Sentiment Stock market averages opened higher on upbeat jobs data, but another

rally in crude is keeping a lid on investor enthusiasm late-Friday. Before the

opening bell on Wall Street, the Labor Department reported that the U.S. economy

added 216,000 jobs in March and the unemployment rate fell to 8.8% from 8.9%.

Economists were looking for 185,000 new jobs and the rate of unemployed to hold

steady at 8.9%. Stocks rallied around the news. Separate data released later

showed the PMI Manufacturing Index down to 61.2 in March, from 61.4 and in-line

with expectations. However, Construction Spending fell 1.4% in February, twice

as much as expected. The stock news remains light ahead of the

earnings-reporting period, but the exchanges are back in focus after NASDAQ OMX

Group (NASDAQ: NDAQ ) and the Intercontinental Exchange (NYSE: ICE ) teamed up

to make a bid for NYSE Euronext (NYSE: NYX ). However, any enthusiasm about

mergers or jobs data is being held in check by rally in crude oil. Prices are

now up $1.22 to $107.94 and setting fresh session highs heading into the

weekend. The Dow Jones Industrial Average is up 46 points, but down 54 from its

best levels of the day. The NASDAQ gained 4. Trading in the options market was

active early, but slowing in afternoon trading. 7.8 million calls and 6.4

million puts traded so far. Bullish Flow Yahoo (NASDAQ: YHOO ) adds 21 cents to

$16.89 and the YHOO Jul 18 – Jan 20 Call Spread is sold at 15 cents, 15,000

times. July calls were bought and January 20 calls sold, in what might be a

closing trade or a roll, as both contracts have substantial open interest. On

the other hand, the investor might be opening a new spread betting that shares

will rally beyond $18 through the July expiration, but not above $20 through

January 2012. Citi (NYSE: C ) adds 4 cents to $4.46 and 137,000 call options

traded on the bank in the first hour Friday. The volume is almost double the

normal and 10 times the day's put volume so far. The biggest trade is a block

of 29,000 C May 5 Calls at the 3-cent asking price. 32,000 now traded vs.

748,000 in open interest. April 4.5, Sep 5 and Sep 5.5 calls are seeing interest

as well. Gains in Citi shares and increasing call volume early Friday comes

ahead of an April 18 earnings report and a 1-for-10 reverse split scheduled for

May 6. Find more option analysis and trading ideas at Options Trading Strategies

. Bearish Flow Boston Scientific (NYSE: BSX ) adds 18 cents to $7.37 and morning

trades include a multi-exchange sweep of 4,278 BSX April 7 Puts at 15 cents,

which is an opening customer buyer, according to International Securities

Exchange data. 5,000 now traded. No news on the stock today. The company is due

to present at an American College of Cardiology conference on April 4. Implied

Volatility Mover CBOE Volatility Index (CBOE: VIX ) is down 1.18 to 16.56 and

returning to levels last seen on Feb. 18, the trading day before the S&P 500

came under pressure on concerns about rallying crude oil prices. Crude bubbled

up almost 5% to $96 per barrel on Feb. 22 on worries about escalating conflict

in Libya. Although crude prices have moved beyond $106 since that time, the S&P

500 has recovered most of the losses sustained from Feb. 18 to Mar. 16 and is

within striking distance of its Feb. 18 52-week high. Meanwhile, VIX has

plummeted 47% since the mid-March multi-month spike of 31.28. The top options

trade in the fear gauge today is a VIX April 27.5 – Jun 24 Put Spread , sold

at $4.075, 20,000 times and probably a roll of a bearish position in the VIX

from April to June. Option Flow Bullish flow detected in Under Armour (NYSE: UA

), with 5699 calls trading, or three times its recent average daily call volume.

Bullish flow detected in Medivation (NASDAQ: MDVN ), with 4396 calls trading, or

twice its recent average daily call volume. Bullish flow detected in Office

Depot (NYSE: ODP ), with 7261 calls trading, or six times its recent average

daily call volume. Increasing volume is also being seen in NYSE Euronext (NYSE:

NYX ), GM (NYSE: GM ) and MGM Resorts (NYSE: MGM ). Frederic Ruffy is the Senior

Options Strategist at Whatstrading.com , a site dedicated to helping traders

make sense of the complex and fragmented nature of listed options trading.

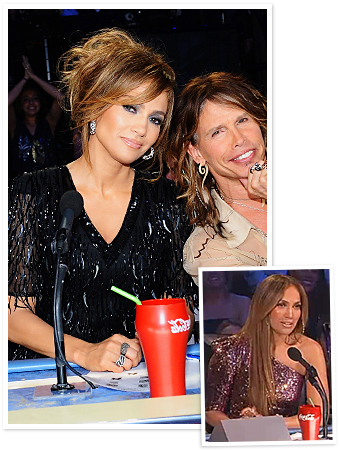

Michael Becker/Fox/PictureGroup

Michael Becker/Fox/PictureGroup