ The government is lying.

TGR: Let’s move on to another interesting bit of information. Several banks have declared a moratorium on housing foreclosures because, on reviewing their documentation, they found they lacked proper authorization.

Bob Moriarty: It’s not true. They did not review the documentation to find out there was fraud involved. People took them to court and got others to admit – and this goes back almost a year – that the banks had people signing 10,000 documents a month, swearing that they’d reviewed foreclosure documents and determined they were all accurate.

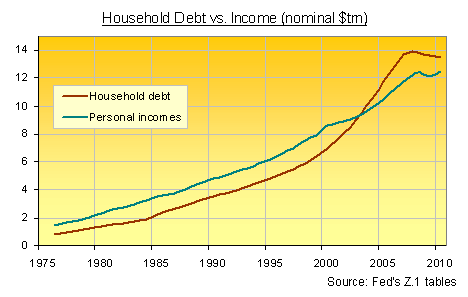

There are two separate issues here. One is that there was fraud in virtually every mortgage issued in the US over the last 10 years, since the Mortgage Electronic Registration Systems (MERS) was set up. When you go to a bank and borrow money on a house, you sign a document with a ‘wet’ signature; that is, your physical signature – not a copy of a signature, but your physical signature. Whoever holds the mortgage is supposed to go down to the local town hall and record it every time there is a change of ownership in the mortgage. It used to be that you would have a stack of paper half an inch thick for everyone who had a mortgage. MERS put all that it into electronic format and threw away the paper. A ‘wet’ signature is required to repossess a house in 23 states. You have to be able to prove there was an agreement between the person taking the mortgage out and the person holding the mortgage. Those papers no longer exist. You get into so much fraud here. The banks had people, public notaries, signing that they’d witnessed people reviewing these documents and it was fraud. People were being foreclosed on that didn’t even have a mortgage.

The second issue is that 45% of the mortgages in Florida are under water. What are those people going to do when Bank of America comes out and says it’s going to stop foreclosures over the whole country and 45% of mortgage-holding Floridians just decided not to pay their mortgages? If these mortgages aren’t repaid – and they won’t be – the banks can’t sell the houses. They are stuck. When you slice and dice the mortgage, who owns the mortgage? People who went through foreclosure two years ago still have the legal right to sue those who foreclosed on their houses because they were committing fraud. There will be cases like that where people will no longer be able to buy or sell a house because they won’t be able to get title insurance and, without title insurance, they can’t get a mortgage. There is no simple answer. The mortgage situation is far worse than anybody imagines. There is no simple solution; the government can’t buy its way out.

TGR: Extrapolating from there, you’ve said the banks will wind up having to close in a sort of “financial holiday”…

Bob Moriarty: If everybody goes without paying their mortgages, how can the banks stay open? But if banks forgive the mortgages, we still have people living in houses they can’t afford. A depression or recession should be a cleansing event; ultimately, what happens is the government gets involved and does what is politically popular. The government, literally, is bribed by all these big banks – Goldman Sachs, JP Morgan, Bank of America, etc. – their campaign contributions are bribes for votes to benefit them. Instead of the banks paying for their stupidity, the cost is transferred to the taxpayers.

TGR: Let’s play this out. People can’t pay their mortgages and the banks are either illiquid or insolvent. Do the banks go under, or does the government do another bailout?

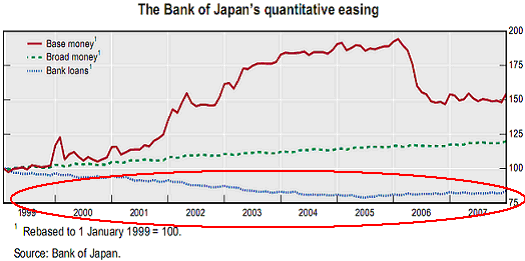

Bob Moriarty: The government bails them out, the same way Zimbabwe did – by printing money. Certainly, you see it in the price of gold. At $1323, the Gold Price is patently absurd. That’s not the price of gold – it’s the price of the Dollar. Everybody believes the Fed is going to print more money, move into quantitative easing part two and destroy the Dollar. Well, we’re so close to hyperinflation, riots in the street and banks closing that it’s crazy.

TGR: That brings us to gold. Central banks in many countries are now Buying Gold and storing it rather than selling it.

Bob Moriarty: Gold is money. You have a choice of holding your assets in Yen, Swiss Francs, Euros, Dollars or Gold Bullion. Banks are doing what makes sense. They are called “reserves” for a reason. If you really need them, you fall back on your reserves. Countries are realizing they’re holding all this paper and, once they take a sniff of the paper, they realize it smells terrible. So, they want to hold some gold; it makes a lot of sense.

TGR: But is that just portfolio rebalancing, or do countries really want to get out of fiat currencies?

Bob Moriarty: They really want out of fiat currency. I have used the analogy of musical chairs for years; the banks and everybody else are playing musical chairs. The flaw is that the music is still playing, and they all think they’ll get a chair; but, if you look around the room, there are no chairs.

China is stuck with all this money. We have a currency war going on right now with China, Japan, Brazil and even the Swiss. Everyone’s trying to destroy their own currency so they can get a competitive advantage. When all currencies are destroyed, the only thing left is gold.

TGR: You are on record saying that, at some point, we will revert to the Gold Standard.

