Wheat and cotton are rising in price. But they’re an impractical inflation hedge…

AS ALWAYS seems the case, there is a big different between what the government statistics are reporting and what’s going on in the real world, writes Jake Weber, editor of The Casey Report.

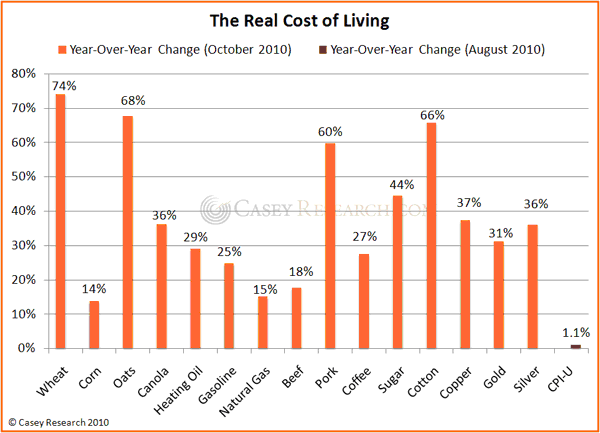

According to the most recent inflation reading published by the Bureau of Labor Statistics (BLS), consumer prices grew at an annual rate of just 1.1% in August.

The government has an incentive to distort CPI numbers, for reasons such as keeping the cost-of-living adjustment for Social Security payments low. While there’s no question that you may be able to get a good deal on a new car or a flat-screen TV today, how often are you really buying these things? When you look at the real costs of everyday life, prices have risen sharply over the last year. For simplicity’s sake, consider the cash market prices on some basic commodities.

On average, our basic food costs have increased by an incredible 48% over the last year (measured by wheat, corn, oats, and canola prices). From the price at the pump to heating your stove, energy costs are up 23% on average (heating oil, gasoline, natural gas). A little protein at dinner is now 39% higher (beef and pork), and your morning cup of coffee with a little sugar has risen by 36% since last October.

You probably aren’t buying new linens or shopping for copper piping at the hardware store every day, but I included these items to show the inflationary pressures on some other basic materials that will likely affect consumer prices down the road.

The jump in gold and Silver Prices illustrates that it’s not just supply and demand issues driving the precious metals higher – the decline in purchasing power of the Dollar is also showing up in the price of physical goods. It is because stashing wheat and cotton in the garage is an impractical way to protect purchasing power that investors are increasingly looking to protect themselves with the monetary metals – a trend that is now very much in motion.

Buy Gold and physical Silver Bullion at the best prices possible by using the award-winning, mining-industry backed world No.1 online, BullionVault…

gol2664

No comments:

Post a Comment