Bob Moriarty: The probability of the world going back to the gold standard is not 99% – it is 100%. When every fiat currency in the world has been destroyed, someone will pick up a $20 gold piece and say: “Hey, why don’t we use this?” We have $1323 gold and $23.12 silver. We’re not at the top. Gold and silver are going much higher and fiat currencies are going much lower.

TGR: Some recent forecasts differ radically as to where gold is going. Kaiser Bottom-Fish writer John Kaiser sees the Gold Price reaching well into the thousands, while Freemarket Gold & Money Report Publisher James Turk says $8000 gold.

Bob Moriarty: You can’t forecast the price of gold in Dollars because what you’re really doing is forecasting the price of the Dollar. The chance of the Dollar adding 3 zeros is about the same as adding 6, 9 or 12 zeros. The USD is going the way of the Zimbabwe Dollar – and you can’t quote gold in Zimbabwe Dollars because it approaches infinity.

Gold is going to retain its value. Gold will still be money when pieces of paper are something to slap on the wall or throw in the furnace to heat your house. Fiat currencies are going down. Let’s go back to the game of musical chairs. Everybody realizes there are no chairs, but they believe someone will bring a chair in and that they’ll be able to find it when the music stops. The music is stopping. The mortgage issue is not a minor financial issue – it is a catastrophic issue because there is no solution.

TGR: How does this situation play out in places like the US, Europe and Japan?

Bob Moriarty: The middle class is being destroyed in the US There will always be rich and there will always be poor, but the middle class is being destroyed; and the middle class gives stability to a country. If you want to see what’s going to happen in the US, turn on the news from Spain, Greece, France or Japan. The truly interesting thing is – the government workers are the ones screaming about entitlements. And they’re going to be attacked by other government workers with bigger guns. This is the biggest financial problem in world history. The tulip-bulb mania, the South Sea India craze, the Florida land boom during the 1920s – those were all local. This is global. It affects everybody…and every bank in the world could close its doors.

You simply have to match income to outgo. We have two-and-a-half wars going on right now, and Obama and American Israel Public Affairs Committee (AIPAC) would love to start another. We can’t afford them; we stand to gain nothing. These wars are destroying the US financially, which results in one bailout after another. Every great empire that has ever collapsed did so because it got involved in military adventurism. The wars, the military adventures the US is involved in, are going to destroy the US financially.

TGR: Given that you foresee a time when the financial system will shut down entirely, what’s your view on equity investing today?

Bob Moriarty: Investors should have a triangle of investments. To start with, the single most-important thing that investors should invest in would be something solid, tangible that they can hold in their hands. Of course, that would be physical gold, silver, platinum or palladium. Second, investors can choose between gold stocks, silver stocks, ETFs or other things. And third, once they get down to money in the bank, buying mortgages or something like that – those are very risky investments. The safest thing you can possibly have now is a US $20 gold piece in your right hand and a 1-ounce gold bar in your left hand.

TGR: Are you advocating that people start selling equities and move into gold, or are precious metals-focused equities still a viable investment strategy?

Bob Moriarty: I still think it’s viable. Once you have enough gold and silver to cover you for a few months, you have to figure out what to do with the rest of your money. Equities – gold mines and particularly producers – will be a very good place to invest. You just might not be able to buy or sell a stock for six months. I’m not telling people to sell equities at all. The crash could come tomorrow, next month or three years from now. I don’t know when the crash is going happen; I just know there will be a crash. I wouldn’t go buy a house, and I wouldn’t keep money in a bank.

TGR: I’ve been reading a lot about the Carlin Trend, the Yukon and even New Guinea as hot spots for gold exploration. What’s your opinion on these locations?

Bob Moriarty: I don’t trust anything that involves groupthink. There are some excellent players in the Carlin Trend. I think they’ll do really well. There are also excellent plays in the Yukon, so it depends on the individual companies. The one thing I’ve learned over the last nine years is that quality of management is, by far, the most important factor. I have seen $1 billion projects destroyed by people who, basically, are idiots.

TGR: Earlier, you mentioned the triangle of investing. Is it too late to buy tangible silver?

Bob Moriarty: That’s a very good question. In December 2001, I was trying to encourage people to Buy Silver. I own a bunch of silver, and I don’t think I’ve ever paid more than $10-11 an ounce for it. I would be a lot happier if we had a correction now and silver and gold came down. So, I can’t say Buy Silver today because I think there’s a good chance it will go lower a month from now. But silver is not as high as it’s going to be, and gold is not as high as it’s going to be.

TGR: You point out that, in absolute Dollar terms, silver is more expensive than it was in 1979; but many of those following the precious metals sector expect silver to outperform, and they’re pointing toward the traditional Gold/Silver Ratio.

Bob Moriarty: Yeah, but they’re wrong. No commodity has as much nonsense written about it as silver. The only thing that’s going to cause a substantial increase in the demand, use and price of silver is going back to a gold standard. When we start using silver as coins, its value will increase substantially. Pure demand for silver as an investment today is not going to make it 17:1. Silver is not money; silver is a commodity.

TGR: Bob, always good to talk with you. Thanks for your time today.

Buying Gold today…? Slash your costs – and get the very safest Gold Bullion – using the award-winning world No.1, BullionVault…

gol2664